Dusk was founded in 2018 with a vision that feels rare in the blockchain world. Instead of choosing hype or speed, it chose responsibility. It was built as a layer 1 blockchain for regulated and privacy focused financial infrastructure. That might sound technical, but the idea behind it is deeply human. People and institutions need privacy, yet the financial world also needs rules, audits, and accountability. Dusk exists because ignoring either side breaks trust.

I feel that Dusk understands something many projects miss. Finance is not just numbers moving on a screen. It is confidence, fear, long term planning, and legal responsibility. Institutions cannot risk public exposure of sensitive data, and individuals should not have their financial lives permanently visible. Dusk is designed to protect that dignity while still proving that everything is done properly.

The core idea of Dusk is to combine privacy with compliance in a natural way. Transactions and data can remain confidential, but when verification is required, the system allows it. This means auditors and regulators can confirm that rules are followed without exposing unnecessary information. It is not about hiding wrongdoing. It is about sharing only what is needed. That balance creates a healthier financial environment.

Technically, Dusk uses a modular architecture. This means the blockchain is built in separate layers that can evolve over time. Consensus, smart contracts, and privacy mechanisms are not locked together in a fragile structure. If regulations change or new technology appears, Dusk can adapt without losing stability. This flexibility is critical for long term survival in regulated finance.

Dusk focuses strongly on real world financial use cases. Tokenized real world assets are a major part of its direction. These include regulated assets that require legal clarity, controlled access, and privacy by default. Dusk is not chasing temporary trends. It is building infrastructure for serious financial applications that need to work reliably for years, not weeks.

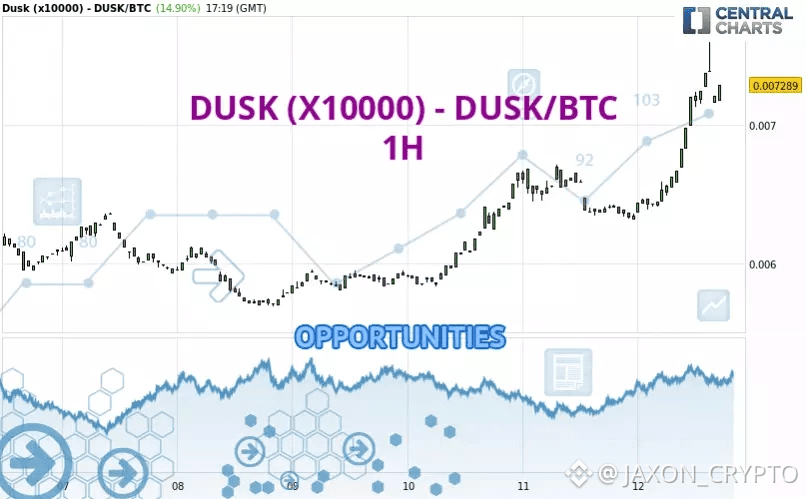

The native token plays a practical role in the ecosystem. It is used for staking to secure the network, for paying transaction fees, and for participating in governance decisions. The economic design encourages long term participation and network health rather than short term speculation. Access through major platforms like Binance can help with liquidity, but the real strength of the token comes from utility and trust, not price movement.

The roadmap of Dusk reflects patience and discipline. Development focuses on strengthening privacy technology, improving performance, expanding developer tools, and forming partnerships that actually use the network. In regulated finance, moving carefully is not a weakness. It is a requirement. Dusk seems aware that trust is earned slowly and lost instantly.

There are risks, and they should not be ignored. Regulations can change unexpectedly. Privacy technology is complex and unforgiving. Institutions move slowly and demand reliability. Competition in compliant blockchain infrastructure is increasing. Any mistake could be costly. But these risks exist because the goal is serious.

Dusk does not try to be loud. It tries to be right. If it succeeds, people may not even notice the technology. They will simply feel safer using financial systems that respect privacy and rules at the same time. In a space full of noise, that quiet confidence may be its greatest strength.