Most stablecoin systems celebrate the wrong moment.

They celebrate when a transaction succeeds.

But in real operations, success is not the end of work. It’s often the beginning of a quieter, harder phase — the phase where nothing is technically wrong, yet nobody feels safe enough to move on.

A USDT payment goes out.

The wallet confirms it.

The chain finalizes cleanly.

PlasmaBFT does exactly what it promised.

And still — nothing closes.

The receiver doesn’t book it.

Ops leaves the task open.

Accounting waits until cutoff instead of marking it settled.

No alarms.

No failures.

Just hesitation.

This is the cost most payment systems never measure.

Not loss.

Not downtime.

But supervision.

In stablecoin operations, ambiguity is heavier than failure. Failure creates an action. Ambiguity creates responsibility without ownership. Someone has to keep watching, not because the system is broken, but because the signal to stop watching never fully arrives.

That gray zone is where teams bleed attention.

Gasless USDT flows sharpen this tension. When users don’t manage gas, they also stop thinking about process. “Send” feels final in a psychological sense. Any delay after that doesn’t feel like normal settlement — it feels like contradiction.

So behavior adapts in subtle ways.

Senders disengage too early.

Receivers hesitate longer than needed.

Ops treats successful payments as provisional.

Support inherits tickets where nobody is wrong.

Screenshots replace certainty.

Explorers become comfort tools.

Retries become insurance.

Nothing breaks.

But the system starts training people to hover.

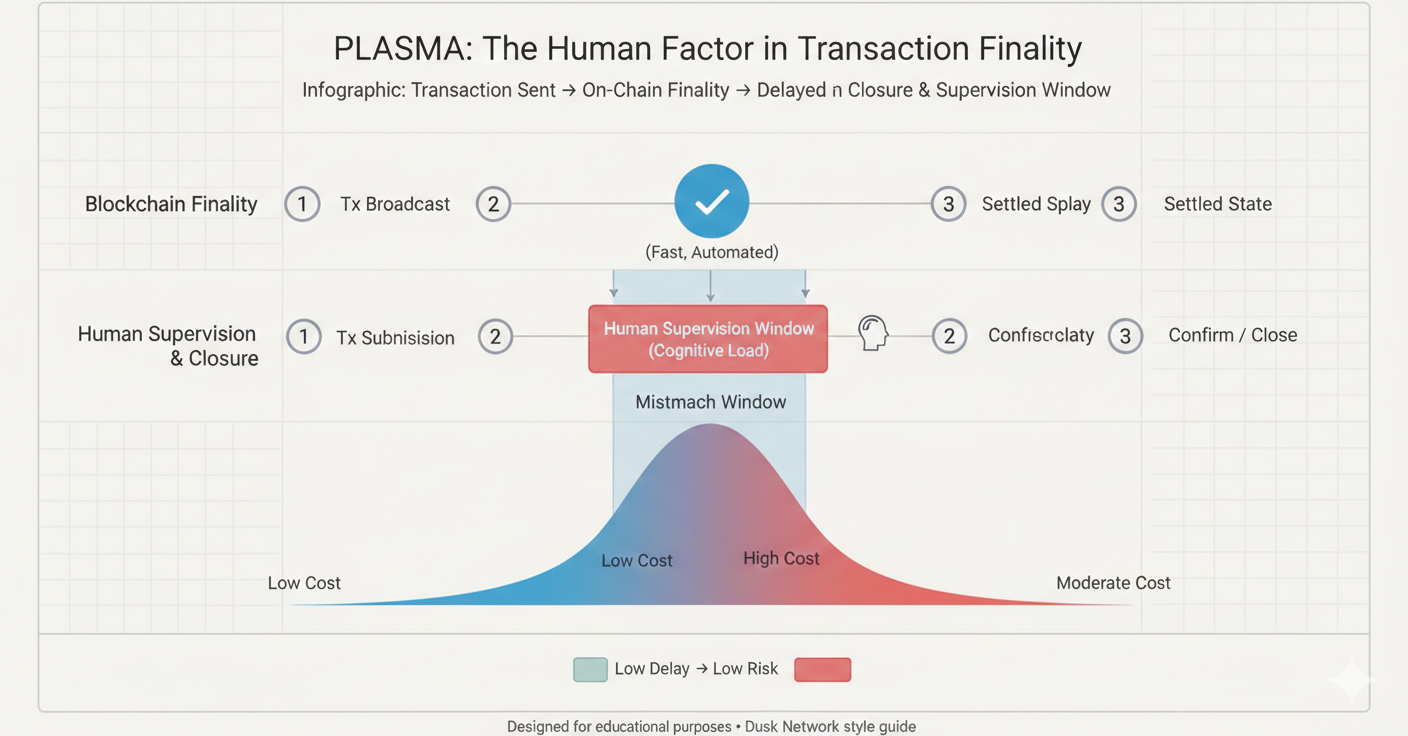

This is not a throughput problem. Plasma isn’t chasing faster blocks for marketing charts. Blocks already move. Ordering is correct. Finality lands. The protocol finishes its job early.

