I remember staring at the screen thinking, this is supposed to be the easy part. It wasn’t a complex DeFi trade or some obscure bridge. Just a simple transfer. And yet between gas fees, waiting for confirmations, and that low- grade anxiety of “did I mess something up?”, it didn’t feel simple at all.

grade anxiety of “did I mess something up?”, it didn’t feel simple at all.

That frustration is what pulled me into looking at Plasma.

Not because it was hyped. Not because someone shilled it in a Telegram group. But because it was clearly designed by people who’ve actually used blockchains for payments, not just for theory or speculation.

Most Layer 1s aren’t built for how people actually use stablecoins

From what I’ve seen over the years, most Layer 1 blockchains start with ideology. Decentralization purity. Novel consensus mechanics. Elegant whitepapers. All important, sure. But then stablecoins show up almost as an afterthought, bolted on like a feature request instead of a core use case.

The reality is simple: stablecoins are the most used crypto product in the world. Not NFTs. Not governance tokens. Not yield farms. It’s USDT, USDC, and their cousins moving across borders, paying salaries, settling trades, and keeping businesses running in places where banks are slow or unreliable.

Plasma flips that starting point.

Instead of asking “how do we build a new blockchain?”, it asks “how do people already use stablecoins, and what’s broken about that?”

That framing alone already puts it in a different category than most traditional Layer 1s.

Gasless transfers sound boring—until you actually need them

I’ll be honest: when I first heard “gasless USDT transfers,” I shrugged. It sounded like marketing fluff. But then I thought about how many times I’ve had to keep a tiny balance of some native token just to move money.

That’s not freedom. That’s friction.

Plasma’s approach is basically saying: if stablecoins are the product, then stablecoins should pay the fee. No mental math. No scrambling to buy gas. No explaining to a non-crypto friend why they can’t send money because they’re missing a different token.

From a retail user perspective, especially in high-adoption markets, this matters more than people realize. From an institutional perspective? It’s almost mandatory. Finance teams don’t want to manage gas inventories across wallets. They want predictable, boring settlement.

And Plasma leans into boring—in a good way.

Sub-second finality changes how you trust the system

This is one of those things you don’t appreciate until you feel it.

Waiting 30 seconds for finality doesn’t sound like much. But psychologically, it’s a gap where doubt creeps in. Did it go through? Should I refresh? Should I resend?

With Plasma’s sub-second finality using PlasmaBFT, transactions feel more like modern payment rails. Tap, done. No second guessing. That’s closer to how Visa or real-time banking feels, and that’s important if crypto ever wants to stop feeling like an experiment.

Traditional Layer 1s often optimize for throughput benchmarks or theoretical decentralization thresholds. Plasma seems to optimize for confidence. That moment where you know the payment is final.

From what I’ve experienced, that changes user behavior more than any TPS number ever will.

