When I first looked at Fogo, I didn’t see another Layer-1 chasing narrative cycles. I saw a trading problem trying to solve itself on-chain.

Anyone who has spent time on a Binance trading desk, even virtually, understands that liquidity is not just about volume. It is about how fast orders meet, how tight spreads stay under pressure, and how little slippage you feel when size hits the book. Binance regularly processes tens of billions of dollars in daily spot volume. On volatile days, that number pushes far higher. What traders value there is not branding. It is execution.

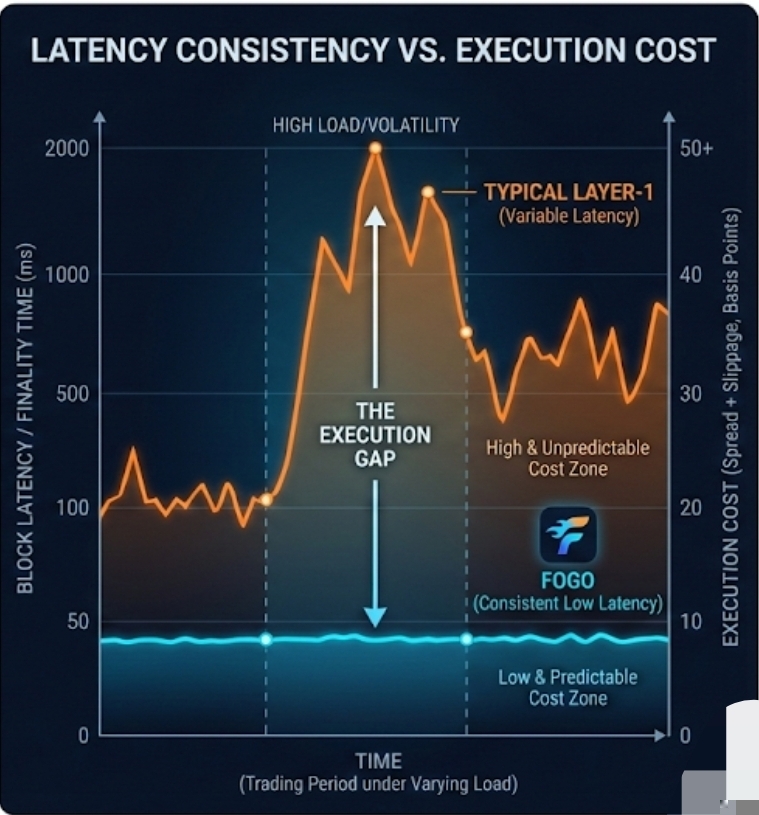

That context matters because most blockchains still settle transactions in hundreds of milliseconds or even seconds. For long-term holders, that is fine. For active traders, it changes the texture of the trade. A delay of one second in crypto can mean a 20 to 50 basis point move during high volatility. That spread becomes the hidden cost.

Fogo is trying to narrow the gap, surface level and the pitch is speed. Block times measured it in tens of milliseconds. Sub-40ms has been cited in early benchmarks. To put that in context, 40 milliseconds is roughly the blink of an eye divided by ten. Underneath that headline is a design choice: parallel execution and a validator setup tuned for performance rather than broad decentralization theater.

That design enables something specific. If blocks are produced every 40ms and confirmations arrive near instantly, market makers can quote tighter spreads because inventory risk drops. Inventory risk is the fear that price moves before you can hedge. On slower chains, that risk forces wider spreads. Wider spreads mean higher costs for traders.

Understanding that helps explain why Fogo talks about liquidity before it talks about retail hype. Liquidity is not noise. It is structure. On Binance, the tightest books are on pairs where depth absorbs size without moving price. The same logic applies on-chain. If a decentralized exchange built on Fogo can settle and confirm quickly, it starts to feel less like a slow AMM pool and more like an electronic trading venue.

But speed alone does not create liquidity. That is the obvious counterargument. Solana already processes thousands of transactions per second and has block times around 400 milliseconds. Ethereum rollups compress transactions off-chain and settle in batches. So what is different here?

