Most chains flex about their fancy tech stack, but the brutal truth is getting people to use it every day in a way that actually keeps the token relevant long-term is the real killer. Vanar Chain kicked off pretty heavy on features, but these days it’s quietly pivoting hard—away from one-shot hype toward making $VANRY something people legitimately need month after month through subscriptions and real ecosystem hooks. Feels like one of the saner long-game plays I’ve seen in Web3 lately.

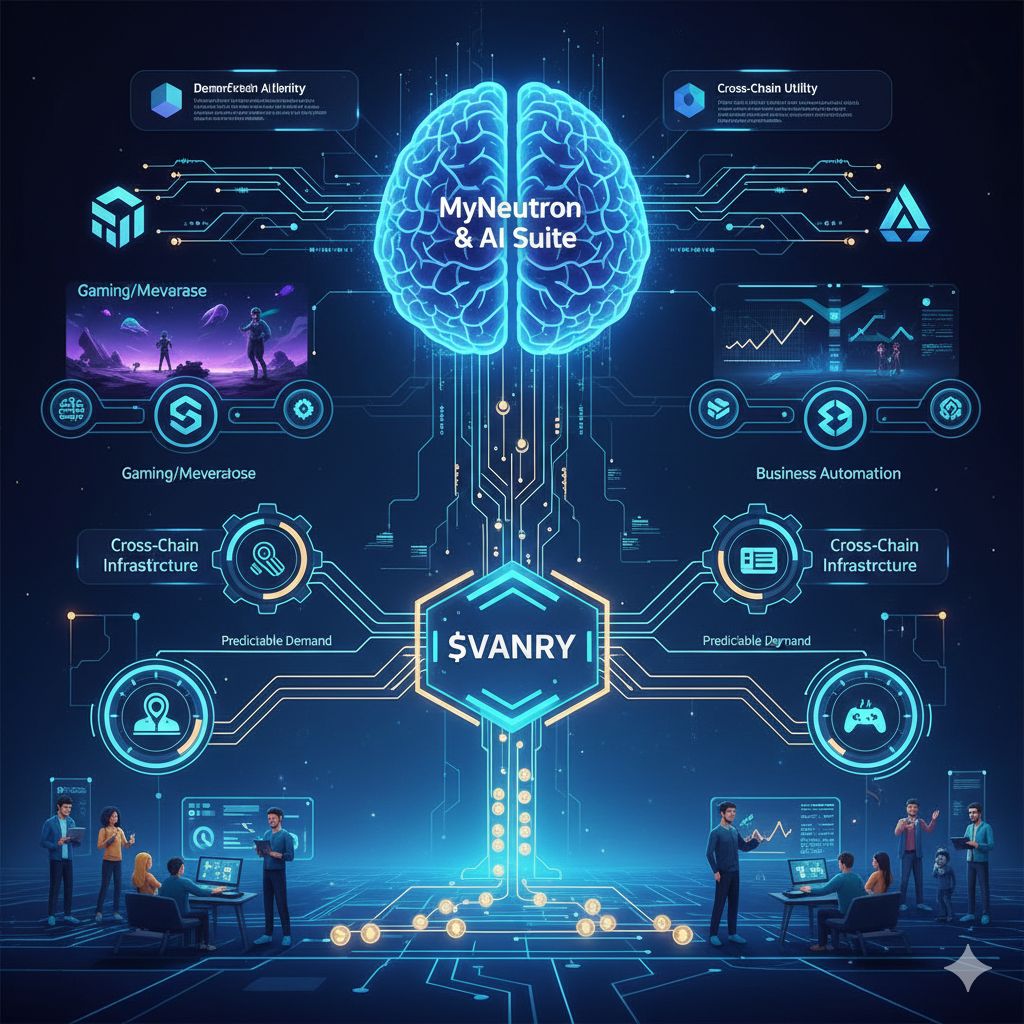

They’re not banking on people trading the token or burning it on random txs anymore. The focus is routing their flagship stuff—myNeutron, the whole AI suite—straight into recurring subs paid in $VANRY. So the token stops being “nice to have for gas” and starts being “you literally can’t keep using this without it.”

Flipping Web3 economics on its head with subscriptions from day one

Normal blockchain products usually do freemium: basics free or dirt cheap, pay extra if you want the good stuff. Vanar’s going the other way—even the powerful AI features start paid, baked in at the protocol level. myNeutron (that semantic memory thing) and the rest of their high-end AI tools are shifting to proper recurring billing cycles that eat $VANRY regularly.

