There is a subtle but important shift happening around Dusk one that most retail traders miss because it has nothing to do with token price, marketing hype, or narrative cycles. The recent updates around Dusk point toward a chain that is quietly exiting the “crypto narrative economy” and repositioning itself as infrastructure for regulated, privacy-sensitive financial markets. That is not a marketing pivot it is a structural one.

There is a subtle but important shift happening around Dusk one that most retail traders miss because it has nothing to do with token price, marketing hype, or narrative cycles. The recent updates around Dusk point toward a chain that is quietly exiting the “crypto narrative economy” and repositioning itself as infrastructure for regulated, privacy-sensitive financial markets. That is not a marketing pivot it is a structural one.

Most blockchains launched with the ambition to reinvent finance. Dusk’s latest direction feels more grounded: integrate into how finance actually functions. That requires features that crypto historically avoided compliance, selective disclosure, standards alignment, and regulatory interoperability. These are not short-cycle narratives. They are prerequisites for real adoption.

1. Selective Disclosure Stops Being a Feature Becomes a Requirement

Dusk’s privacy model is no longer framed as “privacy for users” but “privacy that regulators can operate with.” That difference is critical. In real financial markets:

trading data cannot be public,

counterparty exposure cannot be public,

position size cannot be public,

strategies cannot be public,

balance sheets cannot be public.

But full opacity is unacceptable as well auditors, regulated counterparties, and compliance desks must see what they are entitled to see. Dusk’s selective disclosure mechanism sits exactly in this middle zone. It lets the market function normally while letting regulators verify without surveillance.

That is not optional functionality it is a prerequisite for institutional settlement.

2. DuskEVM Lowers the Adoption Barrier Instead of Raising It

One of the weaker points in many privacy chains historically was forcing teams to rebuild everything from scratch. DuskEVM reverses that. By aligning with EVM tooling, Dusk reduces friction for developers who already know Solidity, already use MetaMask, already deploy on Ethereum.

This matters because regulated institutions do not experiment with exotic tooling. They adopt what integrates into existing stacks. DuskEVM is not about “being another EVM chain.” It is about making privacy deployment realistically adoptable.

3. Messaging Has Consolidated Around a Single Economic Purpose

Earlier Dusk communications scattered across multiple ideas: privacy, settlements, compliance, tokenization, modular execution, and RWA narratives. Post-update messaging shows a clear convergence:

→ Regulated DeFi + Tokenized Securities + RWA Settlement Layer

This is a narrower target with a higher surface area for real adoption. It also aligns directly with global regulatory direction:

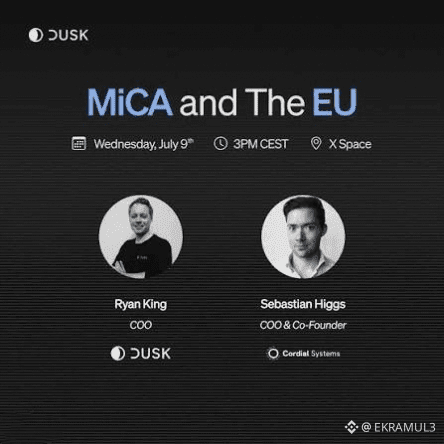

MiCA in the EU,

tokenization pilots in Singapore & HK,

digital bond issuance,

RWA collateral experimentation by banks,

on-chain clearing pilots by broker-dealers.

Dusk is positioning itself in the center of that regulatory migration.

4. Lack of Speculative Noise Is Not a Weakness It’s a Signal

Retail often interprets silence as stagnation. Institutional infrastructure rarely broadcasts progress in the same way consumer chains do. The absence of hype around Dusk is not the absence of work it is consistent with how post-regulatory platforms build.

You can measure this shift by what Dusk no longer talks about:

TVL competitions,

meme liquidity,

superficial DeFi integrations,

roadmap theatrics.

What it talks about now are things infrastructure teams care about:

settlement,

compliance,

disclosure models,

tokenized instruments,

jurisdictional frameworks,

developer standards,

audit interoperability.

That is the language of long-cycle adoption, not short-cycle speculation.

5. Market Positioning Is Entering the “Pre-Demand Phase”

Most participants underestimate how regulated finance adopts technology. It tends to move in three phases:

1. Infrastructure build (quiet, long, boring)

2. Regulatory alignment (institution-led, test environments)

3. Demand phase (adoption moves from pilots → production)

Dusk appears to be transitioning from phase 1 → phase 2, which means price discovery will lag fundamentals. That is how infrastructure curves work. You do not price the layer during build you price it once the market connects to it.

6. Dusk’s Risk Profile Flips When the Market Stops Asking “If” and Starts Asking “When”

The interesting part is this: if regulated capital moves on-chain in size, it will not move on transparent chains that expose positions publicly. Nor will it move into opaque black-box systems. It will move onto settlement rails that allow:

privacy by default,

audit by exception,

compliance by design.

Dusk is one of the few chains architecturally built for that regulatory balance rather than retrofitting it later.

The Real Takeaway

Dusk is no longer a speculative privacy chain. It is positioning itself as regulatory-grade settlement infrastructure for an on-chain financial system that actually mirrors how finance operates today.

That makes its trajectory slower in narrative time, but stronger in adoption time.