The difference Fogo is aiming at is latency consistency. Not just fast blocks, but predictable finality. In trading, predictability is as important as raw speed. A system that sometimes confirms in 50ms and sometimes in 2 seconds is hard to price around. If Fogo can hold block production steady at sub-100ms under load, market makers can model that risk more cleanly. That steadiness becomes part of the foundation.

There is also the Binance angle. Binance traders are used to centralized order books with microsecond matching engines. Moving from that environment to most DEXs feels like stepping from fiber optic to dial-up. Slippage, MEV extraction, and failed transactions introduce friction. Fogo’s architecture, if it holds under real demand, is trying to compress that gap. Not eliminate it. Compress it.

Consider this. On a typical AMM, price impact grows non-linearly with order size because liquidity sits in pools. If block times are slow, arbitrageurs step in between blocks and capture value. That cost is invisible but real. Faster blocks reduce the window for that extraction. Over thousands of trades, even a 0.1 percent improvement in execution quality compounds. For a trader cycling $1 million a week, that is $1,000 saved per cycle. Scale that across a year and the number stops being abstract.

Meanwhile, the broader market right now is sensitive to execution quality. Bitcoin recently hovered around the high $60,000 range after failing to hold above $70,000. Volatility has compressed compared to earlier cycles, but intraday swings of 2 to 4 percent remain common. In that environment, traders rotate quickly. Chains that cannot keep up feel slow, and liquidity migrates.

That momentum creates another effect. If liquidity providers earn more because spreads stay tight and volume flows through, they are incentivized to deploy capital. Fogo’s token incentives, staking yields, and ecosystem rewards layer on top of that. On the surface, it looks like another incentive program. Underneath, it is an attempt to bootstrap depth early so that organic flow can take over.

Of course, there are risks. High performance validator sets often mean fewer validators. Fewer validators can mean higher coordination risk. If a network prioritizes speed, it may accept trade-offs in censorship resistance or geographic distribution. Traders who care about neutrality will watch that closely. Performance is valuable, but only if it is earned, not fragile.

There is also the question of real load. Many chains benchmark at low utilization. The real test is sustained throughput. Can Fogo maintain sub-100ms block times when decentralized exchanges, NFT mints, and gaming transactions all compete for space? If congestion pushes latency up, the edge narrows quickly. Early signs from test environments are encouraging, but production traffic is different.

Still, the direction is telling. We are watching a quiet convergence between centralized trading infrastructure and blockchain settlement. Binance’s centralized model thrives on tight spreads and instant matching. Fogo’s approach suggests that Layer-1s are studying that playbook rather than rejecting it. Instead of arguing that decentralization alone is enough, they are focusing on execution texture.

What struck me is that this is less about speed marketing and more about market structure. If on-chain venues can approach centralized execution quality while retaining self-custody and composability, liquidity does not need to choose sides. It can fragment across both.

That shift could matter over the next few years. ETF inflows have institutionalized Bitcoin. Stablecoins now move over $10 trillion annually across chains, according to recent industry reports. Those flows demand infrastructure that feels steady. If Fogo can support high-frequency trading patterns on-chain without sacrificing core guarantees, it is not just another Layer-1. It becomes part of the trading stack.

Whether it succeeds remains to be seen. Markets are unforgiving. Performance claims get tested in real time. But the idea that a blockchain should feel like a trading venue, not just a settlement rail, reflects a deeper change in how crypto infrastructure is being designed.

Liquidity does not chase narratives for long. It chases execution. And the chains that understand that are quietly building underneath the noise.

Bài viết

From Trading Desks to Layer-1: How Fogo Is Redefining On-Chain Liquidity for Binance Traders

Tuyên bố miễn trừ trách nhiệm: Bao gồm cả quan điểm của bên thứ ba. Đây không phải lời khuyên tài chính. Có thể bao gồm nội dung được tài trợ. Xem Điều khoản & Điều kiện.

0

5

107

Tìm hiểu tin tức mới nhất về tiền mã hóa

⚡️ Hãy tham gia những cuộc thảo luận mới nhất về tiền mã hóa

💬 Tương tác với những nhà sáng tạo mà bạn yêu thích

👍 Thưởng thức nội dung mà bạn quan tâm

Email / Số điện thoại