Imagine you’re wiring money to your family back home in a rush. You open the app, tap send, and in under a second—it’s confirmed, locked in, and impossible to reverse. No endless waiting, no constant refreshing, no second-guessing if the funds made it. That’s the smooth, dependable experience Plasma is working to deliver through its PlasmaBFT consensus, turning stable coin transfers into something that feels just like everyday banking.

Having followed various blockchains for years, Plasma really stands out to me because it keeps things focused. It isn’t chasing every trend or trying to handle everything. Instead, it’s built specifically for stablecoins—perfect for fast remittances, quick business payments, or simple daily transfers. PlasmaBFT draws from proven, efficient designs like Fast HotStuff to create blocks at high speed and get validators to reach firm agreement almost instantly. The big win? Transactions become truly final in less than a second, holding strong even when the network gets busy.

Here’s the simple picture: Validators work like a solid, quick-deciding team. One proposes a set of transactions, the rest review and vote, and once a strong majority says yes, it’s permanently set—no dragging delays. This setup stays reliable and handles problems well, which is exactly what you need when timing is critical for payments.

This matters a lot in real situations. Any delay or hint of uncertainty can break confidence—sending emergency funds, closing a trade, or paying for something online. I’ve watched people test crypto with a basic transfer, hit slow confirmations or hidden fees, and decide it’s not worth the hassle. Plasma directly fixes those issues with stablecoin-first features: often zero-fee USDT moves, and flexible ways to handle network costs using stable assets. It aims to make everything feel straightforward and familiar, like your usual money app.

Think about an urgent family transfer. On some networks, you’re glued to the screen watching confirmations and worrying. Plasma’s design makes it instant and trustworthy, encouraging people to come back and use it regularly.

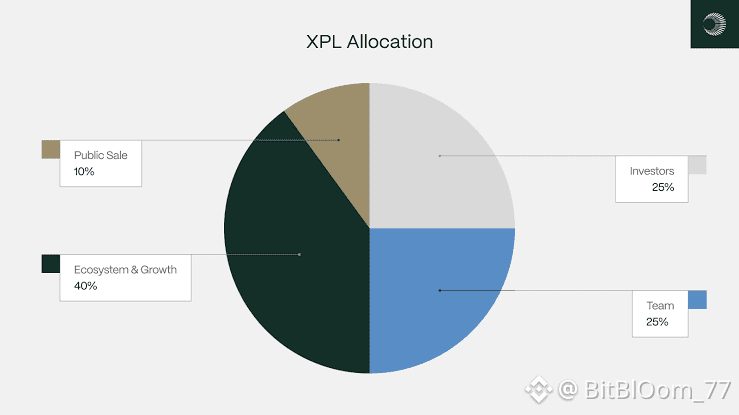

Right now (prices change quickly—always check live sources), XPL is trading around $0.127 to $0.13, with a market cap roughly $230M to $265M and 24-hour volume between $80M and $107M. Circulating supply is about 1.8B to 2.1B tokens out of a total 10B. The healthy trading volume shows real engagement—people are actively trading, not just holding quietly. That kind of attention means solid performance on the tech side could really move the needle as more folks pay notice.

What makes Plasma special? It avoids big flashy speed boasts and instead builds toward stablecoin transfers that are so reliable and easy, you hardly think about the blockchain at all. Lasting success happens when developers build tools on it, more money flows through, and users make it a habit.

If you’re tracking XPL for trades or longer holds, focus on the important signals: increasing transactions, stable-coin movement volumes, fresh integrations with exchanges or wallets, and steady speed during high demand. The real question: Can Plasma become the simple choice when someone just wants to move dollars fast, without crypto headaches?

That’s the true advantage—building habits over hype. Habits drive lasting growth.