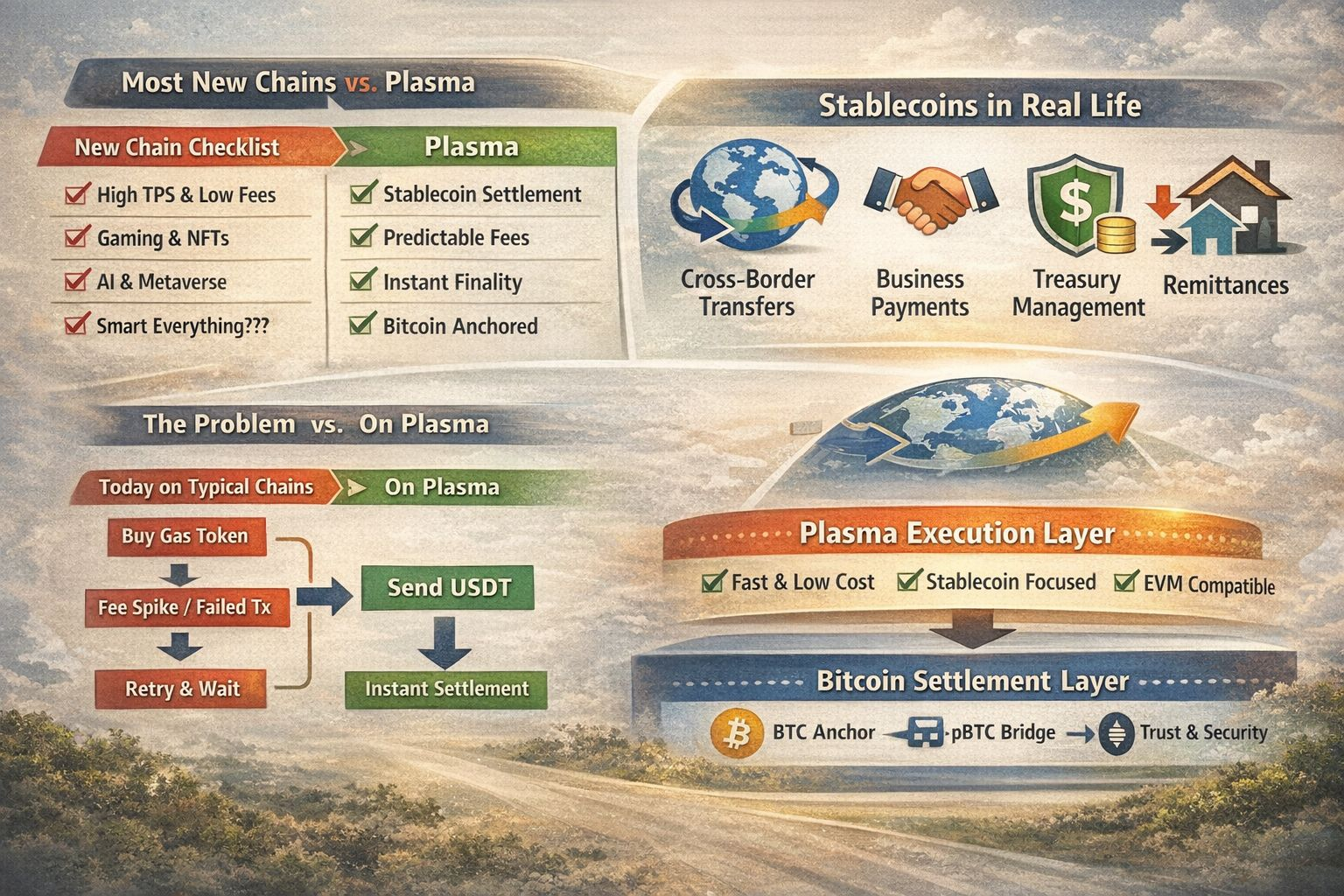

Most “new blockchains” read like the same resume.

Faster TPS, cheaper fees, “for developers”, “for the future”, and somehow also “the home of everything”.

Cool story.

But if you are just trying to send $200 in USDT to your supplier, you do not need a new metaverse. You need a rail that works every time.

That is the real reason stablecoin users will switch to Plasma in 2026. Plasma wins by doing less, on purpose.

Plasma stands out because it refuses to be a general-purpose chain

Plasma is not trying to host every app category under the sun. It is specialized settlement infrastructure built specifically for stablecoins. The design is stablecoin-native, not stablecoin-compatible.

That sounds boring, and that is the point.

Core thesis: Stablecoins already have product market fit

Stablecoins are not a narrative, they are a tool people use daily:

Cross-border transfers when banks are slow or closed.

Business payments to suppliers and contractors.

Treasury management, holding digital dollars without local currency risk.

Hedging in volatile economies.

Remittances when the traditional rails fail or overcharge.

So the real battle is not “who has the coolest chain”. It is “who makes stablecoin transfers feel like normal payments”.

What stablecoin users hate today

If you actually watch how normal people use stablecoins, the pain points are simple:

You have to hold a separate gas token just to move your dollars.

Fees jump around, so you cannot predict costs for payroll or invoices.

Transactions fail, or get stuck, or require weird wallet actions.

You end up learning blockchain mechanics for what should be a basic payment.

Plasma’s pitch is: stop making stablecoin users cosplay as crypto power users.

Plasma’s “first-class” features (built in, not bolted on)

Stablecoin-first gas logic, paymaster, gas abstraction:

Plasma uses a protocol-level paymaster approach so basic USD₮ transfers can be gasless, meaning no extra token shopping trip just to send money.

It also supports custom gas tokens, so fees can be paid in whitelisted assets like USD₮ or BTC, which makes costs more predictable.

Fast, deterministic finality with PlasmaBFT

PlasmaBFT (derived from Fast HotStuff) is built for reliable settlement and near-instant finality goals, which matters for merchants, payroll runs, and accounting workflows where “maybe confirmed soon” is not acceptable.

EVM compatibility, but only as a tool

Plasma is EVM-compatible so teams can migrate tooling and contracts without re-learning everything. But the goal is not to become “Ethereum but faster”. The goal is stablecoin settlement that feels invisible.

Bitcoin-anchored security, trust-minimized bridging

Plasma positions Bitcoin as the long-term neutrality anchor and emphasizes a trust-minimized Bitcoin bridge.

It also talks about pBTC as a canonical Bitcoin asset bridging into the system, so BTC can move efficiently while still leaning on the most trusted base layer.

XPL’s role: backbone, not a toll booth

XPL is the economic backbone for validators and incentives, not a volatile barrier that every stablecoin user must buy just to transact. The stablecoin UX comes first.

XPL today, a quick look

XPL being around $0.104 and down about 3% today is just normal daily volatility.

It shows the token is still trading like a newer crypto asset where sentiment moves price fast.

The circulating supply near 1.80B helps explain why the price sits in the cents range, small moves in dollars can still be meaningful in percentage terms.

Plasma is designed, so stablecoin users do not need to care about XPL price swings for simple transfers. The product thesis is about stable, predictable payments, not token hype.

Conclusion : Why users switch to plasma

Stablecoin users will not switch because Plasma is louder.

They will switch because it removes friction.

When you can send USDT without hunting for gas, when fees feel predictable, when finality is fast and reliable, and when settlement leans on Bitcoin as the neutral anchor, Plasma becomes the obvious default rail for people who use stablecoins like money.

That is the real reason Plasma wins.

Not attention, not hype.

Just stablecoin payments that finally feel normal.