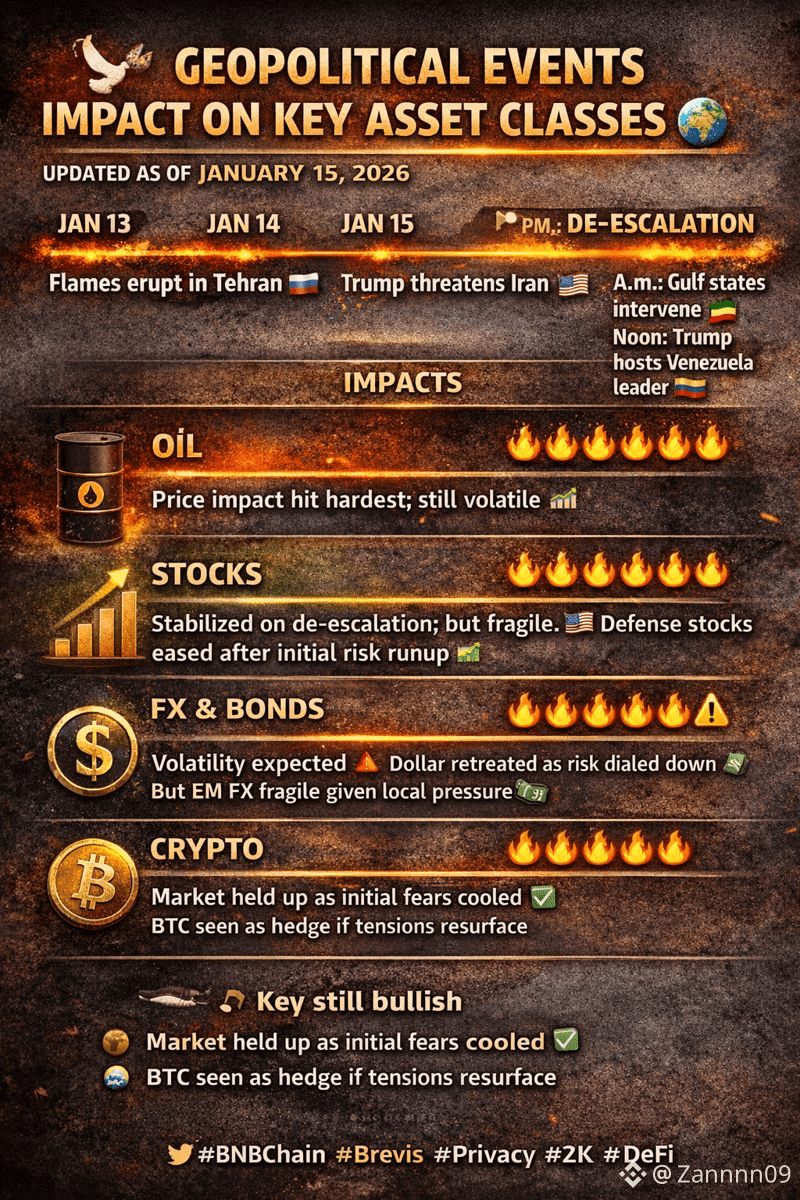

Jan 13, 2026

• Major protests erupt in Tehran over economic hardship and political repression.

• U.S. begins publicly warning Iran about escalation.

Jan 14, 2026

• Reports of thousands killed in Iran civil unrest.

• U.S. sanctions announced against Iranian security officials.

• Trump warns Iran that military options remain “on the table.”

Jan 15, 2026 — Morning

• Arab states (Saudi Arabia, Qatar, Oman, Egypt) launch intense diplomatic pressure on Washington and Tehran.

• Talks focus on avoiding full-scale U.S.–Iran military conflict.

Jan 15, 2026 — Midday

• Trump meets Venezuelan opposition leader in Washington — signaling multi-front diplomacy.

• Minneapolis sees unrest after federal agent shooting; adds to domestic tensions.

Jan 15, 2026 — Afternoon

• Gulf diplomatic channels help temporarily de-escalate U.S.–Iran standoff.

• World oil and risk markets react to reduced immediate strike threat.

📉 MARKET IMPACTS🛢️ Oil & Energy

• With war risk receding after diplomatic pressure, oil prices pulled back sharply as traders unwound premium pricing.

• Brent and WTI volatility remains elevated — Middle East risk still a headline driver.

• If tensions spike again, global crude could see rapid repricing and supply risk premiums.

Key takeaway:

Oil markets responded quicker to de-escalation than escalation — showing how tightly they price Middle East geopolitical risk.

📊 Equity & Risk Assets

• U.S. equities climbed on reduced geopolitical flashpoint.

• Defense stocks had earlier rallied on risk headlines but eased after diplomatic progress.

• Safe havens (Gold, U.S. Treasuries) rallied during peak tension and trimmed gains post-diplomacy.

💸 Currency & Rates

• FX markets saw the dollar strengthen during peak risk, then retrace on news of de-escalation.

• EM currencies (especially in MENA region) remain fragile given ongoing local pressures.

🌐 GEOPOLITICAL IMPLICATIONS🏛️ U.S. Foreign Policy

• Trump signals both strength and restraint — maintaining military leverage while backing off immediate use of force.

• Engagement with Venezuela opposition underlines U.S. intent to shape political outcomes in Latin America.

🕊️ Regional Diplomacy

• Gulf states’ successful de-escalation push shows a shift:

Even strategic rivals of Iran prefer stability over conflict.

Riyadh, Doha, and others now acting as middle-ground brokers.

⚠️ Iran’s Position

• Tehran now projects a narrative of “strength and survival” domestically and internationally.

• But internal instability, sanctions, and economic pressures remain acute.

🚀 CRYPTO MARKET & SENTIMENT EFFECTS🟠 Risk-On Narrative

• Crypto markets often rally on reduced geopolitical fear — Bitcoin and majors held support after de-escalation signals.

🔐 Narrative Plays

• Privacy and compliance coins (linked to DeFi infrastructure and regulatory clarity) gained interest on shifting regulatory focus.

• Safe-haven narratives in crypto (like BTC as protection) briefly ticked up during peak risk.

🧠 Macro Trading Signals

• Geo headlines are now a live factor in positioning — funds increasingly use crypto as part of cross-asset hedging strategies.

📌 BIG PICTURE

Risk has not disappeared.

The world is navigating:

✔ Structural diplomatic pressure

✔ Domestic political tensions

✔ Proxy conflicts and alliances

✔ Markets pricing both fear and relief

But for now, diplomacy dampened the fuse — and global markets reacted quicker than most expected.