Plasma’s pitch, in one minute

Let me start from the boring truth. Most people don’t “use a blockchain.” They use stablecoins. They send USDt to a friend, pay a freelancer, move funds between wallets, park cash, stuff like that.

Plasma is built around that exact behavior. Not around memes, not around a hundred random apps, but around moving stablecoins smoothly. The whole pitch is basically: if stablecoins are already the main product on-chain, then the chain should treat them like the main product too. Simple.

And yeah, I find that refreshingly… practical. Not sexy, but practical wins a lot.

“Stablecoin-native”… what does that actually mean?

On most EVM chains, a stablecoin is just another token. It works, but it’s kinda clunky.

You want to send USDt? Cool.

First make sure you have the gas token.

Then check fees.

Then maybe swap.

Then try again.

New users hate this part, and honestly, so do I.

Plasma’s idea is to make stablecoin behavior feel “built-in.” Not like a bolt-on feature. So you get things like stablecoin-friendly fee setups, and contracts that are designed with payments in mind.

I’m not saying it’s magic tech. It’s more like changing the default settings. And defaults matter more than people admit.

The real upside, smoother money stuff

Here’s where it gets interesting. If a chain is designed for money movement, a few things start to feel less annoying:

Less gas confusion.

Stablecoin users don’t want a scavenger hunt for gas. Anything that reduces that friction is a big deal, especially if you’re thinking mainstream.

Payment-style contracts don’t feel “extra.”

Escrow, payouts, subscriptions, refunds, streaming payments… these are normal needs. On many chains they exist, but they feel like side quests.

Plasma’s approach pushes them closer to the center.

Liquidity tends to hang around.

When stablecoin rails are smooth, tools like payroll apps, simple swap flows, lending, and settlement services naturally want to live nearby. Not always, but often.

Small note (because I’ve seen this go wrong): it only works if builders actually use these stablecoin-first tools. If everyone ignores them and builds like it’s “just another EVM,” then you lose the advantage.

Market check, price, TVL, and the vibe today

Alright, numbers. Not because numbers are everything, but because they keep us honest.

