XRP advanced 3.07% last week, according to TradingView, outperforming major digital assets even as the digital asset sector as a whole recorded $173 million in net outflows. WhileBitcoin and Ethereum exchange-traded funds faced combined redemptions of over $218 million, XRP attracted $33.4 million in new investments, illustrating selective institutional demand during a period of declining ETP volumes.

Regional divergence defined XRP's outperformance

CoinShares's 273 Digital Asset Fund Flows Weekly Reportconfirms the market is in its fourth consecutive week of net outflows, bringing the four-week total to $3.74 billion. Bitcoin alone recorded $133 million in withdrawals, while Ethereum saw $85.1 million exit investment products. In contrast,XRP and Solana stood out by attracting $33.4 million and $31 million, respectively.

The divergence becomes more pronounced at the regional level. The United States led global redemptions with $403 million in outflows. However, this was partially offset by inflows totaling $230 million across Europe and Canada. Germany posted $114.8 million in net inflows, and Canada added $46.3 million. The data suggests that capital is rotating geographically rather than uniformly exiting the asset class.

XRP’s relative resilience appears to be linked to this regional fragmentation. Outside the U.S. regulatory environment, institutional positioning may support allocations into select altcoins that are viewed as structurally differentiated from Bitcoin and Ethereum exposure.

card

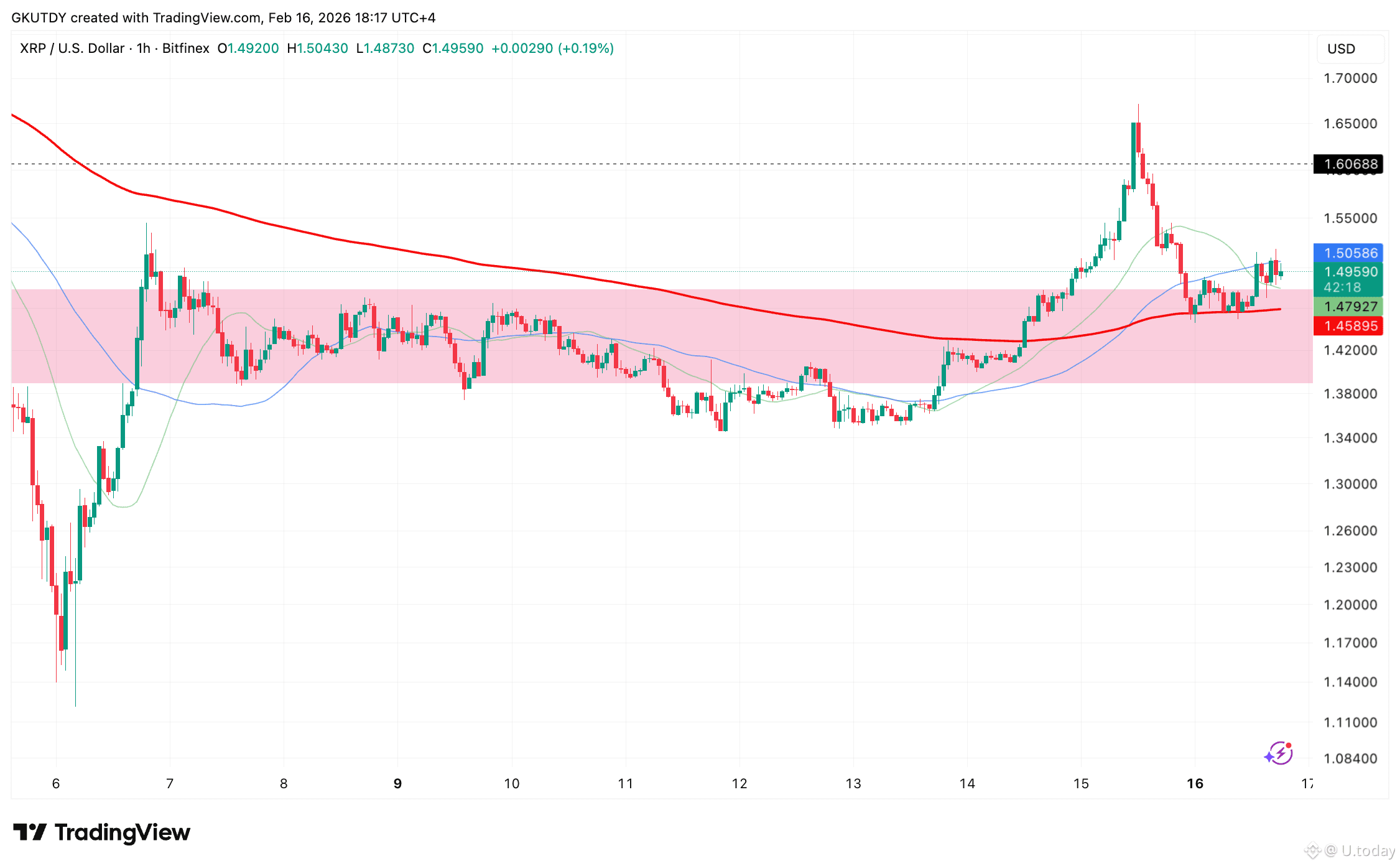

From a market structure perspective, exchange-traded product volumes declined 57%, from $63 billion to $27 billion, over the previous week, signaling reduced speculative intensity. Despite thinner liquidity, TradingView data shows thatXRP defended the $1.40-$1.48 support range.

The decline in inflow levels from an earlier peak at $63.1 million to $33.4 million suggests normalization rather than reversal. If U.S. redemptions stabilize and European demand remains robust, XRP’s relative strength could extend into the next quarter, especially if broader sector flows shift back toward balance instead of sustained withdrawal.