The first time Walrus caught my attention wasn’t because of a big green candle. It was because of a boring, practical problem that every serious onchain app eventually hits: the chain can be decentralized, the contract can be unstoppable, but the data is usually sitting somewhere fragile. Images, videos, game states, AI datasets, app configs, archives, proofs, logs, even “simple” NFT metadata. If that storage layer breaks, gets censored, or gets repriced, your “decentralized” app quietly turns into a broken website. That’s the moment Walrus starts to feel less like a Sui-side experiment and more like one of those base layer utilities crypto has been missing.

Walrus is a decentralized “blob storage” protocol, built to store large data files (blobs) efficiently while keeping them retrievable and durable. The core idea is simple: instead of every node storing full copies of everything (expensive), Walrus uses erasure coding to split data into shards, spread them across many storage nodes, and still allow recovery even when a portion of nodes are offline. Walrus calls its approach “RedStuff,” a 2D erasure coding scheme designed for resilience and self healing behavior. In plain language, it’s like tearing a document into many pieces, giving pieces to hundreds of people, and still being able to reconstruct the full document even if a lot of people disappear. That combination of redundancy and efficiency is the main reason Walrus is being discussed as “permanent, affordable storage” instead of just another storage coin. The Walrus docs even frame its cost efficiency as roughly “about 5 times the size of stored blobs,” which is far lower overhead than brute force replication.

Now here’s the part traders care about: durability and affordability aren’t marketing words in storage. They’re the product. If a storage network can’t keep costs predictable, it doesn’t matter how good the tech is, because apps won’t commit to it long-term. Walrus explicitly tries to keep storage costs stable in fiat terms, which is a subtle but important design choice. Users pay WAL to store data for a fixed period, and the WAL paid is distributed over time to storage nodes and stakers as compensation. The point is not just “pay token, get storage,” it’s “pay once, lock predictable storage behavior.”

