Bitcoin (BTC) is trading around $88,000 as of Wednesday, recovering after failing to break the psychological resistance of $90,000 earlier this week. The market continues to show a clear divergence between institutional and retail behavior, with U.S. spot Bitcoin ETFs recording persistent capital outflows, while companies and whale addresses quietly accumulate BTC in anticipation of a potential rebound.

🏦 ETF Outflows Continue as Institutional Sentiment Turns Cautious

Data indicates that U.S. spot Bitcoin ETFs registered seven consecutive days of net outflows. On Monday alone, withdrawals reached $19.29 million, bringing the previous week’s total to $782 million. Analysts suggest this reflects increasing caution from institutional participants — a trend that may intensify downward pressure if sustained.

On-chain platform Arkham Intelligence shows that BlackRock, the largest Bitcoin ETF provider by assets under management, transferred over 2,200 BTC to Coinbase Prime, signaling portfolio reduction and potential liquidity release into markets. This move hints at short-term uncertainty among large traditional finance entities.

🧾 Companies and Whales Continue Accumulation

In contrast, corporate confidence in Bitcoin remains comparatively stable. MicroStrategy added 1,229 BTC last week, bringing its total holdings to 672,497 BTC at an average purchase price of $74,997. Likewise, Japanese firm Metaplanet accumulated 4,279 BTC over the last three months, now holding 35,102 BTC at an average of $104,679.

Whale behavior also appears constructive. According to Lookonchain, two newly created wallets withdrew 2,201 BTC from Binance — typically interpreted as tokens being moved to long-term storage. Such movement suggests some large-scale investors are positioning for a potential recovery in early 2026.

📊 Will Retail Optimism Spark a Recovery?

Market sentiment indicators show retail investors expect a near-term rebound — a trend historically common around the New Year. However, Santiment data highlights a recurring pattern: over the last three months, BTC price action often diverged from small-investor expectations. If this “inverse retail” trend repeats, Bitcoin may still face short-term corrective pressure.

🔮 Technical Outlook: BTC May Retest Support Near $85,000

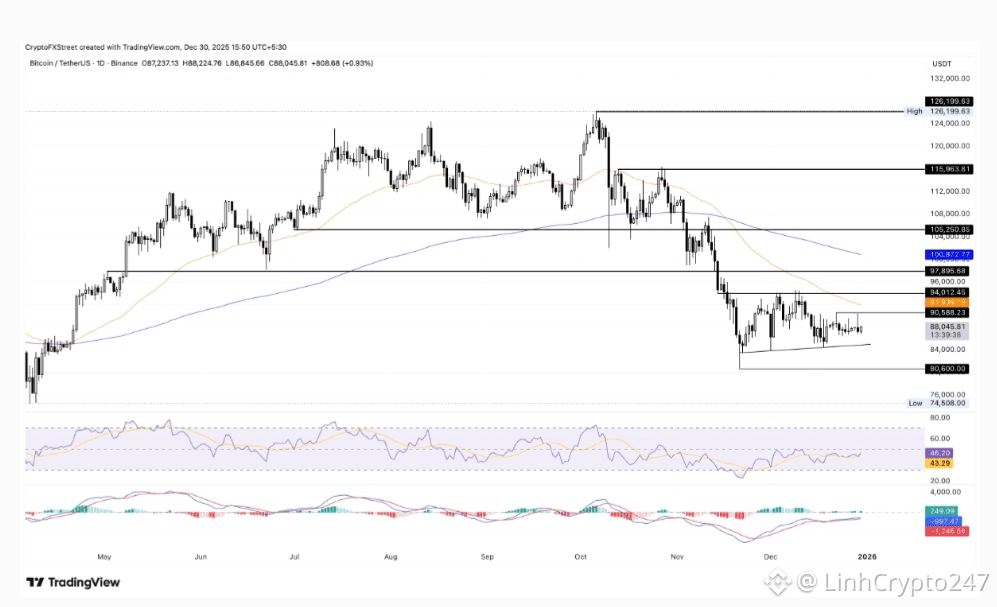

Bitcoin has not yet successfully reclaimed momentum above $90,588 — the December 22 high. A daily close above this threshold would help validate bullish continuation toward the 50-day EMA at $91,924, and potentially the next resistance region around $94,012.

On the chart, indicators currently deliver neutral signals:

On the chart, indicators currently deliver neutral signals:

RSI hovers around 44, below the midline — implying sellers still hold influence.

MACD lines are rising toward the zero level but narrowing, hinting that a bearish cross remains possible.

If selling persists, BTC risks retesting short-term trendline support connecting the November 22 and December 1 lows — near $85,000.

📌 Stay Updated — Follow for More Daily Crypto Coverage

For more crypto news, ETF flow data, on-chain insights, and technical outlooks — follow this feed to never miss key market updates.