In Web3 projects, execution often fails because teams make extreme trade-offs—rushing with excessive spending or clinging too tightly to existing barriers, missing critical windows. Walrus, a storage project incubated by Mysten Labs with $140 million in private funding and a $2 billion valuation, illustrates a different approach. Rather than fully subordinating to the Sui ecosystem or isolating itself, the team applies a “balanced operational strategy,” carefully weighing contradictions such as speed versus security, dependency versus independence, and short-term monetization versus long-term positioning.

By tracking implementation, analyzing decision logic, and validating outcomes, it becomes clear that each choice is a calculated trade-off: leveraging ecosystem advantages to accelerate launch, protecting core technology for autonomy, focusing on select scenarios for efficient monetization, and proactively hedging risk to safeguard future growth.

1. Ecosystem Leverage: Balancing Dependency and Autonomy

Cold-launch success often depends on leveraging ecosystem momentum. Walrus maximized the Sui ecosystem’s resources to accelerate adoption: reusing Sui’s Move smart contract framework, developer onboarding averages just 2.5 days—70% faster than typical storage protocols. Testnet activity attracted 14 million accounts, processed 5 million Blob chunks, and reached 27.85TB of active storage. Subsidies and scenario support programs activated early demand in AI and RWA use cases.

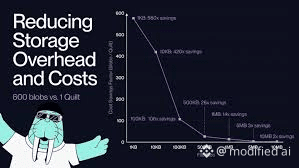

At the same time, the team retained full control of core technology. RedStuff two-dimensional erasure coding operates independently of Sui, providing redundancy at 4–5 times, 99.98% data availability, annual storage costs 80% lower than Filecoin, and 36-minute recovery times. A compliance node alliance ensures regulatory alignment for RWA scenarios. Non-Sui developer engagement is growing, laying the groundwork for future cross-ecosystem expansion.

Positive: Rapid ecosystem adoption combined with retained technological autonomy demonstrates operational balance.

Risk: Dependence remains high—78% of partners and 90% of revenue are still Sui-linked. Changes in the ecosystem could significantly affect business outcomes.

2. Technical Implementation: Prioritizing Practicality over Extremes

Many projects fall into a “parameter race,” chasing extreme redundancy or speed without regard for practicality. Walrus instead aligns technical decisions with real-world requirements. RedStuff’s row-column encoding balances redundancy, security, and efficiency, reducing costs while meeting AI and RWA demands. Optimizations focus on high-frequency access, cutting recovery time by 40% relative to Arweave.

The architecture also reflects trade-offs: non-core functions like ordering and payments rely on Sui to accelerate deployment, while core storage and compliance remain independent. During high Sui TPS, latency triples and request failures rise, illustrating the trade-off between ecosystem integration and technical resilience. Extensions such as “storage + compute” services for AI and zero-knowledge proof for RWA are designed to enhance commercial value rather than demonstrate technology for its own sake.

Positive: Technical choices are pragmatic, aligned with commercial scenarios, and enable rapid adoption.

Risk: Node entry costs are high ($150,000 per node), the network is concentrated geographically, and dependence on Sui creates vulnerability to external congestion or network changes.

3. Commercial Strategy: Targeted Monetization and Ecosystem Alignment

Walrus focuses on AI and RWA scenarios rather than a broad, general-purpose approach, capturing high-value revenue efficiently. AI scenarios use tiered pricing with base, dynamic, and value-added fees; RWA scenarios employ full-cycle charges, compliance premiums, and staking fees. Together, these generate over 90% of revenue, with RWA contributing 47%. Token mechanisms further link commercial activity with ecosystem growth, forming a feedback loop that incentivizes participation and supports WAL value.

Positive: Focused monetization and token alignment create both short-term revenue and long-term incentive structures.

Risk: Heavy concentration in two scenarios and primarily small- to mid-sized clients limits resilience and scale potential.

4. Risk Hedging: Anticipating Challenges

The team has implemented forward-looking strategies:

Cross-ecosystem readiness: Ethereum and BSC adaptation is underway to reduce dependence on Sui.

Node network expansion: Lightweight clients and regional incentives aim to grow the network to 500 nodes with better geographic balance.

Token stability: Extended lock-ups and revenue-linked WAL buybacks mitigate volatility.

Positive: Proactive risk management strengthens long-term viability.

Risk: Cross-chain adaptation, node expansion, and token mechanisms are complex and require sustained execution; delays or missteps could constrain growth.

Operational Insights

The Walrus case highlights that success in Web3 storage is rarely about excelling in a single dimension. It is about managing trade-offs: leveraging ecosystems without losing autonomy, optimizing technology for practical use rather than perfection, targeting high-value scenarios for monetization, and hedging risks while scaling.

Conditional Outlook: If Walrus continues to balance ecosystem integration, technical autonomy, and scenario expansion while executing node and token strategies effectively, it could grow from a niche leader into a core Web3 storage infrastructure provider. If these balances falter, progress could stagnate and competitive pressures may limit long-term valuation.

#MarketRebound #StrategyBTCPurchase #WriteToEarnUpgrade #CPIWatch