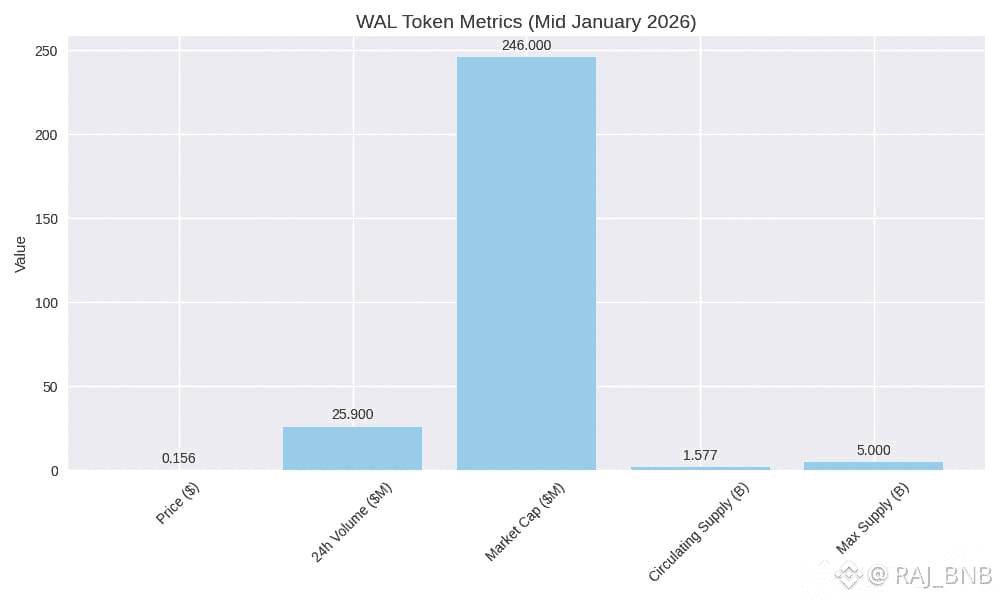

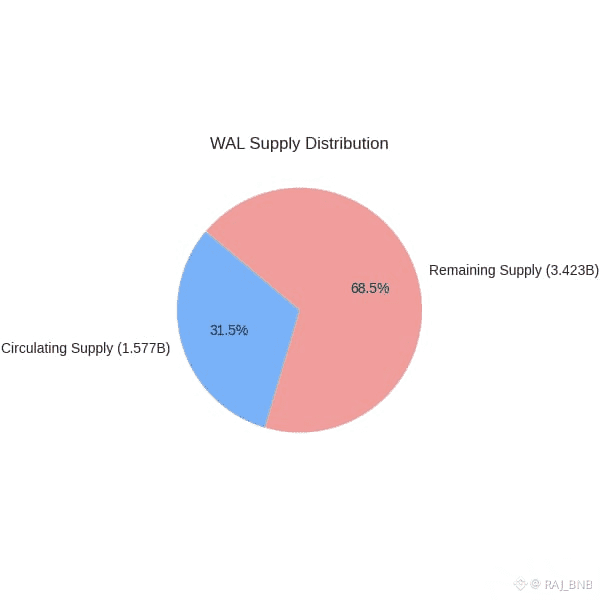

As of mid January 2026, WAL is not a microcap nobody can trade. One major tracker shows WAL around $0.156 with roughly $25.9M in 24-hour trading volume, ~$246M market cap, ~1.577B circulating supply, and 5B max supply. Those numbers don’t prove success, but they do signal something valuable to investors: the market already treats Walrus as a real infrastructure bet, not a weekend meme. It’s liquid enough to matter, but still early enough that adoption (not hype) can actually reprice the asset over time.

So why the title claim, “Not Just for Sui”? Because even though Walrus uses Sui as its control plane, the storage problem it targets is universal. Every chain that wants real user-facing apps eventually needs a reliable way to store data that doesn’t belong inside the blockchain itself. You don’t put a 300MB video “on chain.” You store it somewhere else, and you store a pointer on chain. That “somewhere else” is where the real centralization risk lives. Walrus aims to remove that weak link by making blob storage verifiable, decentralized, and economically incentivized. The Walrus whitepaper describes this as a “third approach” to decentralized storage, using modern erasure codes plus Sui for lifecycle management and economics.

If you’ve been around crypto long enough, you’ve probably seen storage narratives rise and fall: Filecoin, Arweave, various replication networks, “IPFS but tokenized” projects. Some of them do valuable work, but the market reality is harsh. Storage is not a casino. It’s a utility business, and utility businesses win by being boring and reliable. That’s why Walrus’s unique angle isn’t just “decentralized.” It’s programmability plus efficiency: store blobs, retrieve fast, and make the system resilient enough to behave like infrastructure. Walrus’s own explanation is direct: builders can store, read, manage, and program large data files like video, images, and PDFs, while a decentralized architecture handles availability and security.

Where Walrus becomes interesting for traders is in how adoption could show up. It won’t be a single “partnership headline” that changes everything. It will look like usage: more blobs stored, more apps relying on it, more WAL paid for storage, more rewards flowing to operators, more predictable economics. If you’re trying to evaluate this like an investor, you want to watch real indicators, not vibes. Metrics dashboards such as Token Terminal track fundamentals and trends (like token trading volume over longer windows), which can help you spot whether Walrus is entering “real usage” territory or just being traded as a chart.

There’s also a strategic reason the “standard for permanent storage” idea matters. Permanence is a coordination game. Once developers trust that data is durable and cheap, they build products that assume it. After that, switching costs rise. Imagine a game that stores world-state, assets, and player history in a storage layer designed to persist. Or an AI app that stores training shards and model artifacts in permanent decentralized storage. If those apps grow, the storage layer becomes part of the stack. That’s the type of lock in that doesn’t feel like lock in. It feels like reliability.

Of course, none of this is risk-free. Storage networks can fail economically even if they succeed technically. If rewards don’t properly incentivize storage nodes, reliability can degrade. If token emissions are misaligned, operators may not stay. If pricing is unstable, developers won’t commit. And if demand never arrives beyond the home ecosystem, Walrus could stay boxed into “Sui infrastructure” rather than becoming a cross-ecosystem standard. Those are not minor concerns, they’re the whole investment debate.

But if you want the clearest “human” takeaway, it’s this: Walrus isn’t interesting because it’s flashy. It’s interesting because it targets one of crypto’s most underappreciated truths, that decentralization isn’t only about execution and settlement. It’s also about data. And the projects that solve data in a way that developers can trust, year after year, usually end up with more staying power than the ones that only win attention for a season.