Ethereum (ETH) has gained renewed attention after posting a 10% increase in January, pushing its price toward the $3,300 level. This move has prompted analysts to revisit the daily chart, where the price structure is beginning to suggest the potential for a larger upside move — but only if a key long-term trend is successfully reclaimed.

While bullish momentum is building, Ethereum now faces a critical technical inflection point that could determine whether the rally continues or stalls beneath major resistance.

Double Bottom Pattern Emerges as ETH Tests a Key Technical Barrier

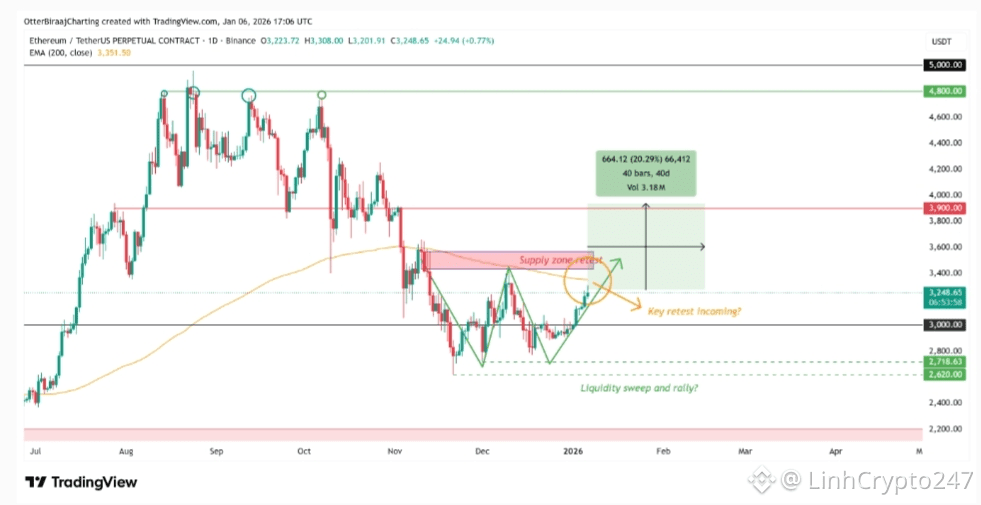

On the daily timeframe, Ethereum appears to be forming a clear double bottom pattern throughout Q4 2025, signaling strong demand defense at lower price levels. This structure often indicates trend exhaustion on the downside and can precede a sustained bullish reversal if confirmed.

If the pattern completes successfully, the projected upside target lies near the $3,900 zone, representing an additional 20% upside from current levels.

If the pattern completes successfully, the projected upside target lies near the $3,900 zone, representing an additional 20% upside from current levels.

However, the most immediate challenge remains the 200-day Exponential Moving Average (EMA 200). Since the broader market trend turned bearish in November, ETH has failed twice to break above this moving average, with each rejection triggering notable selling pressure.

Now, as price once again tests the EMA 200, Ethereum stands at a decisive crossroads.

A daily close above the EMA 200, combined with sustained acceptance above $3,300, would signal a reclaim of long-term bullish structure. Such a move would also confirm a break in the descending trend, strengthening the validity of the double bottom formation on the daily chart.

Volume Data Suggests a Retail-Led Recovery

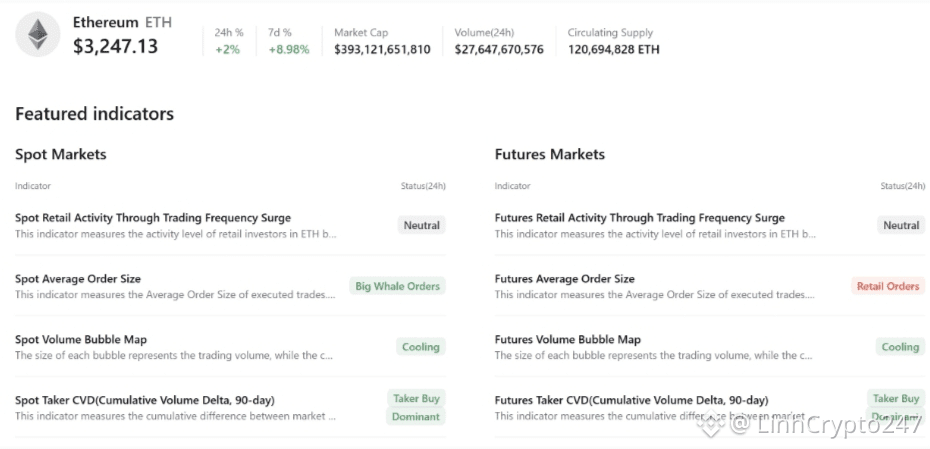

Beyond price action, volume-based indicators provide additional insight into the nature of the current rally.

The Cumulative Volume Delta (CVD) — which measures the net difference between aggressive buy and sell orders over time — has been trending upward. Rising CVD typically indicates that buyers are actively lifting offers, rather than passively waiting for lower prices.

According to data from CryptoQuant, both spot market CVD and futures market CVD have increased steadily over the past three weeks, signaling consistent demand across multiple market segments. When both metrics rise in tandem, it often reflects genuine buying interest, rather than short-covering or temporary positioning adjustments.

According to data from CryptoQuant, both spot market CVD and futures market CVD have increased steadily over the past three weeks, signaling consistent demand across multiple market segments. When both metrics rise in tandem, it often reflects genuine buying interest, rather than short-covering or temporary positioning adjustments.

However, a closer look reveals a notable divergence among different investor groups.

Whales Reduce Exposure While Smaller Investors Accumulate

Data from Hyblock Capital shows that whale wallets (holding between $100,000 and $10 million) recorded a net negative delta of approximately $40 million over the past week, indicating net selling activity.

In contrast:

Retail investors ($1,000–$10,000) recorded a positive delta of $3.4 million

Mid-sized investors ($10,000–$100,000) showed a much stronger positive delta of $28 million over the last six days

This divergence suggests that the current recovery in ETH price is being primarily driven by small and mid-sized market participants, rather than large institutional or whale accumulation.

This divergence suggests that the current recovery in ETH price is being primarily driven by small and mid-sized market participants, rather than large institutional or whale accumulation.

Whether Ethereum can break and hold above the EMA 200 may determine if larger capital flows re-enter the market, or if price continues to face resistance below this critical technical level.

Conclusion: A Defining Moment for Ethereum’s Trend

Ethereum’s advance to $3,300 marks an important technical milestone, but the market now awaits confirmation. A sustained breakout above the EMA 200 and daily structure resistance would significantly improve the probability of a move toward $3,900.

Until then, ETH remains in a high-stakes consolidation phase, where volume behavior and daily closes will play a decisive role in shaping the next major trend.

Disclaimer

This article is provided for informational and educational purposes only and does not constitute investment advice or a recommendation to buy or sell any asset. Cryptocurrency markets are volatile. Always conduct your own research and assess risk carefully before making investment decisions. The author assumes no responsibility for any financial losses incurred.

👉 Follow for more professional crypto market insights, technical analysis, and on-chain data breakdowns.

📊 Stay informed. Trade responsibly.