Bitcoin has never moved randomly. Since its inception, the world’s largest cryptocurrency has followed a surprisingly consistent 4-year market cycle, closely aligned with its halving events. As investors look ahead to 2026, a growing debate is emerging: Are we heading toward another major correction, or has Bitcoin finally broken free from its historical rhythm?

Understanding Bitcoin’s 4-Year Cycle

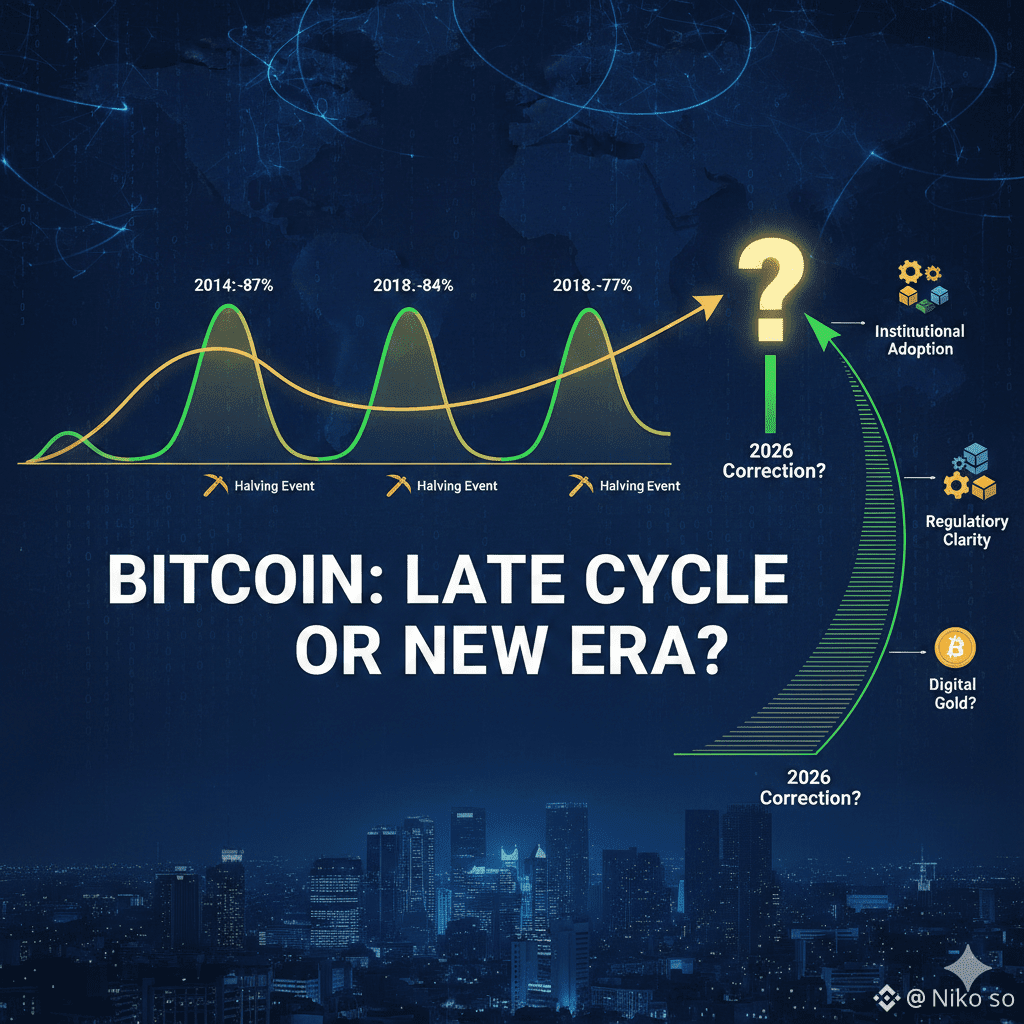

Bitcoin halvings occur roughly every four years, cutting the block reward for miners in half. Historically, this supply shock has triggered strong bull markets, followed by euphoric peaks and then deep corrections.

Looking at past cycles:

2014: Bitcoin crashed 87%, falling from around $1,240 to $166

2018: A brutal 84% decline, from $19,804 to $3,124

2022: A comparatively milder but still painful 77% drop, from $69,000 to $15,473

In each case, the deepest bear market occurred roughly two years after the halving, forming a long-term bottom before the next accumulation phase began.

What the Current Cycle Suggests

If this historical structure remains intact, the current cycle may already be approaching its later stages. Assuming Bitcoin topped near $126,000, a standard 70–75% correction would imply a potential bottom in the $30,000–$37,000 range.

While this scenario may sound alarming, it would actually align closely with Bitcoin’s past behavior. Each cycle has seen diminishing percentage drawdowns, suggesting that while volatility remains high, the asset may be gradually maturing.

Why This Cycle Could Be Different

Despite history favoring a correction, several game-changing factors could disrupt the traditional cycle:

Institutional adoption, including spot Bitcoin ETFs

Government and regulatory clarity in major economies

Macroeconomic shifts, such as easing monetary policy

Bitcoin’s growing role as digital gold

These developments were largely absent in earlier cycles. If sustained institutional demand continues, Bitcoin may experience shorter, shallower drawdowns or even a structural shift away from the classic 4-year pattern.

Late Cycle or New Era?

From a market psychology standpoint, many signs point toward a late-cycle environment: elevated optimism, aggressive price targets, and increasing retail participation. Historically, these conditions have preceded major corrections.

However, Bitcoin has also evolved significantly. Its infrastructure, liquidity, and investor base are far stronger than in previous eras. This raises a critical question: Is Bitcoin still bound by its old cycles, or is it entering a new phase of market maturity?

Final Thoughts

The 4-year Bitcoin cycle has remained remarkably accurate across multiple market eras. Until clear evidence proves otherwise, it remains a powerful framework for understanding Bitcoin’s long-term behavior.

That said, markets evolve. If a truly transformative catalyst enters the space, 2026 may not look like 2014, 2018, or 2022.

Will history repeat once again — or are we about to witness Bitcoin’s first cycle break?

Only time will tell, but for now, the cycle remains one of the most important signals investors should respect.