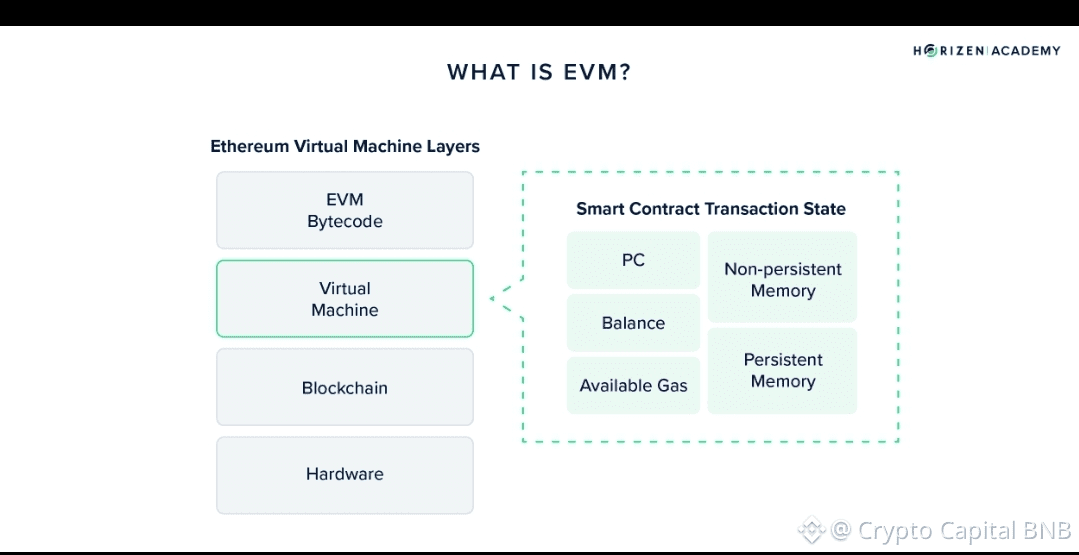

Full EVM compatibility, without the usual trade-offs

I’m not a maximalist about tech stacks, but EVM compatibility matters. Developers already know it. Tools already exist. Infra already works.

Plasma using Reth instead of reinventing the wheel feels like a mature decision. It’s not trying to be clever for the sake of being different. It’s trying to be useful.

A lot of traditional Layer 1s chase novelty and end up isolated. New VM, new language, new mental overhead. Plasma sticks with what works and focuses innovation on settlement and UX instead.

As a user, I appreciate that. As someone who’s watched devs burn out learning yet another stack, I appreciate it even more.

Bitcoin-anchored security isn’t about hype—it’s about neutrality

This part is subtle, and I think it’s easy to misunderstand.

Plasma anchoring security to Bitcoin isn’t about borrowing brand value or trying to ride narratives. It’s about neutrality. Bitcoin is boring, slow, and extremely hard to censor. That’s the point.

Traditional Layer 1s often end up politically or economically entangled. Foundation decisions. Validator cartels. Governance drama. Anchoring to Bitcoin is a way of stepping outside some of that noise.

Does it magically solve all censorship risks? No. But it adds a layer of resistance that most chains simply don’t have.

I think institutions notice this more than retail does. When you’re settling large volumes, neutrality isn’t a philosophy—it’s a requirement.

Plasma feels less like a “chain” and more like infrastructure

This is where my personal bias probably shows.

I’m tired of chains that want communities, mascots, and constant engagement. Payments infrastructure shouldn’t beg for attention. It should quietly work.

Plasma doesn’t feel like it’s trying to be your identity. It feels like plumbing. And that’s a compliment.

Traditional Layer 1s often measure success by ecosystem noise. Plasma seems more focused on whether money moves reliably, cheaply, and without drama.

That mindset shift is rare in crypto.

But it’s not without risks or open questions

To be fair, there are things that make me pause.

Stablecoin dependence cuts both ways. If regulatory pressure increases or issuers change terms, a stablecoin-centric chain feels that impact more directly. There’s also concentration risk—if most activity revolves around one or two assets, resilience depends on them staying healthy.

There’s also the question of adoption inertia. Payments are a winner-takes-most game. Even if Plasma is better, getting merchants, institutions, and users to switch isn’t trivial.

And Bitcoin anchoring, while elegant, adds complexity. It’s another layer to understand, another system to monitor. Simplicity always has trade-offs.

None of these are deal-breakers to me, but pretending they don’t exist would be dishonest.

Why Plasma feels different to me, personally

I think the biggest difference between Plasma and traditional Layer 1 blockchains is intent.

Most Layer 1s feel like experiments looking for users. Plasma feels like a response to existing behavior. People already use stablecoins. They already want fast settlement. They already hate gas friction.

@Plasma doesn’t ask users to change habits. It removes obstacles.

That’s not flashy. It’s not maximalist. But it’s grounded.

I’ve been around long enough to know that the chains that matter long-term usually aren’t the loudest ones early on. They’re the ones that quietly fit into real workflows and stay there.

Whether #Plasma becomes that or not is still an open question. But the way it’s designed tells me the builders are paying attention to how crypto is actually used, not how it’s debated on Twitter.

And honestly, that alone makes it worth watching.