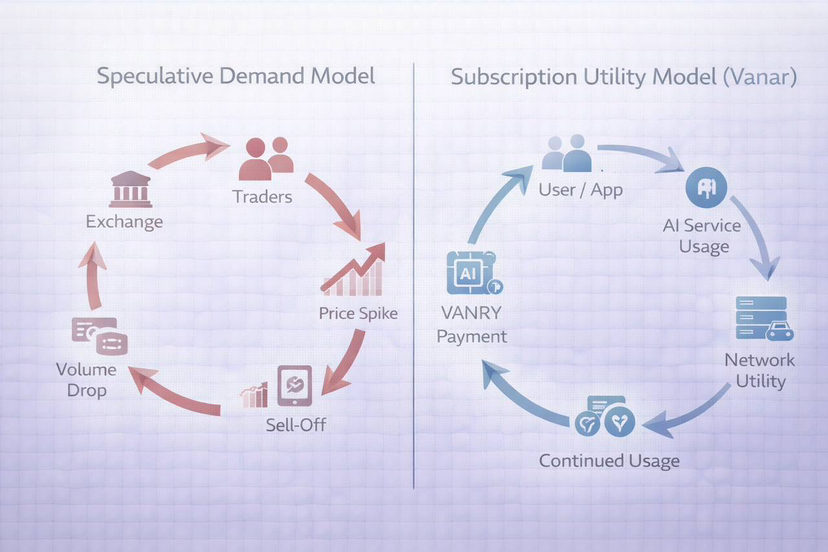

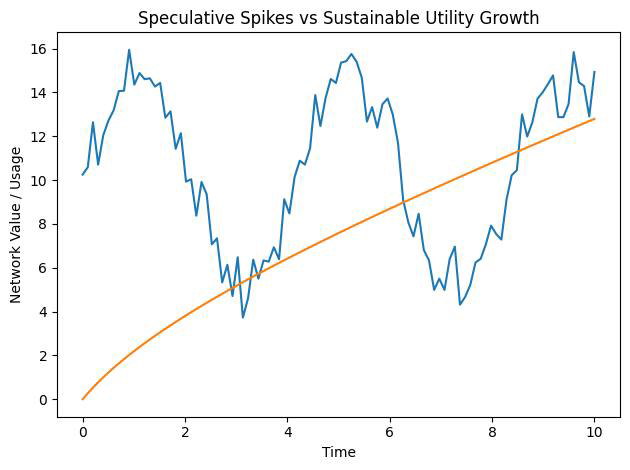

This quietly fixes one of crypto’s dumbest ongoing problems: token demand is a rollercoaster because usage is random and hype-driven. Lock people into subscriptions and you get predictable, repeating buys. The token suddenly isn’t a moon coin—it’s tied to actual ongoing platform value.

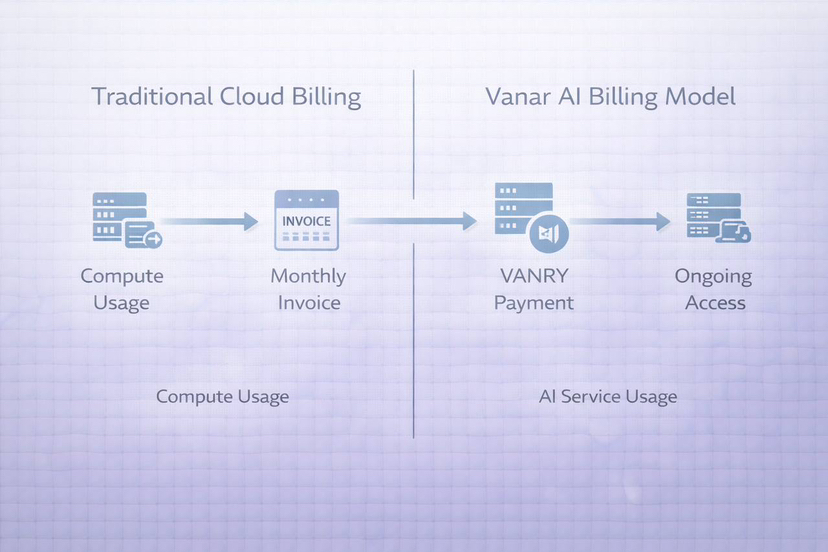

It’s straight out of cloud billing 101. Companies plan monthly for AWS, Google Cloud, whatever—compute, storage, API hits. Vanar’s doing the same for on-chain AI: pay steady for query batches, memory indexing rounds, reasoning flows, etc. Not just “when someone transacts.

Why this could actually make the network feel stable for once

Subscriptions don’t just create demand—they glue users to the product and force consistent behavior. Any builder or project leaning on Vanar’s on-chain AI gets stuck with scheduled $VANRY outflows. That baseline buying pressure doesn’t vanish when Twitter sentiment tanks or some big event ends.

