🔍 The Core Reasons Behind the Drop

The sharp -12.37% decline in $SOL is not an isolated event. It's being driven by three main factors:

1. Technical Breakdown & Overheated Conditions

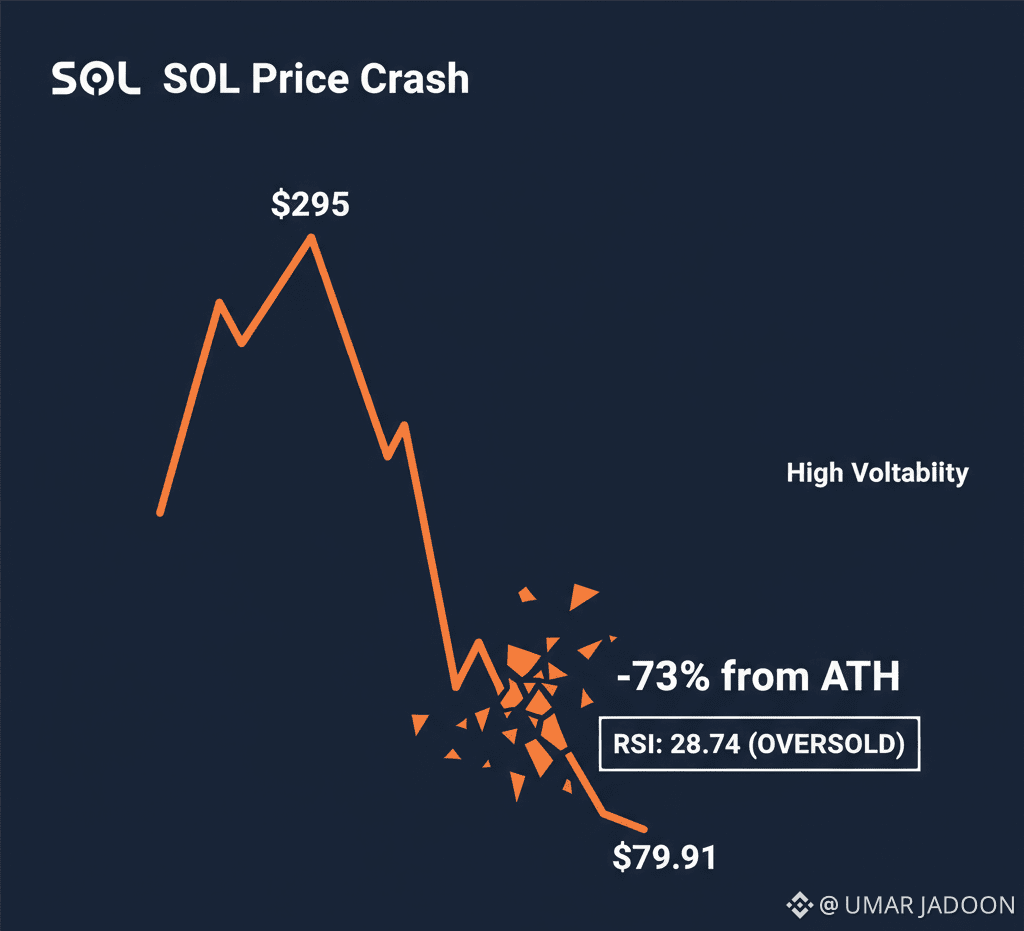

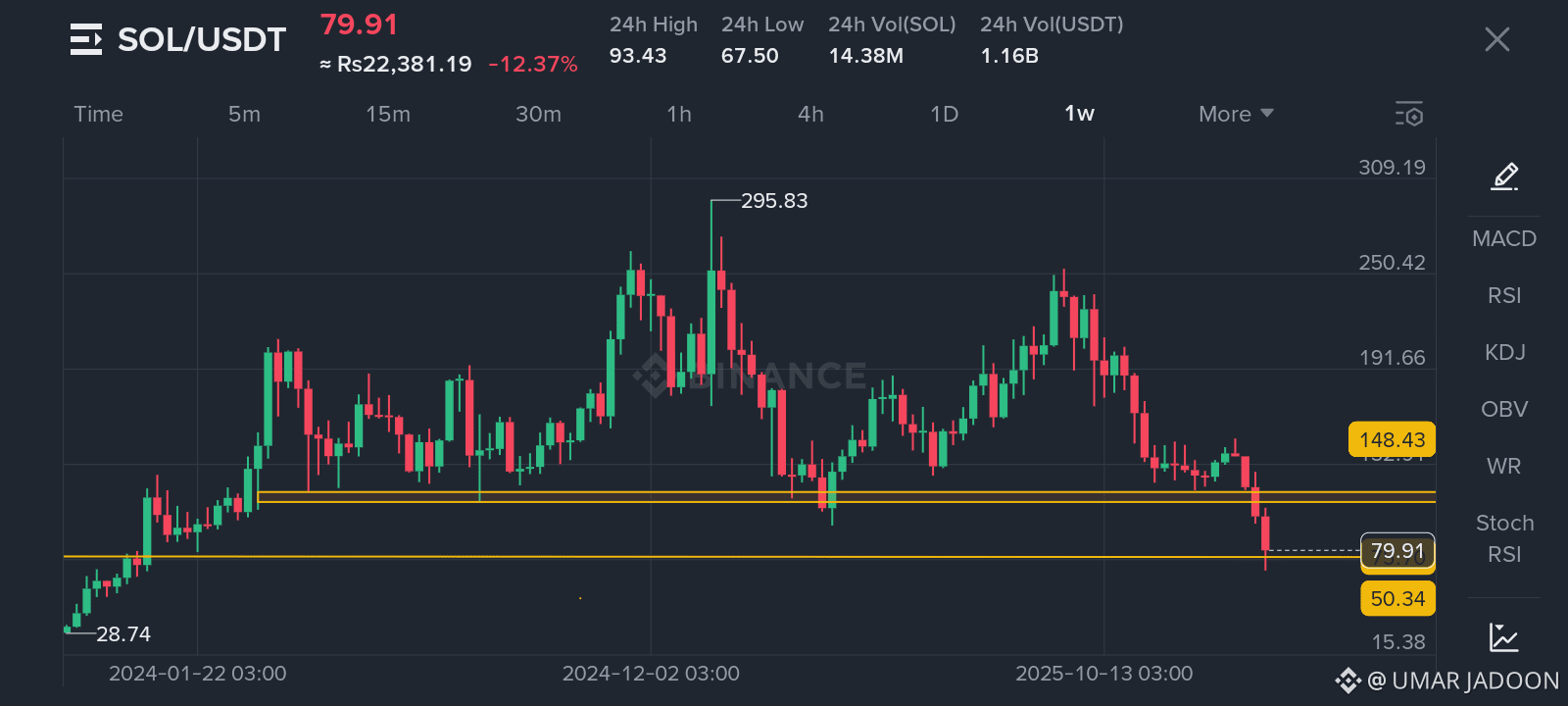

· SOL had an incredible parabolic run from $0.83 (Jan 2024)** to **~$295 (late 2025). Corrections are normal after such moves

· The current price of $79.91 represents a ~73% drop from its all-time highs near $295

· Technical indicators like RSI at 28.74 show extremely oversold conditions, but this doesn't guarantee an immediate bounce

2. Bitcoin Dominance & Market-Wide Selling

· When Bitcoin ($BTC) experiences major corrections, altcoins like SOL typically get hit harder (higher beta)

· ~70% drops from highs are common in crypto bull cycles - ETH dropped 65% in 2016, BTC dropped 84% in 2017

· SOL's high correlation with BTC means it gets dragged down during market-wide risk-off sentiment

3. Solana-Specific Network Challenges

· While Solana has improved significantly, occasional network congestion and outages have historically shaken confidence

· Competition from other L1s (Ethereum L2s, newcomers) creates uncertainty about Solana's long-term market share

· High validator costs and centralization concerns periodically resurface during market stress

📊 What The Charts Are Telling Us

Current Technical Status:

· 24H Range: $67.50 - $93.43 (massive 38% intraday volatility!)

