Crypto-collateralized stablecoins were created because DeFi needed something simple: a stable unit of account that doesn’t break every time the market moves. People can’t price loans, run trades, or manage risk properly when everything is swinging up and down. That’s why stablecoins became the foundation layer of DeFi. But not all stablecoins are built the same. Crypto-collateralized stablecoins are different because they stay “stable” by locking volatile assets like ETH or BTC inside smart contracts, then minting stablecoins against them.

The key detail is over-collateralization. If you want $1 of stablecoins, you usually must deposit more than $1 of crypto value—sometimes 150% to 300%. This extra buffer is what keeps the system alive when markets crash. If the collateral falls too much, liquidation kicks in automatically to protect the peg. That’s the whole idea: stability is enforced by rules, not by a company holding dollars in a bank.

This model is powerful, but it comes with stress. Liquidations can happen fast. Congestion can slow reactions. Liquidity can disappear when everyone rushes to exit at the same time. And as DeFi grows, these stablecoins don’t just need “good contracts.” They need reliable settlement infrastructure that can handle heavy volume while still keeping execution clean.

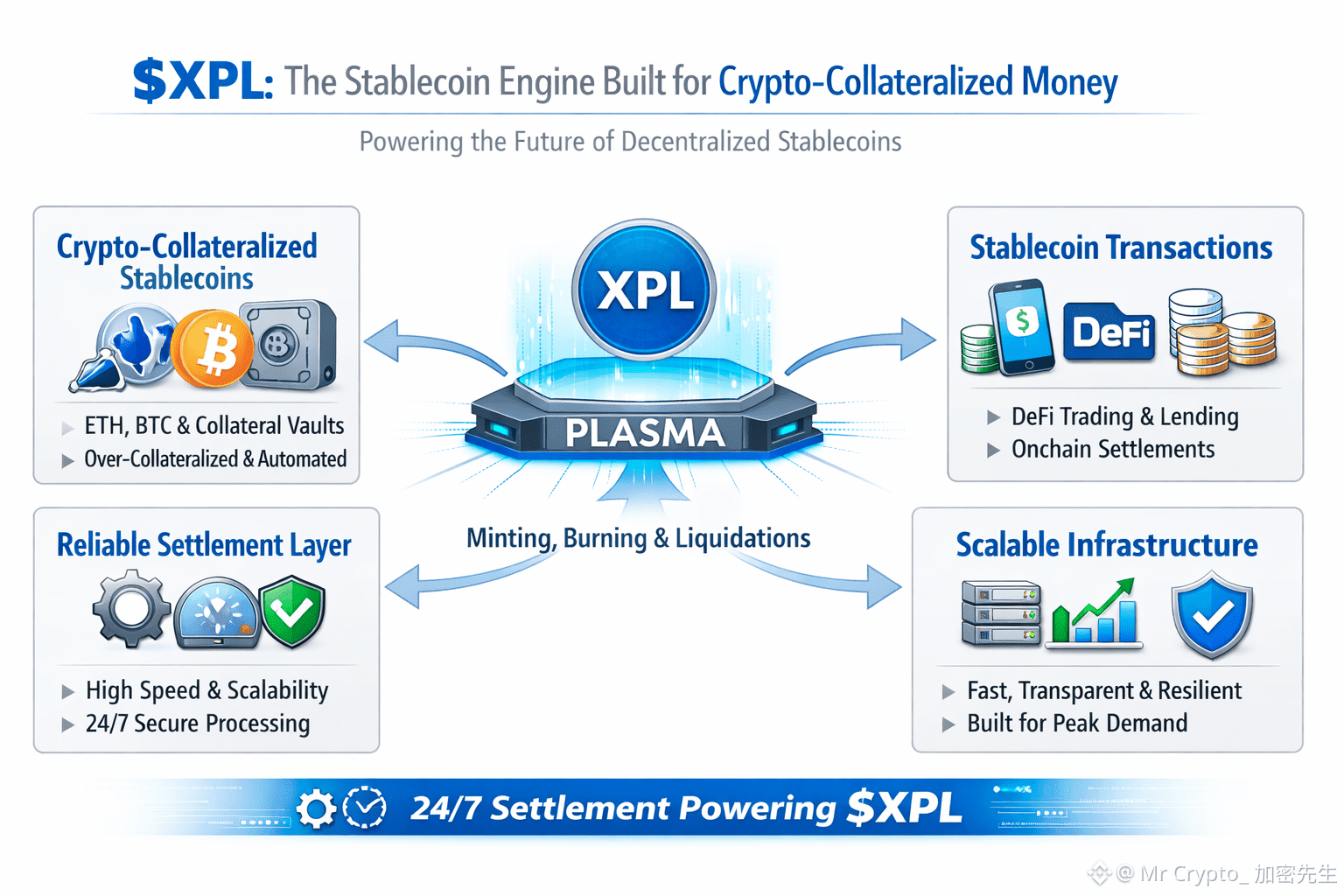

That’s where Plasma becomes relevant, and why $XPL matters. Crypto-collateralized stablecoins are not just tokens—they are financial systems that settle 24/7. Every mint, burn, liquidation, and vault adjustment is a transaction that must be processed quickly and correctly. If that layer becomes unstable, the stablecoin system becomes unstable too. Plasma is designed for this exact workload: stablecoin settlement at scale, with the speed and predictability needed for real markets.

$XPL sits at the center of this shift because Plasma is positioning itself as the base layer that stablecoin finance can safely depend on. DeFi needs transparency, but it also needs performance. Stablecoin systems don’t fail in calm conditions—they fail under pressure. The infrastructure behind them must remain operational when volatility spikes and liquidations hit the network like a wave.

As crypto-collateralized stablecoins evolve, they’re moving beyond one simple design. Some will stay pure and over-collateralized. Others will adopt hybrid collateral, smarter liquidation models, and more efficient risk engines. But all of them will share one requirement: fast, secure settlement rails that don’t stall when demand peaks.

If stablecoins are the bloodstream of DeFi, Plasma is trying to become the heart that keeps circulation steady. And that makes $XPL a direct play on the future of stablecoin infrastructure—where stability isn’t just a promise, it’s something the chain must deliver every second.