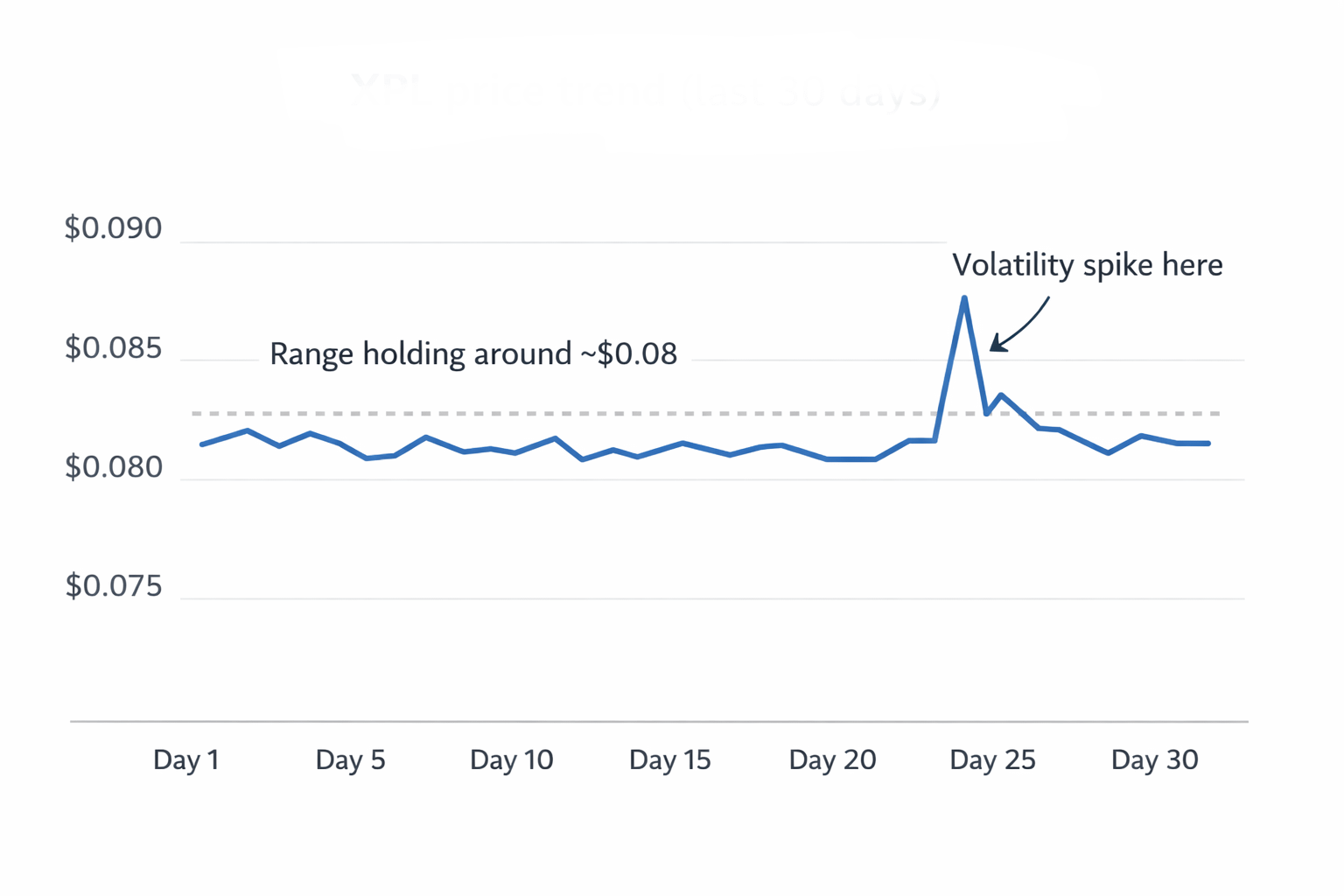

XPL is hovering around the $0.08 area today, depending on the tracker. Binance shows roughly $0.081 with big 24h volume, while CoinMarketCap shows around $0.084 with a lower 24h volume figure. That kind of mismatch is normal across sites. Different exchange mix, different timing, sometimes different reporting quirks. It happens.

Now the chain-side stuff is the part I personally care about more.

