Most blockchains begin with the same ambition: be faster, be cheaper, be louder. They compete for attention, chase narratives, and build ecosystems around whatever trend happens to be popular that year. Plasma started somewhere completely different. It asked a question that most projects ignored: why is sending digital dollars still so complicated?

Today, moving stablecoins usually requires holding a separate gas token, estimating fees, worrying about congestion, and retrying failed transactions. Something as simple as sending money to family, paying a freelancer, or moving savings across borders becomes a technical process. For an industry that claims to be building the future of finance, this is a strange failure.

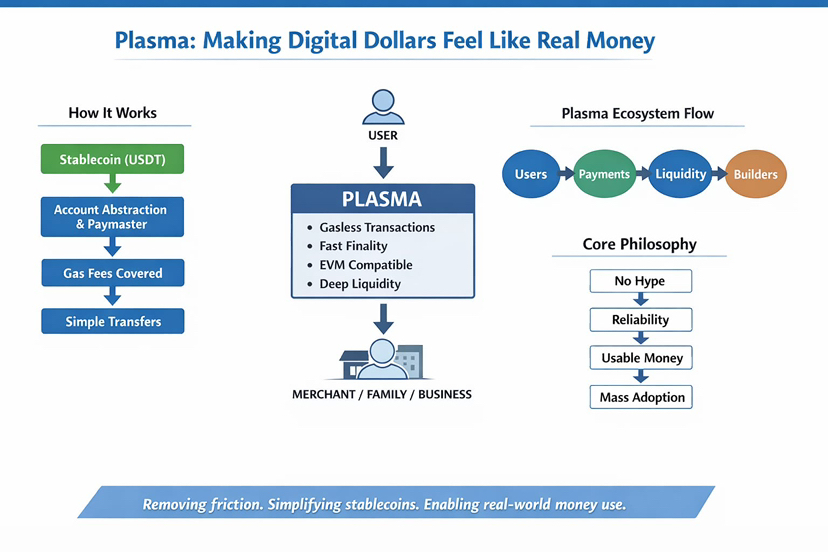

Plasma treated this friction not as a minor inconvenience but as the central problem. If stablecoins are supposed to behave like money, then using them should feel natural. No tutorials. No token juggling. No anxiety. Just send and receive.

That philosophy shaped everything that followed.

On most blockchains, stablecoins are secondary assets. They exist, but the network is not designed around them. On Plasma, they are first-class citizens. The entire system is optimized for moving digital dollars efficiently.

Through native account abstraction and Paymaster infrastructure, Plasma allows users to send USDT without holding gas tokens. For basic transfers, the network covers fees under controlled conditions. Abuse is limited, costs are predictable, and users are protected from complexity.

In practice, this changes everything.

A user can install a wallet, deposit USDT, and immediately start transacting. No ETH. No MATIC. No BNB. No learning curve. For experienced crypto users, this feels convenient. For newcomers, it feels revolutionary.

This design removes one of the biggest psychological barriers in crypto: fear of doing something wrong. It enables micro-payments, subscriptions, remittances, and everyday spending. It allows merchants to accept stablecoins without worrying about fee volatility. It allows customers to carry one asset instead of a bundle of tokens.

This is how money scales: when people stop thinking about the infrastructure.

Behind this simplicity sits serious engineering. Plasma is not built on experimental consensus or fragile shortcuts. It uses PlasmaBFT to deliver sub-second finality, allowing transactions to settle almost instantly. Payments do not linger in uncertainty. They complete.

Equally important, Plasma is fully EVM-compatible and runs on the Reth execution engine. Instead of reinventing the execution layer, the team adopted a high-performance Ethereum client. This preserves compatibility with existing tooling, audits, libraries, and developer workflows.

For developers, this matters more than marketing.

It means that applications built for Ethereum can migrate with minimal friction. Often, switching networks is little more than changing an RPC endpoint. No rewrites. No retraining. No wasted engineering cycles.

This approach reflects Plasma’s mindset. It does not aim to surprise developers. It aims to support them.

