There are moments in crypto when a project doesn’t change much internally, but the way it lands suddenly feels different. That’s what happened with Vanar recently. Not because of one loud announcement or a viral metric, but because the narrative finally tightened into something that sounds less like a theme and more like infrastructure.

A month ago, Vanar was easy to summarize in one sentence: a gaming- and metaverse-focused Layer-1 with big adoption ambitions. That description wasn’t wrong, but it was incomplete. It framed Vanar as a vertical chain — good at certain things, interesting for certain audiences — rather than as a base layer trying to solve structural problems. This week, that framing started to fall apart.

What changed isn’t Vanar’s identity. It’s the way the project is explaining itself, and the way the market is listening in 2026.

Crypto conversations have matured. Speed alone doesn’t impress anymore. Neither does slapping “AI” onto a roadmap. People are now looking for systems that can support payments, tokenized real-world assets, compliance-style constraints, and automation that actually works under real conditions. In that context, Vanar’s message suddenly fits the moment much better than it did a few weeks ago.

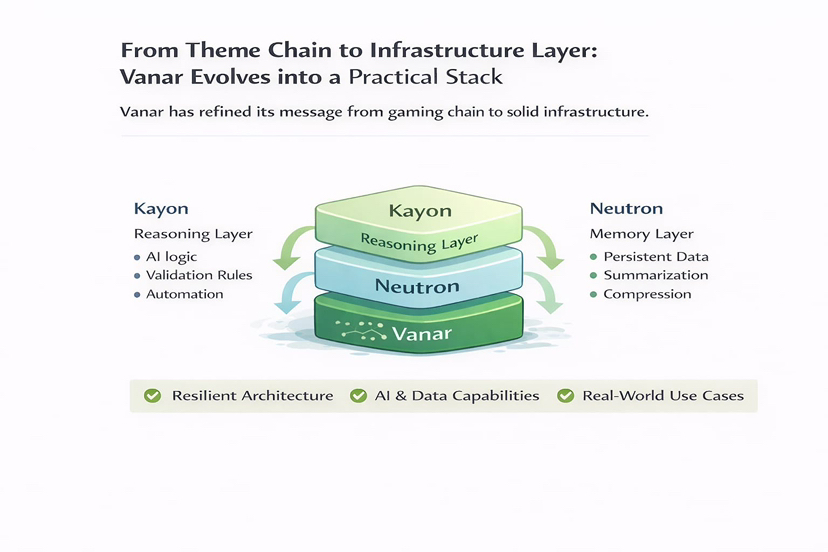

The biggest shift is how Vanar now presents itself as a stack, not a buzzword.

Instead of vague language about AI and adoption, the architecture is being described in layers that make intuitive sense. Vanar as the base layer is about fast, low-cost execution where activity happens. Neutron is positioned as the memory layer — compressing large, complex information into forms that can live on or alongside the chain without breaking performance. Kayon is framed as the reasoning layer — the part that can read that information, apply rules, validate conditions, and act on it.

That matters more than it sounds. When a project can describe itself as a stack, you can trace a line from vision to implementation. You don’t have to guess how “AI” fits in. You can see where data lives, how it’s processed, and what it’s used for. That’s when a blockchain stops sounding experimental and starts sounding buildable.

This is also why the “real-world adoption” narrative feels stronger now. In 2026, adoption doesn’t mean raw user counts anymore. It means supporting workflows that look boring but scale: payments that settle reliably, assets that carry compliance logic, AI agents that can execute tasks without breaking things. Vanar’s messaging now aligns with those expectations instead of fighting them.

The consumer side adds weight to this shift. Vanar isn’t pitching adoption from zero. Products like Virtua Metaverse and the VGN games network already exist, and they anchor the story in reality. They show that Vanar has experience dealing with users who don’t care about chains, wallets, or technical complexity. That history matters. It makes the ambition of onboarding billions feel directional rather than aspirational.

Gaming and metaverse aren’t being abandoned in this framing — they’re being reframed as proof points. If a chain can handle real-time gaming economies and digital ownership at scale, it has a credible foundation to expand into broader use cases like branded digital assets, enterprise workflows, and AI-driven applications.

The token narrative is another place where the story matured. Many Layer-1 tokens never escape the role of “gas with branding.” Vanar’s positioning around VANRY leans into participation instead — staking, validation, governance, and long-term alignment. That becomes more important as a chain moves toward AI-native infrastructure and real-world usage, because governance stops being decorative. The rules of the system actively shape what gets built and what survives.

In other words, once you’re no longer just chasing throughput, incentives matter. Who runs the network, how decisions are made, and how value flows through the system become part of the product itself. Vanar is starting to talk about that openly, which makes the project feel more serious.

The “why now?” question has a simple answer. The market got more selective, and Vanar’s message got more precise at the same time. Last month, it was easy to dismiss Vanar as a chain with a gaming narrative. This week, it’s being framed as a practical Layer-1 with a clearer data-and-AI direction, aimed at the parts of crypto that are actually growing up.

If this direction holds, the next expectations are obvious. People will want tangible proof that the stack works through integrations and live use cases. They’ll want onboarding flows where the chain disappears behind the product. And they’ll want concrete examples of what the AI layer does in production — not demos, but workflows that are faster, safer, or more reliable because it exists.

That’s why Vanar matters more today than it did a few weeks ago. Not because it reinvented itself, but because it sharpened its identity at exactly the moment when clarity started to matter more than hype.

In 2026, infrastructure doesn’t win by being loud. It wins by being understandable, usable, and quietly indispensable. Vanar is starting to sound like it knows that.