It’s classic Web2 SaaS logic: sign up for a CRM, billing tool, analytics dashboard—keep paying forever if it keeps delivering. Once myNeutron or Kayon AI slots into someone’s daily workflow (better analytics, faster automation, smarter reasoning), paying in #VANRY isn’t a choice—it’s baked into running the business.

Businesses (especially regulated ones) love predictable costs way more than surprises. Clear monthly #VANRY subs beat the hell out of “gas spiked 5x this week” or “we only pay when users actually do something.”

Spreading utility outside their own chain

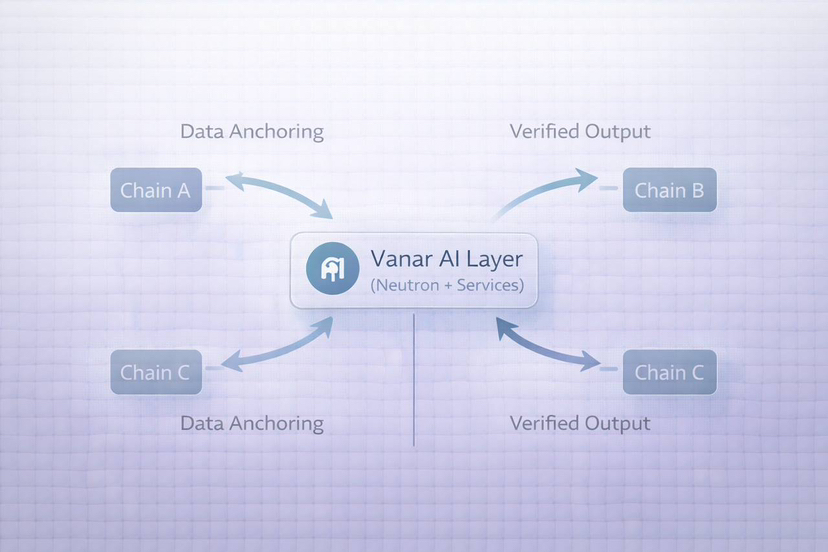

They’re not stopping at their own L1 either. Recent updates and roadmap teases point to Neutron expanding cross-chain—letting other ecosystems pull in Vanar’s compressed, semantically rich data while Vanar stays the settlement home base.

That could create #VANRY demand from totally outside projects. Need Vanar’s memory layer on another chain? You might have to settle or anchor in $VANRY. Token utility suddenly isn’t trapped in one ecosystem—it’s useful across many. That’s way more powerful than just trying to be the fastest/cheapest smart-contract chain.

Vanar could end up more like an “AI infra provider for multiple chains” than just another L1 fighting for dApp dominance.

Partnerships and actual integrations stacking up

It’s not vaporware. They just got into NVIDIA Inception, which means better access to serious AI hardware acceleration and dev tools—makes the chain way more legit for real AI builders.

They’re also pushing hard into gaming, metaverse stuff, AI-powered experiences, in-game microtransactions, even some real-economy tie-ins. Spreading across those verticals means token demand isn’t riding on one hype train—if gaming cools, maybe AI automation or metaverse picks up slack. Diversification makes it tougher for the whole thing to crater.

Ditching speculation for boring, repeatable utility

Most L1 tokens live on trading volume, narrative pumps, or influencer shills—super thin ice that cracks the second the mood sours. Vanar’s trying the opposite: subscription billing + utility-locked token usage means value can come from actual customers using the product, not just traders chasing pumps.

It’s how normal software companies make money—recurring revenue from people who need it to run their ops. Less Twitter fireworks, more quiet business sense.

The hard parts they still gotta nail

Subscriptions sound great but they flop hard if the product sucks or isn’t worth paying for repeatedly. If myNeutron or the AI tools don’t save serious time, improve results, cut real costs, or drive clear ROI, people will drop it fast and call it dead weight.

They need to keep shipping: bulletproof tech, killer docs, smooth onboarding, rock-solid on-chain billing (no weird edge cases), nice dashboards for spend tracking, proper invoicing/off-chain views, and decent support when things go sideways.

Scale’s the other monster. Real recurring demand needs hundreds or thousands of paying users/apps. That means grinding on education, grants, dev relations, hand-holding early teams—way more work than just launching cool features.

Bottom line: heading toward a token that actually powers sustainable usage

Vanar’s move to subscription AI utility + cross-chain expansion feels like one of the more grown-up stories floating around right now. They’re wiring #VANRY directly into predictable, repeating product activity instead of hoping speculation saves the day.

Most chains never make it past the “shiny tech + hype token” phase. Vanar’s at least trying to turn #VANRY1 into something builders and businesses keep buying because the services are legitimately part of how they operate.

That’s not flashy, but it’s the kind of boring that lasts.