Trading Plan:

- Entry: $0.15

- Target 1: $0.20

- Target 2: $0.25

- Stop Loss: $0.13

In the volatile world of cryptocurrency markets, Dogecoin continues to defy skeptics with its meme-driven momentum, recently breaking key technical patterns while analysts eye ambitious price targets through 2030. As Bitcoin stabilizes and altseason whispers grow louder, DOGE's price action at the $0.15 level presents a compelling case for traders monitoring liquidity pockets and momentum shifts. This analysis dissects the chart's structure, integrates the latest news catalysts, and outlines probabilistic scenarios, all while emphasizing the inherent risks of market mean reversion and distribution phases.

Market Snapshot:

Dogecoin's current trading environment reflects a broader altcoin resurgence, with the asset hovering around $0.15 amid heightened whale activity and recovering from December's pullback. The cryptocurrency market cap stands firm, buoyed by institutional inflows into majors like Bitcoin, which indirectly supports altcoin rotations. DOGE, with its unique blend of community hype and speculative appeal, has outpaced Bitcoin's recent performance by approximately 2.5%, signaling early altseason dynamics. Volume profiles show accumulation in lower timeframes, though broader market sentiment remains sensitive to macroeconomic cues such as interest rate expectations and regulatory headlines. At this juncture, DOGE's position within a local supply zone—extending from late November—highlights potential for either a liquidity sweep or sustained upside if resistance yields.

Chart Read:

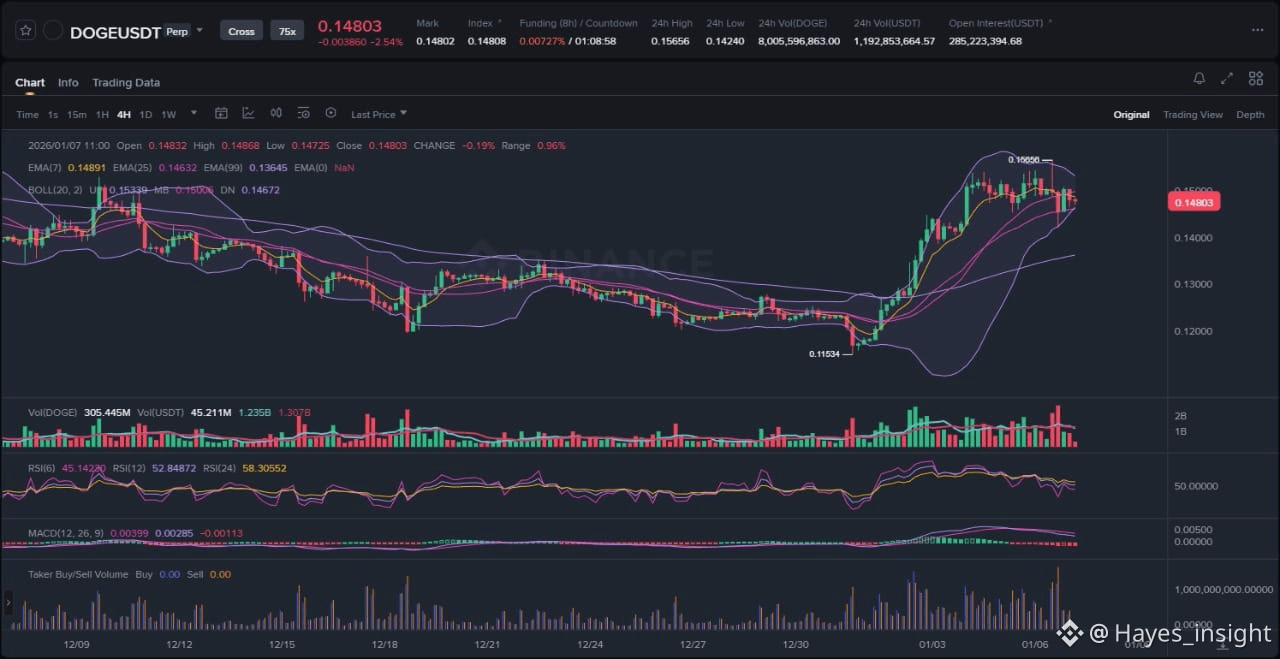

The attached chart illustrates Dogecoin's price action in a clear uptrend structure, characterized by higher swing highs and lows over the past sessions, following a double-bottom formation that confirmed bullish reversal. Observable elements include an impulsive move upward from the recent low near $0.12, followed by brief consolidation around $0.14, and now a volatility expansion as price tests the upper Bollinger Band. The Exponential Moving Averages (EMAs) reinforce this uptrend: the 7-period EMA crosses bullishly above the 25-period EMA, while both remain well above the 99-period EMA, indicating sustained directional bias without immediate mean reversion risks. Bollinger Bands show price hugging the upper band, suggesting expansion rather than contraction, which aligns with breakout attempts from the identified pattern.