Stability, predictability, and reliability are not exciting buzzwords. They are the foundation of financial infrastructure.

Most new chains launch empty. They deploy a mainnet, announce incentives, and hope liquidity arrives. Plasma reversed this logic.

Before its mainnet launch in September 2025, it secured deep partnerships and capital commitments. When users arrived, markets were already active. Stablecoin lending, borrowing, and trading were functional from day one.

Within weeks, total value locked surpassed five billion dollars. Lending markets showed tight spreads and real depth. Integration with Aave positioned Plasma as one of the largest stablecoin hubs outside Ethereum.

This is not about vanity metrics. Deep liquidity has practical consequences. Large transfers do not move prices. Institutions can operate without slippage. Protocols can rely on predictable execution.

Liquidity creates gravity. Gravity attracts builders. Builders attract users. Users attract more capital.

Plasma understood this feedback loop early.

Infrastructure alone is not enough. It must translate into real products. Plasma One is where the ecosystem meets everyday life.

It functions as a stablecoin-based neobank, offering wallet accounts, interest-bearing balances, debit cards, cashback rewards, and instant transfers. For users in volatile economies, this is not speculation. It is protection.

In places like Buenos Aires or Istanbul, where local currencies lose value rapidly, holding digital dollars can preserve purchasing power. Plasma One turns stablecoins into usable money. Not just savings. Spending power.

Because transfers are gasless, small daily payments become viable. Coffee, transport, subscriptions, utilities. Merchants can eventually receive local currency while customers pay in stablecoins through integrated processors.

This is how alternative financial systems emerge. Not through ideology. Through convenience.

One of the strongest signals in Plasma’s evolution has been its institutional orientation. Integration with Fireblocks is not cosmetic. Fireblocks is used by firms managing billions under strict compliance frameworks.

Institutions do not adopt infrastructure casually. They prioritize security, auditability, and operational stability. Combined with Plasma’s EVM compatibility and liquidity profile, this reveals a clear strategy: build rails that professional capital can trust.

While many projects chase retail narratives, Plasma has quietly positioned itself as backend infrastructure for serious finance.

Its native token, $XPL, reflects this philosophy. Rather than serving as a speculative decoration, it coordinates network activity. It secures validators through staking, enables governance, supports Paymasters, and aligns incentives across participants.

Its relevance is tied to usage, not hype.

As transaction volume grows, demand for security and coordination grows with it. This does not guarantee price appreciation. It guarantees purpose.

As 2026 approaches, Plasma stands at a demanding but promising stage.

Its strengths are clear. It holds a strong position in stablecoin DeFi. Its user base is expanding. Its products are live. Its institutional connections are real.

But challenges remain.

Significant $XPL token unlocks in mid-2026 may introduce selling pressure. Staking incentives are designed to counterbalance this, but incentives only work if participants respond.

At the same time, many users still treat Plasma primarily as a transfer layer. For sustained growth, activity must deepen. High-frequency payments, business tooling, subscription systems, cross-asset bridges, and advanced DeFi products will determine whether Plasma becomes indispensable or merely useful.

Planned Bitcoin bridges, regional expansion of Plasma One, and continuous protocol upgrades will test execution capacity.

This is where narratives end and operations begin.

For a long time, I treated Plasma as something I had already understood. A solved story. A finished chapter. Revisiting the documentation changed that.

What stood out was not marketing. It was coherence.

Account abstraction was not added later. It was foundational. Execution was not experimental. It was conservative. Liquidity was not an afterthought. It was prioritized. Products were not demos. They were businesses.

Plasma is not trying to be everything. It is trying to do one thing extremely well: make digital dollars move like real money.

No friction. No drama. No spectacle.

Just reliability.

In an industry obsessed with novelty, this focus feels almost radical.

If Plasma succeeds, it will not be remembered for token rallies or viral moments. It will be remembered for something quieter: making stablecoin payments feel normal.

And in finance, normalisation is the ultimate form of adoption.