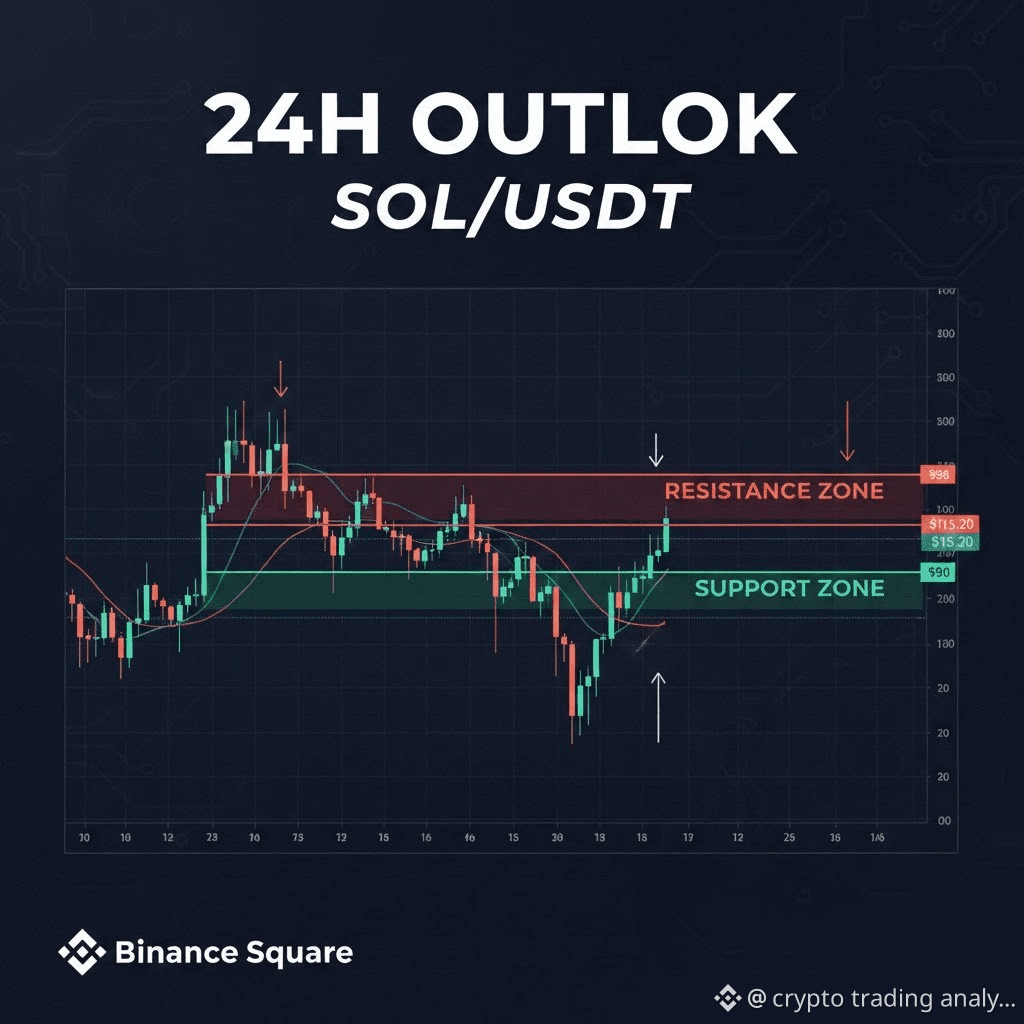

$SOL Current Price: ~$83.8

Market Structure: Short-term bearish consolidation after a sharp sell-off

Technical Structure

$SOL experienced a strong impulsive drop from the $96–100 zone, followed by a dead-cat bounce and is now consolidating below key resistance, indicating weak bullish strength. Price action is forming a bearish flag / range compression, which often resolves with continuation unless buyers reclaim resistance.

Key Levels

Immediate Support:

$82.5 – $81.8 (intraday demand zone)

$79.5 – $78.0 (major support, last bounce base)

Immediate Resistance:

$86.0 – $87.5 (range high & supply zone)

$90.0 (trend-break level; bullish only above this)

24-Hour Scenarios

Base Case (Higher Probability):

Price continues to range between $82 – $87, with sellers defending rallies. A breakdown below $82 may trigger a quick move toward $79–78.

Bullish Scenario:

If $SOL reclaims and holds above $87.5 with volume, upside extension toward $90–92 is possible, but this requires broader market strength.

Bearish Scenario:

A clean break below $81.5 opens downside toward $78, and in high volatility conditions, even $75 cannot be ruled out.

Momentum & Sentiment

Momentum remains weak

Buyers lack follow-through

Market sentiment is cautious to bearish short-term

Trading Insight

Scalpers: Trade the range ($82–87) with tight stops

Short-term bears: Watch breakdown below $82

Bulls: Wait for confirmation above $88–90 before entering

⚠️ Risk Disclaimer: This is technical analysis, not financial advice. Crypto markets are highly volatile—always manage risk and use stop-losses.

📌 Not financial advice. Trade with proper risk management.

Disclaimer: I am not your financial advisor.

#cryptotradinganalysisboss #BinanceSquare #TechnicalAnalysis #altcoins