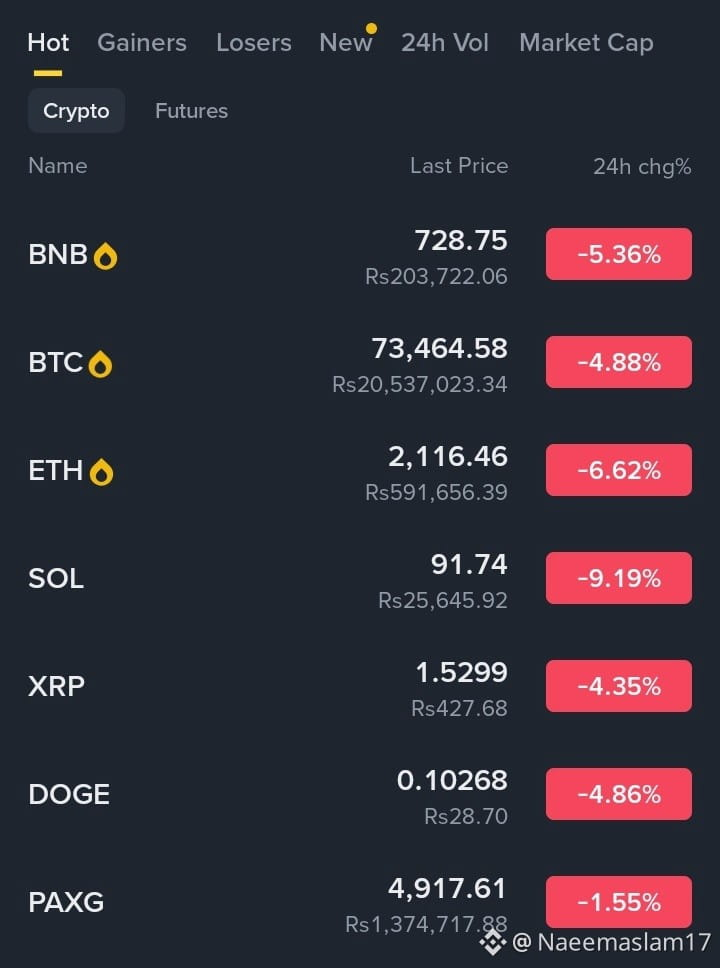

The crypto market is facing broad selling pressure, with $BTC , $ETH , $BNB , #SOL , #XRP and #DOGE all down together. When majors move in sync like this, it signals macro and liquidity-driven weakness, not project-specific bad news.

The crypto market is facing broad selling pressure, with $BTC , $ETH , $BNB , #SOL , #XRP and #DOGE all down together. When majors move in sync like this, it signals macro and liquidity-driven weakness, not project-specific bad news.

1️⃣ Bitcoin Pullback Triggered Risk-Off Sentiment

Bitcoin’s drop below key short-term support has flipped market sentiment bearish. Large traders are locking profits after recent rallies, and once BTC weakens, altcoins typically fall harder due to lower liquidity and higher risk exposure.

2️⃣ Leverage Flush & Liquidations

A sharp move down usually wipes out over-leveraged long positions. As BTC and ETH dipped, forced liquidations accelerated selling, pushing prices lower across the board — especially high-beta coins like SOL.

3️⃣ Weak Volume = No Dip Buyers

Current volume shows buyers are stepping back, waiting for clearer confirmation. Without strong spot demand, even small sell orders push prices down faster.

4️⃣ Macro Pressure Still in Play

Global markets remain cautious due to:

Uncertainty around interest rate cuts

Strong USD strength

Risk-off behavior in equities

Crypto, being a risk asset, reacts quickly when traditional markets turn defensive.

5️⃣ Altcoins Bleeding More Than Bitcoin

Coins like SOL and ETH are seeing deeper drops because:

Higher speculative positioning

Faster profit-taking

Reduced rotation from BTC into alts

This is typical during short-term market corrections.

🧠 What This Means for Traders

This looks like a healthy correction, not a market collapse

Smart money usually accumulates during fear phases

Chasing trades in red candles is risky — patience pays

📌 Key Focus:

Watch BTC dominance, volume return, and support holds. A stable Bitcoin often leads to an altcoin recovery.

#DPWatch #