There’s a quiet shift that happens before any real adoption wave. Not when prices move. Not when influencers arrive.

But when users stop arguing about how something works and start caring only about whether it works. That’s the moment Web3 gaming seems to be approaching.

The first time this became clear to me wasn’t through a whitepaper or a roadmap. It was through how gamers talk. Not about tokens. Not about chains. About fairness. About permanence. About not losing progress because a server shut down or a publisher changed terms. Ownership, but without ideology attached to it. That matters, because gaming has never rejected crypto because it was “too new.” It rejected it because it felt intrusive.

For years, Web3 gaming tried to lead with the wrong question:

“How do we put blockchain into games?”

The better question was always:

“How do we stop blockchain from being noticed at all?”

That’s where Vanar’s positioning becomes interesting.

Vanar doesn’t frame itself as a general-purpose Layer 1 trying to be everything. It places itself directly at the intersection where games, entertainment, and high-frequency user behavior collide. That choice already filters the type of problems it needs to solve. Latency matters more than ideology. UX matters more than composability buzzwords. Emotional engagement matters more than throughput benchmarks in isolation.

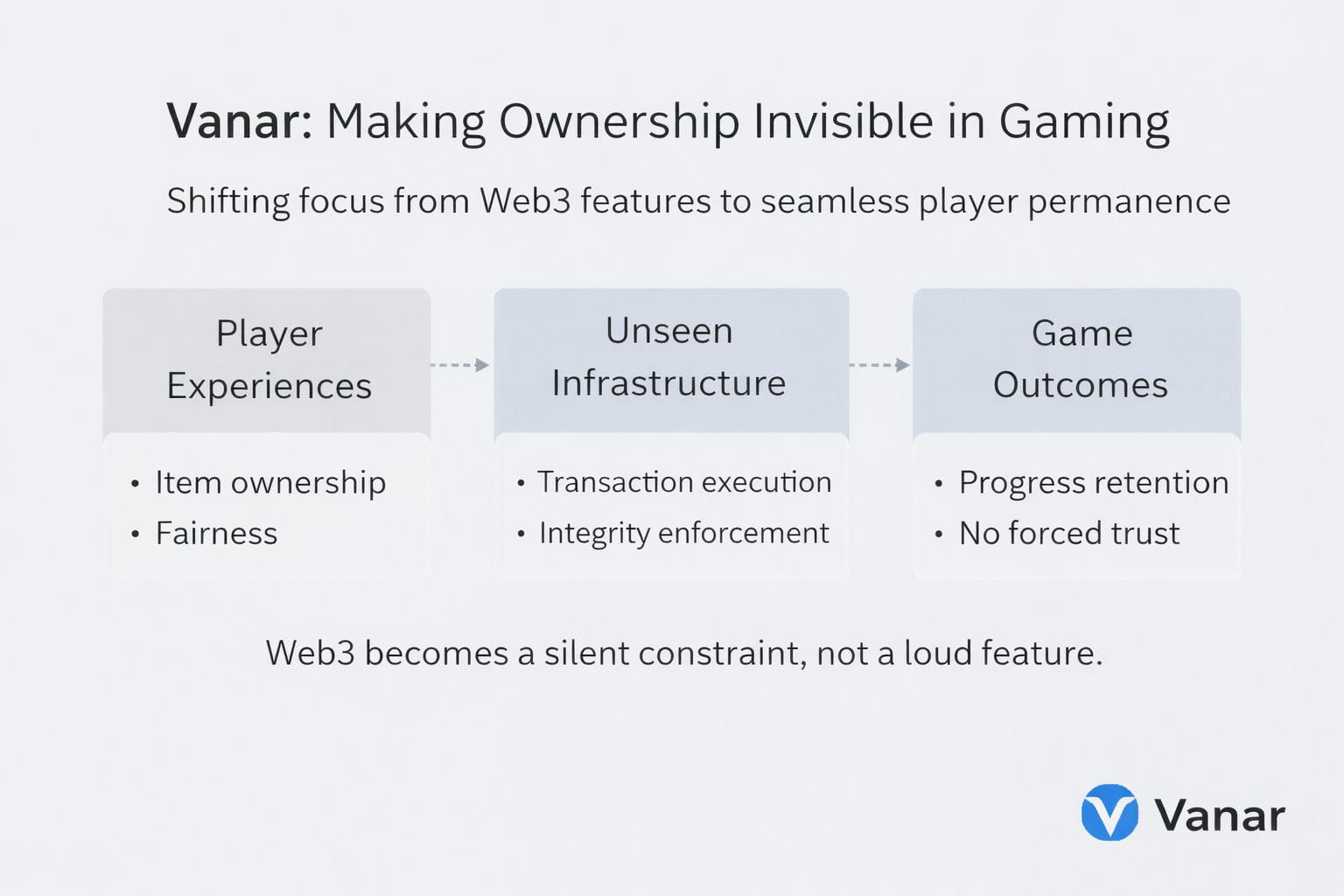

Gaming economies are not theoretical. They’ve been running live experiments for decades. Scarcity, inflation, sinks, rewards, black markets, bots, whales, churn cycles all of it exists already. Crypto didn’t invent these dynamics. It arrived late to them. What Web3 actually brings is not “value creation” but verifiability. Proof that items exist. Proof that rules were followed. Proof that ownership didn’t change quietly behind the scenes. That’s the layer Vanar is trying to sit under not as a visible feature, but as a silent constraint that keeps systems honest.

From an investor’s perspective, this reframes the thesis. The question isn’t whether gaming will adopt Web3. It already is, unevenly and cautiously. The real question is whether Vanar can become a chain where daily, unremarkable behavior happens on-chain without users treating it as a financial act. Because gaming doesn’t scale through speculation. It scales through repetition.

If users mint, trade, upgrade, and discard items without thinking about gas or wallets, then demand becomes behavioral rather than narrative driven. That’s rare in crypto. Most chains survive on attention. Very few survive on habit.

Vanar’s challenge is also clear. Gaming chains fail when they remain empty frameworks. When studios don’t ship. When token incentives attract extractive behavior instead of play. When liquidity is thin enough that volatility becomes the user experience.

None of those risks are abstract. They are historical. So analyzing Vanar seriously means watching boring things:

Are real games deploying?

Is on chain activity growing without incentives screaming in the background?

Does VANRY play an unavoidable role inside the system, or can it be bypassed?

Those answers won’t come from announcements. They’ll come from usage patterns over time. If Vanar succeeds, it won’t be because gamers suddenly love crypto. It’ll be because crypto finally learned to stay out of the way. And when ownership feels normal not exciting, not ideological that’s usually when it stops being niche and starts being permanent. That’s the bet Vanar is making.