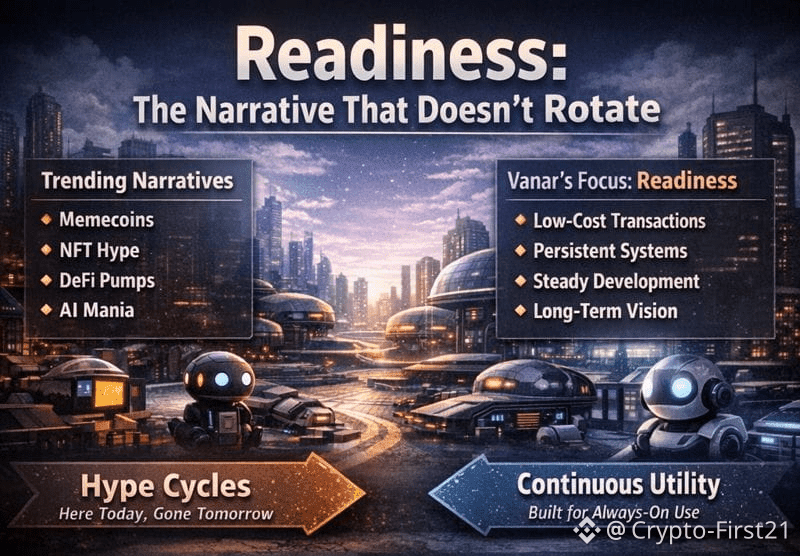

Vanar’s story right now isn’t about explosive rallies or a new token meme. It’s about being ready—ready for AI-native apps, ready for persistent digital environments, and ready for a market that increasingly rewards systems that can operate continuously without friction. That quiet readiness is why it keeps coming up in conversations even when narratives rotate elsewhere.

A chain is ready when its technical design supports constant usage, when its economics don’t punish frequent interaction, and when it’s positioned for use cases that don’t switch off during bear markets. Vanar’s core positioning is built around persistent digital environments and AI-native applications. In simple terms, these are systems that need to run all the time, make lots of small decisions, and record frequent state changes without becoming too expensive or too complex.

One of the more concrete design goals Vanar has communicated is extremely low transaction costs, with targets around fractions of a cent per transaction. That matters more than it sounds. Many blockchains can handle bursts of activity, but they struggle when usage becomes constant. Games, AI agents, digital identity systems, and long-lived virtual environments don’t transact once a day; they transact thousands of times. Readiness here means the chain doesn’t collapse under that weight, technically or economically.

Large general-purpose chains today often optimize for liquidity, composability, and DeFi throughput. Vanar optimizes for continuity. It’s less about how much value can be locked and more about how reliably small actions can be executed over long periods. That’s not a narrative that explodes overnight, but it’s one that becomes obvious once usage patterns change.

As of early 2026, Vanar’s circulating supply sits a little above two billion tokens, with total supply structured to support long-term ecosystem use rather than aggressive short-term scarcity. For traders, that’s a double-edged sword. On one hand, it limits sudden supply shocks. On the other, it means price appreciation depends heavily on genuine usage rather than mechanical token tricks. In my experience, markets eventually reward the former, but they’re impatient about it.

Investors are no longer just asking which project mentions AI, but which infrastructure can actually support autonomous agents that act, learn, and transact repeatedly. Second, Vanar has shown steady ecosystem progress: developer tooling updates, documentation releases, and exchange-side activities that increase visibility and liquidity. These aren’t flashy milestones, but they’re the kind that indicate a project is preparing for sustained demand rather than a short-term pump.

I pay close attention to behavior rather than announcements. Are applications actually deploying? Are transactions happening consistently, not just during campaigns? Is the token being used as gas in real workflows rather than sitting idle? Those questions matter more than roadmap promises. Early data suggests Vanar is still in the phase where infrastructure is ahead of demand, which is both a risk and an opportunity.

There are real risks worth stating plainly. Small-cap infrastructure chains compete in a brutal environment. Developers may choose larger ecosystems for distribution. Liquidity can dry up quickly during market stress. Token supply mechanics can become a headwind if demand doesn’t grow fast enough. Readiness doesn’t guarantee success; it only creates the conditions for it. I’ve seen many technically sound projects fade because adoption never arrived.

That said, readiness is one of the few narratives that doesn’t rotate out every quarter. When the market moves from speculation to utility, from one-off transactions to continuous systems, chains built for persistence suddenly look obvious in hindsight. Vanar is positioning itself for that shift, not by shouting, but by building for it.

I see it as an infrastructure bet on a specific future: one where blockchains quietly run in the background of digital worlds, AI systems, and long-lived applications. That kind of future doesn’t announce itself with green candles. It shows up in steady transaction counts, boring reliability, and developers who don’t leave once incentives end.

If readiness does turn into adoption, the narrative won’t need to rotate back to Vanar. It will already be there, doing its job, while the market catches up.