The friction appears after consensus — where humans need permission to disengage.

Sub-second finality matters here not as speed, but as compression. Compression of the window where someone feels personally responsible for monitoring value that should already be settled.

The shorter that window, the fewer compensating behaviors appear.

No second checks.

No internal pings.

No “just confirming” messages.

When the signal is singular and immediate, workflows close themselves.

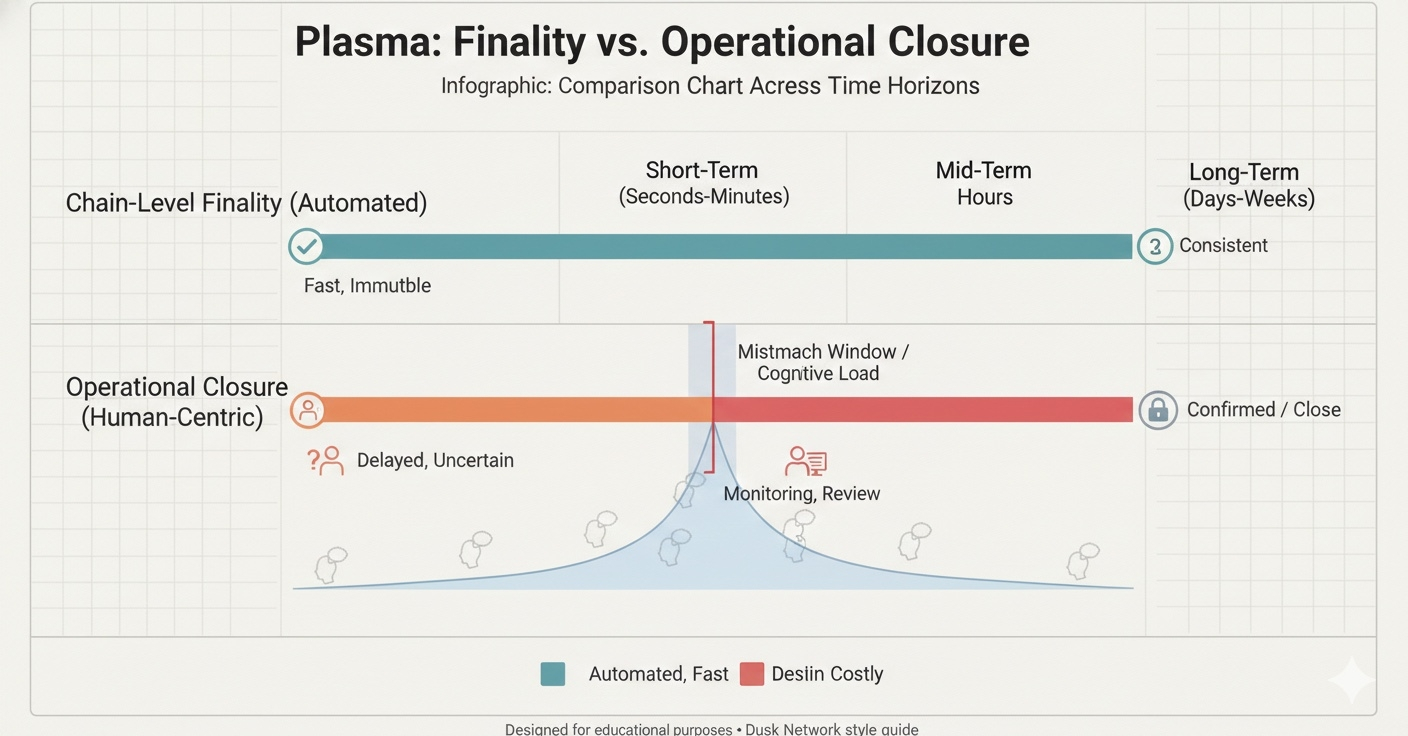

Bitcoin anchoring lives outside this daily pressure. It answers long-horizon questions about neutrality and durability. That matters for where value rests over years. But operations don’t run on years. They run on batch windows, cutoffs, and reconciliation deadlines.

Those clocks don’t care that “nothing went wrong.”

They only care whether a payment is finished enough to stop thinking about.

This is where Plasma feels intentionally designed.

Not to prove that transactions finalize.

But to make finality felt early enough that humans disengage naturally.

The real test isn’t whether the ledger agrees.

It’s whether nobody feels the need to verify it again.

The first time a routine USDT transfer forces someone to keep a dashboard open, the network hasn’t failed. But it has shifted work onto people who shouldn’t be doing it.

And systems that quietly create supervision costs don’t scale cleanly. They scale anxiety.

Plasma’s pressure point isn’t speed.

It’s closure.

Because in payments, the most expensive state isn’t failure.

It’s success that still requires watching.