When I look at Fogo, what stands out isn’t speed claims it’s what the project thinks is actually broken in blockchains.

Most Layer 1s frame the problem as throughput: blocks are too slow, fees spike, UX degrades. Fogo’s framing is sharper. The real failure happens under stress, when execution timing becomes unreliable. Confirmations stretch, ordering becomes contentious, and the chain starts behaving less like a settlement venue and more like a negotiation layer. For trading, that distinction matters more than raw TPS.

Fogo’s answer is not to “out-Solana Solana,” but to rethink coordination. The team is explicit that latency isn’t just a compute issue it’s a geography and variance problem. When every validator, regardless of location or performance, sits on the critical path, the slowest actors define the system’s behavior. Physics wins.

This is where the validator zone model becomes the core architectural bet. Instead of requiring global coordination inside every block, Fogo limits active consensus to a single zone per epoch, while other zones stay synced but don’t vote or propose. Latency drops because the quorum shrinks. Zones rotate over time, preserving geographic distribution across epochs rather than within each block.

It’s a clear trade off: decentralization across time instead of instant global participation. Some chains accept the performance cost and call it decentralization. Fogo chooses determinism and owns the compromise.

The same thinking applies to validator standards. Fogo doesn’t hide from the idea that

underperforming infrastructure degrades everyone’s execution. The project pushes toward a canonical high-performance client path with Firedancer as the end state and architectural decisions designed to reduce tail latency, not just improve averages. That’s a venue mindset: control variance, protect execution quality.

This comes with risk. A dominant client increases systemic exposure if something goes wrong. Validator curation introduces governance pressure and potential capture if rules aren’t applied transparently. These aren’t theoretical concerns they’re the fault lines where the model either proves resilient or breaks under real usage.

Fogo Sessions fits the same philosophy. By enabling scoped permissions and gas abstraction, it removes constant signing friction and makes applications feel usable under time pressure. But it also introduces dependency layers (like paymasters) that become part of the trust and economic model. Smooth UX is not free; it shifts where risk lives.

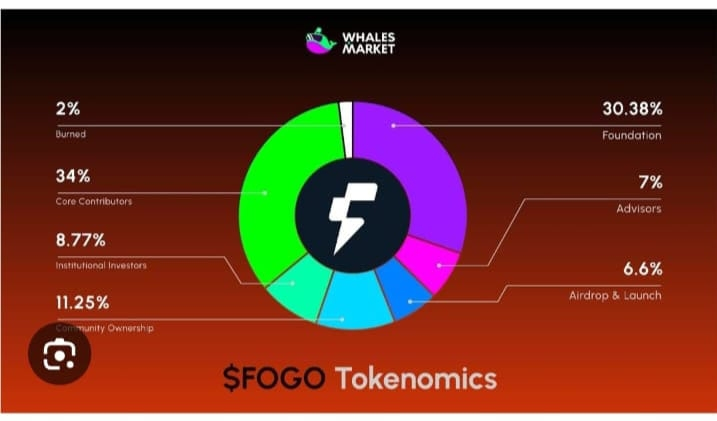

On token structure, Fogo has been relatively direct about allocations and unlocks, with meaningful circulating supply early. That invites real price discovery instead of artificial scarcity uncomfortable, but cleaner if the goal is institutional-grade participation rather than narrative momentum.

Taken together, Fogo isn’t trying to be a universal

blockchain. It’s trying to be reliable infrastructure for time-sensitive execution. Whether that works won’t be decided by benchmarks or marketing. It will be decided during volatility: when activity spikes, enforcement becomes unpopular, and the system has to choose consistency over convenience.

That’s the real test