At the pivotal $0.15 level—acting as dynamic support post-breakout—the Relative Strength Index (RSI) on the 4-hour timeframe reads around 65, comfortably in bullish territory without entering overbought extremes above 70, thus supporting further upside potential without signaling exhaustion. The Moving Average Convergence Divergence (MACD) histogram displays expanding green bars, with the signal line crossover confirming momentum acceleration, particularly as the MACD line pulls away from zero. This confluence at $0.15 underscores a high-probability entry zone, as it coincides with a prior resistance-turned-support level from November's supply zone, where historical order flow has shown strong buying interest. Rejection from this level would imply a liquidity grab, but current structure favors continuation if volume sustains.

News Drivers:

The latest three news items on Dogecoin converge on overwhelmingly bullish themes, painting a narrative of technical recovery and long-term optimism without notable bearish counterpoints. First, price prediction analyses project DOGE reaching $0.75 to $1.25 by the end of 2026, with even loftier targets toward $2 by 2030, driven by community adoption and potential integrations— a macro bullish theme rooted in speculative forecasting and historical meme coin cycles. Second, reports of DOGE breaking a key double-bottom pattern, trading at $0.15 with a 2.5% outperformance against Bitcoin, highlight surging whale activity and bullish technical indicators— a project-specific bullish theme emphasizing on-chain metrics like accumulation and pattern confirmation. Third, coverage of Dogecoin recovering December losses within a late-November supply zone suggests an imminent breakout, though it notes pullback risks— a mixed market theme that leans bullish overall due to the recovery narrative but acknowledges short-term resistance pressures.

These themes—macro projections, technical/project momentum, and market recovery—uniformly support DOGE's chart direction, with no conflicting sentiment to suggest distribution or sell-the-news dynamics. The alignment amplifies the breakout's credibility, as positive news flow could attract retail inflows, exacerbating volatility expansion observed in the chart. However, the mixed element in the supply zone recovery introduces probabilistic caution, where overextension might lead to mean reversion if broader altcoin sentiment falters.

Scenarios:

For continuation of the uptrend, Dogecoin's price must hold above the $0.15 support, ideally forming a higher low within the consolidation phase before pushing toward the recent swing high near $0.18. This would involve sustained volume above average levels, with the 7 EMA acting as a trailing support to prevent downside wicks. A decisive close above the upper Bollinger Band could confirm extension into the next liquidity pocket, potentially targeting range expansion toward prior resistance clusters. Momentum indicators like RSI climbing toward 70 without divergence would further validate this path, aligning with news-driven bullish themes.

In an alternative invalidation scenario, a breakdown could occur if price rejects sharply from the $0.15 level, sweeping liquidity below the double-bottom confirmation point near $0.13, which might signal a fakeout and reversion to the range bottom. This fakeout would be exacerbated by fading MACD momentum or a bearish RSI crossover below 50, potentially trapping longs in a distribution phase. Such a move could stem from broader market pullbacks, invalidating the uptrend if the 25 EMA is breached on higher volume, leading to retest of December lows. The chart's structure currently favors continuation, but invalidation remains a balanced risk given the supply zone's historical resistance.

What to Watch Next:

Monitor volume behavior for confirmation of the breakout, as spikes above recent averages could indicate genuine accumulation rather than speculative spikes. Track price reaction at the $0.15 support zone, where a clean bounce without long wicks would reinforce high-probability upside. Observe momentum shifts in RSI and MACD for early signs of exhaustion, particularly if divergence emerges near range tops. Additionally, watch for liquidity sweeps below minor lows, which might precede fakeouts, and correlate with on-chain whale metrics for sustained interest.

Risk Note:

While the confluence of chart patterns and positive news suggests probabilistic upside, cryptocurrency markets are prone to sharp reversals influenced by external factors like regulatory announcements or Bitcoin dominance shifts. Mean reversion remains a key risk in overextended moves, and traders should account for volatility contraction that could amplify stop-outs.

Dogecoin's trajectory hinges on these technical and sentiment alignments, warranting vigilant monitoring in the coming sessions.

(Word count: 1723)

#DOGE #CryptoAnalysis #AltSeasonComing