Every major financial shift begins somewhere unglamorous. Not on trading screens or price charts, but in the invisible plumbing that decides what can be trusted, preserved, and reused. The internet itself did not transform commerce because of websites; it did so because data became persistent, addressable, and cheap to move. Walrus starts from a similar premise, but applies it to a world where data and capital are no longer separate concepts.

At first glance, Walrus looks like infrastructure for data. Blobs, immutable bytes, files stored across a distributed network, each bound to an object on Sui. Simple. Almost boring. But that simplicity hides a deeper ambition. Walrus treats data the way modern finance treats assets: something that must be durable, verifiable, owned, and composable across systems. Once that framing clicks, the rest of the architecture makes sense.

Sui plays a crucial role here, not as a marketing partner but as a structural dependency. Walrus binds every blob to an onchain object, giving data something it has historically lacked on the internet: a native notion of ownership, lifecycle, and accountability. A file is no longer just copied and forgotten. It exists, it persists for a defined period, it belongs to an address, and its state can be reasoned about programmatically. This alone changes how developers think about storage. Data stops being passive and starts behaving like infrastructure.

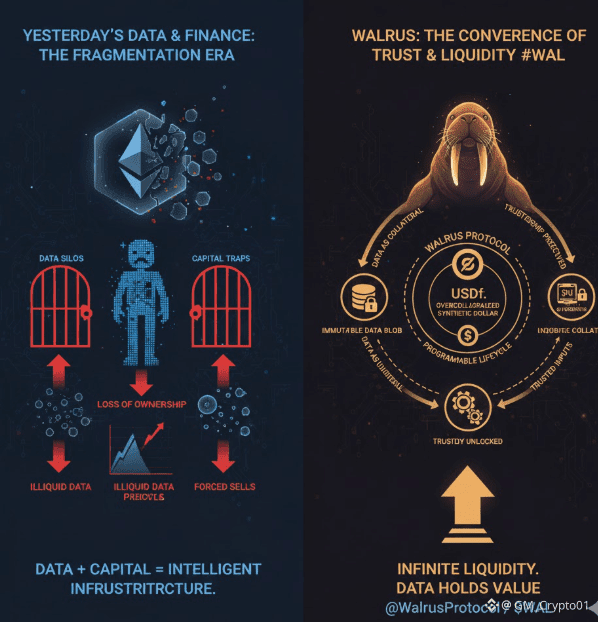

But Walrus does not stop at persistence. It introduces a more provocative idea: that resilient data markets and financial liquidity are converging problems. In traditional systems, data creates value indirectly. It informs decisions, models risk, and feeds institutions that sit on top of it. Walrus compresses that distance. By making data natively onchain and economically addressable, it becomes possible to treat it as collateral, signal, and substrate all at once.

This is where Walrus’ broader vision aligns with universal collateralization. In parallel to its data layer, the protocol embraces a model where capital does not need to be liquidated to be useful. Liquid digital assets and tokenized real-world assets can be deposited as collateral to mint USDf, an overcollateralized synthetic dollar. The implication is subtle but profound. Liquidity becomes something you unlock, not something you exit into. Ownership and usability coexist.

Seen through this lens, Walrus is not just solving storage. It is helping define what counts as reliable input for onchain finance. Data that is immutable, discoverable, and bound to clear ownership becomes a primitive that financial systems can trust. When data and assets live in the same execution environment, new forms of credit, risk assessment, and yield creation become possible without recreating offchain intermediaries.

The developer experience reflects this philosophy. Getting started on Walrus is intentionally grounded. You install tooling, connect to Testnet, fund an account, store a file. Nothing flashy. But every step reinforces the same idea: actions have onchain consequences. Uploading a blob is a transaction. Extending its lifetime is a transaction. Deleting it is a transaction, even if the data itself can never be fully erased from history. This explicitness is not friction. It is honesty. Walrus does not pretend that decentralization is clean or reversible. It exposes those realities so systems built on top of it can be designed responsibly.

Over time, this approach unlocks a different kind of scalability. Not just more files or faster reads, but deeper integration with economic systems. When blobs are tracked, owned, and time-bound, they can be referenced by smart contracts, AI agents, and financial protocols. When collateral can be mobilized without liquidation, capital becomes patient. Yield is no longer extracted by force but generated by design.

USDf sits at the center of this evolution. As an overcollateralized synthetic dollar, it provides stable onchain liquidity while preserving exposure to underlying assets. In practice, this means a developer, institution, or protocol can remain invested while still accessing usable capital. In a world where volatility is the norm, that stability is not a convenience; it is infrastructure.

Walrus’ insistence on Testnet-first experimentation reinforces the long-term mindset. Data persistence is not guaranteed there. Things can be wiped. Assumptions are challenged early. This is not an accident. Systems meant to support global finance and data markets must be comfortable with failure during construction. What matters is that the primitives hold when conditions become real.

The broader story is not about replacing existing storage solutions or stablecoins overnight. It is about convergence. Data that can be trusted. Assets that can be mobilized without being sold. Liquidity that does not hollow out ownership. Walrus sits at that intersection, quietly building the connective tissue.

Most protocols announce revolutions. Walrus builds conditions. Conditions where data can hold value, value can remain productive, and systems can scale without becoming brittle. In the long run, that is how infrastructure wins. Not by demanding attention, but by becoming unavoidable.