Financial privacy is often framed as a debate about anonymity versus regulation.

In practice, this framing misses the point.

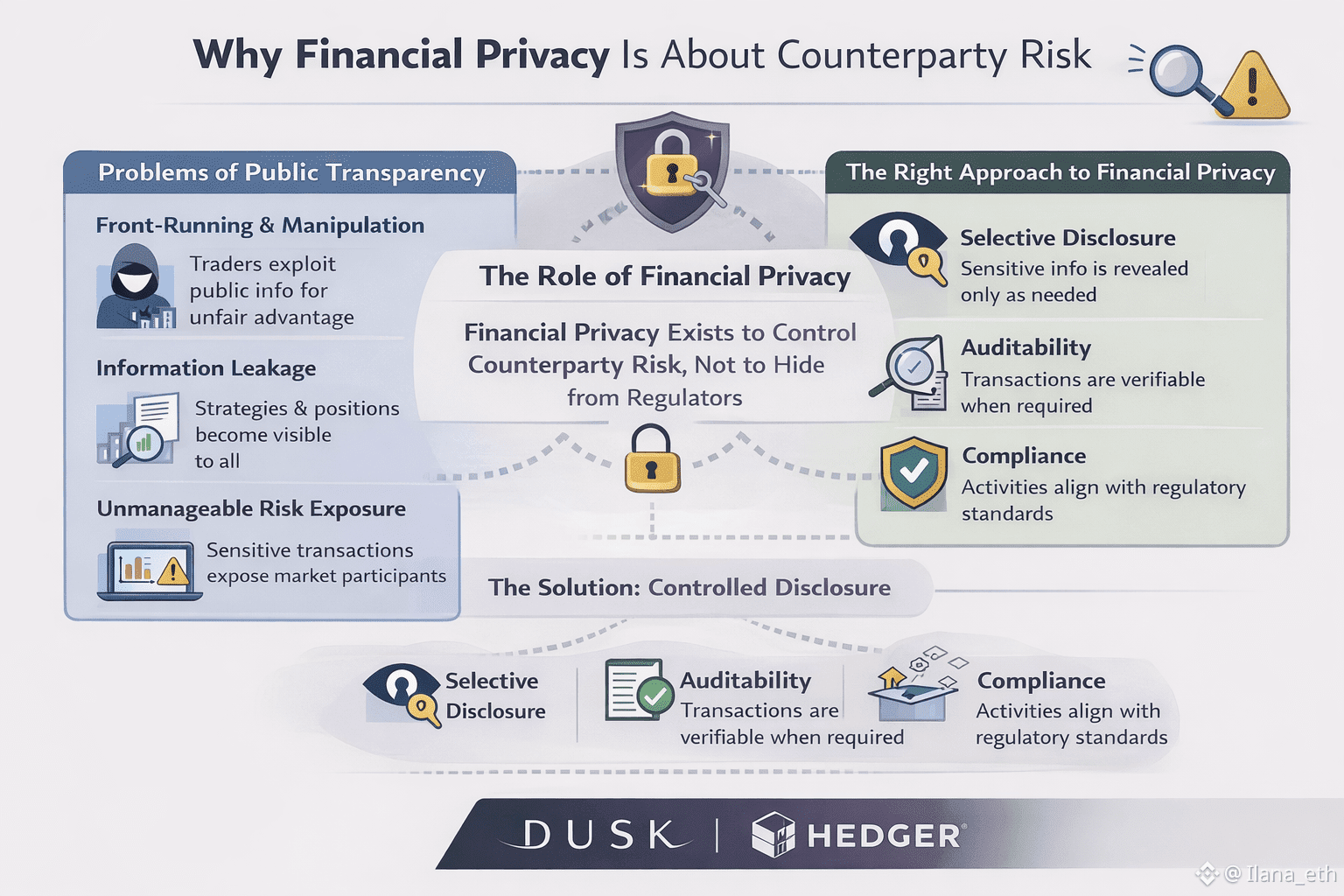

In real financial markets, privacy exists to manage counterparty risk not to avoid oversight.

Counterparty Risk Is an Information Problem

Every financial transaction creates exposure. The more a counterparty knows about your positions, liquidity, or strategy, the more leverage they have over you.

This is why traditional finance protects sensitive information by default. Trading desks do not publish open positions. Fund flows are disclosed selectively. Risk is managed through controlled visibility, not radical transparency.

Blockchains, however, invert this model. Public ledgers expose balances, flows, and behavior to everyone, all the time. What was designed for openness becomes a liability in financial environments.

Why Public Transparency Fails Institutions

For institutions, transparency is not inherently good or bad ,it is conditional.

When all transaction data is public, counterparties can:

Front-run large trades

Infer portfolio strategies

Target liquidity vulnerabilities

These risks compound at scale. This is why many institutions experiment with blockchain technology but hesitate to deploy real capital on public chains.

The issue is not decentralization.

It is uncontrolled information leakage.

Why Anonymity Is Not Enough

Anonymity is often proposed as a solution. Hide identities, and risk disappears.

In regulated finance, this approach fails. Markets require accountability, auditability, and enforceable compliance. Complete opacity replaces counterparty risk with regulatory and legal risk.

Institutions need a third model: confidential by default, auditable by design.

Dusk’s Approach: Privacy as Infrastructure

This is where Dusk’s design philosophy becomes relevant.

Dusk does not treat privacy as a feature layered on top of public execution. Instead, privacy is built into the infrastructure to support selective disclosure.

Through Hedger, Dusk enables transactions where sensitive financial data remains confidential, while cryptographic proofs ensure correctness and compliance. Regulators and authorized parties can verify activity without exposing full transaction details to the public.

This approach aligns with how financial markets already operate:

Privacy protects counterparties from strategic exploitation

Auditability preserves trust and enforcement

Compliance is maintained without sacrificing confidentiality

Privacy, in this model, is not an escape from regulation. It is a requirement for functional regulated markets.

Why This Matters for RWAs and DeFi

As tokenized real-world assets and compliant DeFi mature, counterparty risk becomes more pronounced. Larger positions, regulated instruments, and institutional participation magnify the cost of information leakage.

$DUSK Dusk’s architecture combining a compliance-focused Layer 1, EVM compatibility through DuskEVM, and privacy-preserving mechanisms like Hedger addresses these constraints directly.

This allows financial applications to operate on-chain without exposing participants to unnecessary risk.

Reframing the Privacy Narrative

The future of on-chain finance will not be built on full transparency or full anonymity.

It will be built on systems that understand why privacy exists in finance in the first place.

By framing privacy as a counterparty risk management tool rather than an ideological stance, @Dusk illustrates how blockchain infrastructure can align with real financial requirements not just theoretical ones.