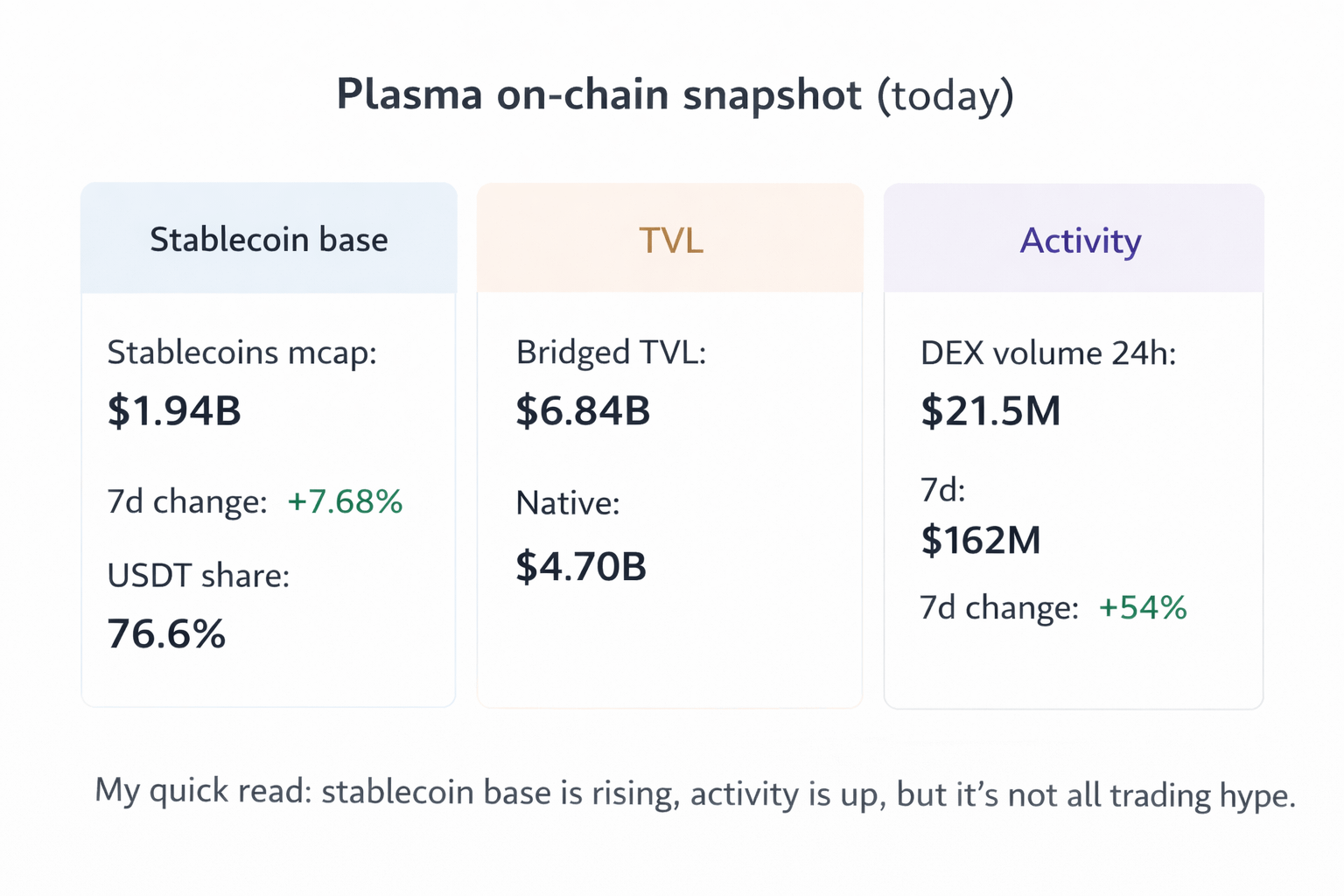

Plasma’s stablecoin market cap is about $1.94B, up about 7.68% over 7 days, and USDT share is roughly 76.6%. TVL is listed around $6.84B bridged, with $4.70B native. Activity-wise, DEX volume is around $21.5M (24h) and $162M (7d), with the weekly number up about 54%.

My quick read (and I’ll say it plainly): stablecoin growth matters more to me than a random green candle on XPL. It’s harder to fake stablecoin supply growth for weeks and weeks. Also, the activity increase looks healthy, but it doesn’t feel like pure “trading frenzy.” More like movement, settlement, repositioning… the money stuff.

Not gonna lie, there are trade-offs

If you build around stablecoins, you inherit stablecoin reality. Admin controls exist. Freezes can happen. Blacklists are a thing.

You can call that “bad,” or you can call it “real life,” but either way it’s part of the deal.

Also, that heavy USDT dominance is efficient… and risky. Efficient because it’s liquid and widely used. Risky because the chain becomes extra sensitive to one issuer’s rules. That’s not a Plasma-only issue, but Plasma will feel it more because stablecoins are the whole point.

And bridging risk is always lurking. If a huge chunk of value comes through bridges, then bridge trust becomes part of the chain story. I wish it wasn’t true. It is.

If this works, what happens next?

Here’s my simple watchlist:

Does stablecoin supply keep rising without needing crazy incentives?

Do real apps use the stablecoin-native approach, or do they ignore it?

Does activity keep climbing in a “payments and settlement” way, not just short-lived trading bursts?

If Plasma hits those three, it stops being a narrative and starts looking like infrastructure. The boring kind that people don’t brag about… they just use it.