· Volume: Extremely high at 14.38M SOL ($1.16B USDT) - indicates panic selling

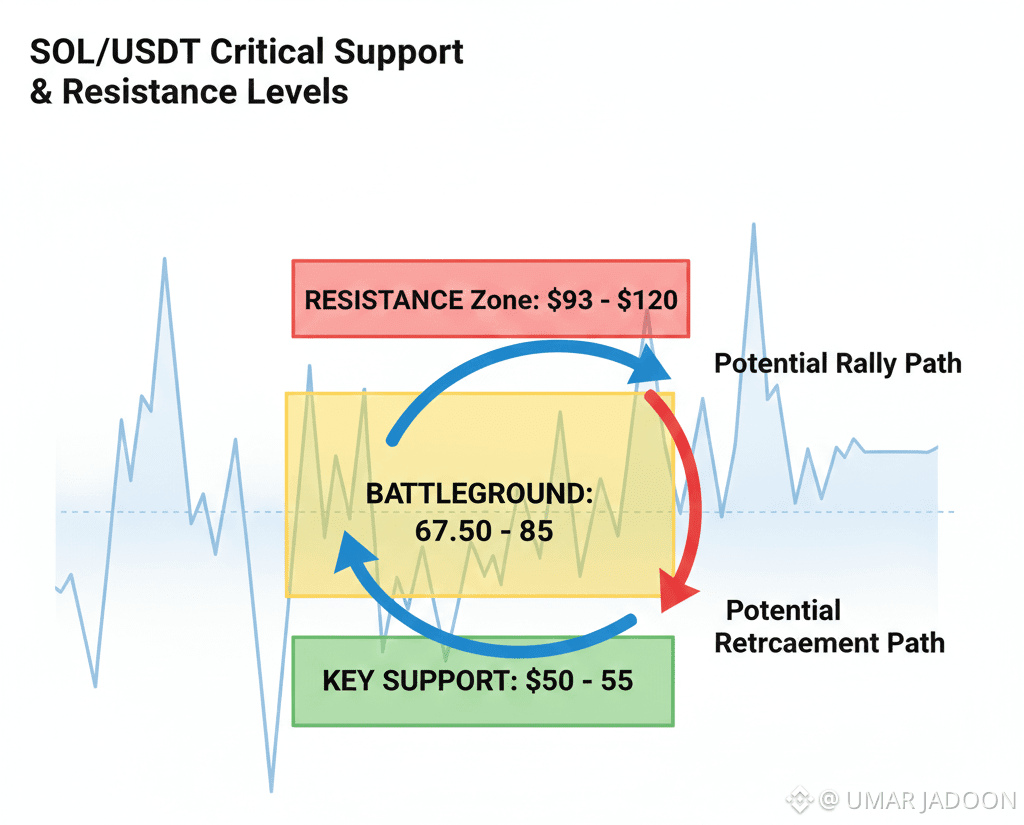

· Key Support Levels: $70 psychological level, $67.50 (24H low), $50-55 (previous cycle highs)

· Key Resistance: $93.43 (24H high), $110-120 zone

Market Structure Analysis:

· The price action from 2024-2025 showed classic bubble formation with three distinct peaks

· We're now in the post-bubble consolidation phase which can last months

· Daily RSI at 28.74 suggests we're approaching short-term capitulation levels

💡 Critical Factors to Watch

Short-Term (Days/Weeks):

1. Bitcoin stability - If BTC finds a bottom, SOL will likely bounce faster

2. Network activity - Watch for DEX volumes, NFT sales, and developer activity on Solana

3. Relative strength - Does SOL bounce harder than other altcoins when BTC stabilizes?

Medium-Term (Months):

1. Adoption metrics - Real usage determines long-term value

2. Competitive landscape - Can Solana maintain its developer mindshare?

3. Macro environment - Crypto needs favorable conditions to resume uptrend

🎯 Trading Psychology & Common Mistakes

What Most Traders Get Wrong:

· Trying to "catch the falling knife" - buying too early in a steep downtrend

· Ignoring timeframes - what's a "crash" on a daily chart might be a blip on a weekly

· Forgetting that -70% drops require +233% gains just to break even

Smart Money Behavior:

· Accumulating during fear (but slowly, with dollar-cost averaging)

· Focusing on fundamentals over price action

· Preparing for volatility to continue before any sustained recovery

📈 Potential Scenarios & Price Targets

Bearish Scenario (40% probability):

· Break below $67.50 leads to test of $50-55 zone

· Could form a complex bottoming pattern over 3-6 months

· Recovery delayed until broader crypto market sentiment improves

Base Scenario (50% probability):

· $67.50 holds as support, forming a bottom here

· Range-bound trading between $70-100 for several weeks

· Gradual recovery as fear subsides and fundamentals reassert

Bullish Scenario (10% probability):

· V-shaped recovery back above $100

· Requires extremely positive catalyst (major partnership, protocol upgrade, etc.)

· Quick reclaim of $120 resistance zone

🧠 The Bigger Picture Perspective

Historical Context Matters:

· Ethereum crashed 96% after its 2018 peak before eventually making new highs

· Bitcoin has experienced 5 drawdowns of -75% or more in its history

· SOL's technology and ecosystem remain among the strongest in crypto

What Really Drives Long-Term Value:

· Developer activity - Still one of the most active chains

· User adoption - DEX volumes, active addresses, NFT sales

· Institutional interest - Continued investment in Solana ecosystem projects

💎 Final Thoughts & Risk Management

The Bottom Line:

SOL's crash is a combination of market-wide crypto correction + altcoin overextension + some chain-specific concerns. The extreme oversold conditions suggest we're nearing at least a short-term bounce, but the medium-term path depends on broader crypto market recovery.

Essential Risk Rules Right Now:

1. Never trade with leverage in these conditions - liquidation risk is extreme

2. Dollar-cost average if accumulating - don't try to time the exact bottom

3. Keep a long-term perspective - fundamentals beat short-term price action

4. Have an exit strategy before you enter any trade

$SOL #RiskAssetsMarketShock #solana @Solana Official