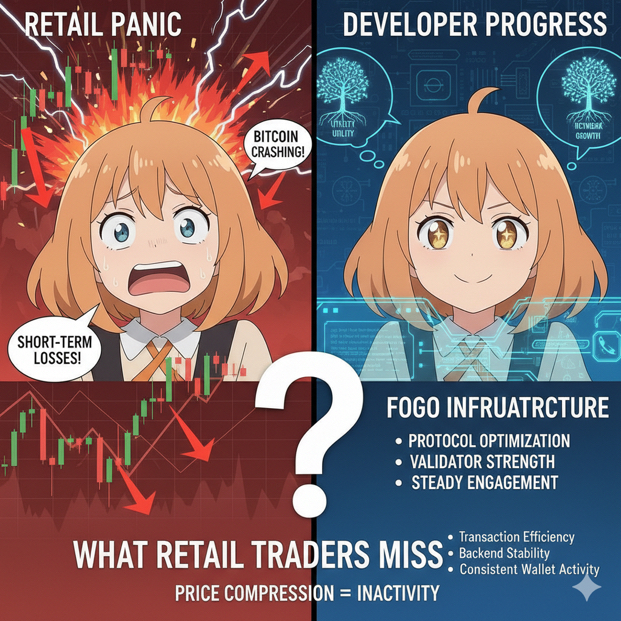

What if the strongest narratives in crypto are the ones the market underestimates the longest? FOGO’s recent trajectory fits that pattern, unfolding quietly while broader attention remains fixed on high-volatility large-cap assets. Instead of dramatic expansion phases, FOGO has traded within controlled consolidation structures, reflecting measured liquidity participation rather than speculative surges.

Recent protocol-level refinements focused on backend efficiency and network stability improvementS

Infrastructure adjustments aimed at optimizing transaction processing consistency

Stable token supply structure with no abrupt emission or structural changes reported

Steady wallet activity and transaction throughput indicating sustained on-chain engagement

Market-wide Bitcoin dominance shifts influencing liquidity rotation across mid-cap ecosystem tokens

Observable volume compression during broader consolidation phases across major cryptocurrencies

Comparable patterns seen among utility-driven and infrastructure-aligned digital assets

Capital rotation trends moving between large-cap infrastructure tokens and emerging ecosystem coins

Beyond surface-level price movement, FOGO’s ecosystem activity reflects operational continuity. Network performance updates have prioritized optimization over expansion headlines, aligning with infrastructure-focused digital assets that emphasize durability. On-chain data has shown consistent transactional throughput without abnormal spikes, suggesting organic participation rather than volatility-driven activity. Circulating supply metrics remain structurally stable, reinforcing the absence of sudden inflationary or unlock-related disruptions.

In current market conditions, Bitcoin’s volatility cycles continue to set the tone for capital distribution across the sector. When dominance metrics rise, liquidity typically consolidates into large-cap infrastructure tokens, compressing mid-cap ecosystems such as FOGO. When dominance stabilizes, relative participation across smaller networks tends to normalize, reflected in balanced order book structures and tighter spreads. FOGO’s recent trading behavior has mirrored this broader pattern without deviating into extreme volatility.

Volume metrics indicate contraction during macro consolidation, consistent with sector-wide liquidity moderation. This pattern has also been observed among other utility-focused tokens whose performance correlates closely with capital flow cycles rather than narrative momentum. Market structure signals, including range-bound movement and measured turnover, align with assets undergoing accumulation or equilibrium phases rather than breakout-driven speculation.

Comparatively, infrastructure tokens with strong base-layer positioning have experienced liquidity concentration during dominance expansions, while emerging ecosystem assets have shown delayed reaction patterns. FOGO’s trading environment fits within this rotational framework, responding proportionally to broader shifts rather than isolated catalysts. Correlation coefficients during recent volatility spikes indicate that FOGO’s short-term price movements remain influenced by major asset fluctuations, particularly during rapid market-wide adjustments.

Ecosystem expansion efforts have centered on strengthening internal functionality and maintaining operational continuity. While not characterized by aggressive outward integrations, the network’s stability-focused upgrades contribute to predictable throughput and structural consistency. Such developments often coincide with periods of subdued price action, particularly when broader macro conditions limit speculative capital deployment across secondary assets.

Ecosystem expansion efforts have centered on strengthening internal functionality and maintaining operational continuity. While not characterized by aggressive outward integrations, the network’s stability-focused upgrades contribute to predictable throughput and structural consistency. Such developments often coincide with periods of subdued price action, particularly when broader macro conditions limit speculative capital deployment across secondary assets.

Liquidity behavior further reflects measured participation. Bid-ask spreads have narrowed during low-volatility windows, while turnover increases modestly during macro-driven momentum waves. Exchange flow observations indicate no abnormal structural imbalances, reinforcing the perception of controlled market positioning rather than distribution-heavy activity.

Across the wider crypto landscape, capital rotation between large-cap infrastructure tokens, utility-driven networks, and emerging ecosystem assets continues to define performance dispersion. FOGO’s relative stability during dominance-driven cycles places it within the cohort of tokens influenced more by structural liquidity shifts than narrative amplification. This alignment highlights how underestimated narratives often coexist with disciplined infrastructure refinement.

In an environment where rapid appreciation frequently overshadows operational continuity, FOGO’s recent performance illustrates a different dynamic. The combination of steady on-chain engagement, stable supply metrics, measured volume trends, and sensitivity to Bitcoin-led liquidity cycles positions FOGO squarely within the broader framework of utility-oriented digital assets navigating consolidation under evolving macro market conditions.