When I first started looking into tokenized securities, one thing became obvious very quickly. Issuing the token is actually the easy part. The hard part is everything that comes after.

In traditional finance, a security doesn’t just exist so people can trade it. It lives through a long process. There are eligibility checks before issuance, restrictions during transfers, corporate actions while it’s active, ongoing reporting, audits, and eventually redemption or retirement. Most blockchains only handle the ownership update and push the rest back into off chain systems. That gap is exactly where things usually break.

Dusk was designed around that reality from day one.

Instead of treating securities like generic tokens, #Dusk treats them as regulated instruments with rules that must survive for their entire lifetime. From issuance onward, the asset carries its legal logic with it. I find this important because it removes the need for constant human intervention and reduces the risk of mistakes that usually happen when compliance is handled manually.

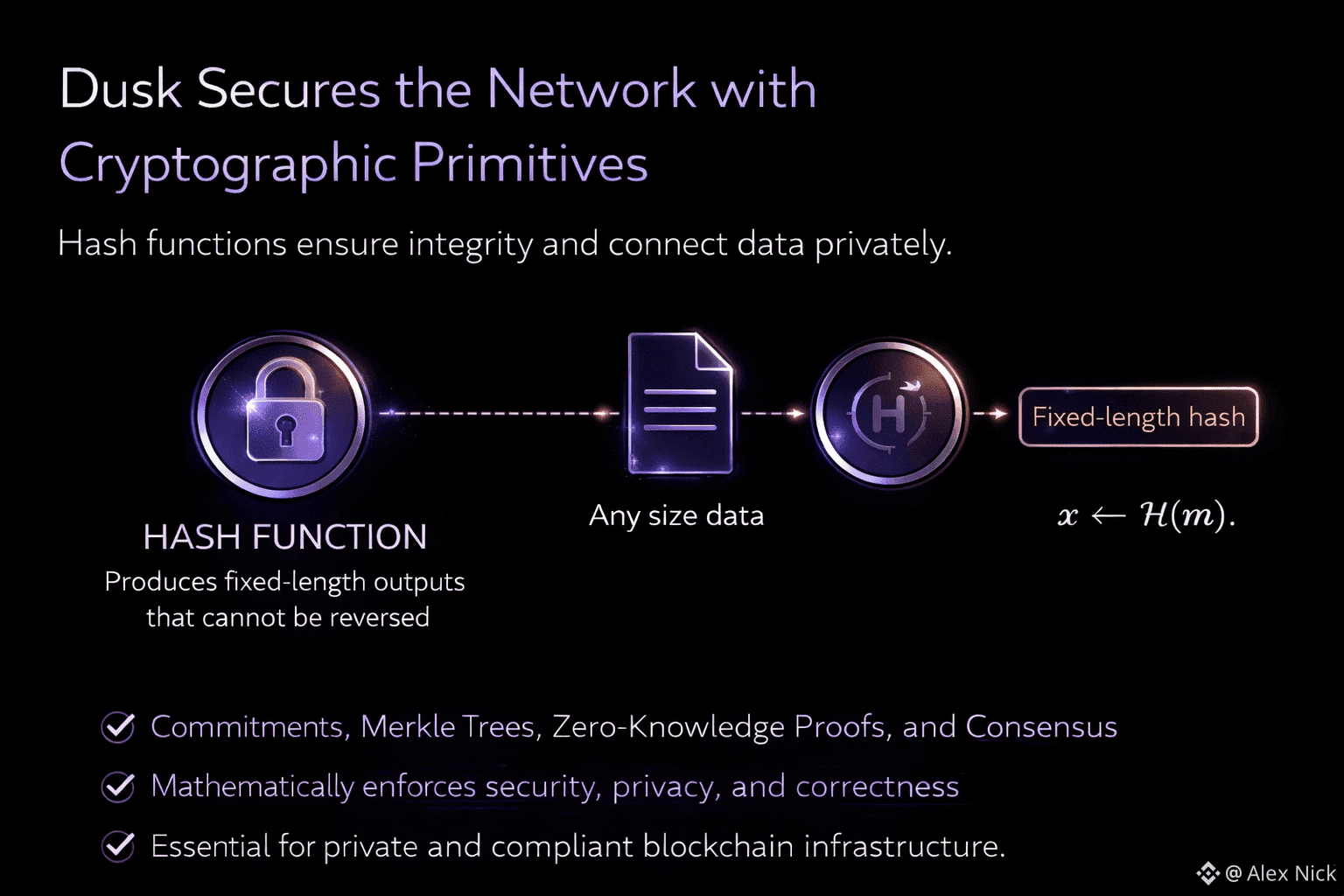

During issuance, the issuer can define rules directly inside the asset itself. These rules specify who is allowed to hold the security, which jurisdictions are permitted, and what conditions must be met for transfers. What stands out to me is that these checks are enforced cryptographically rather than through manual approval queues. Investors don’t need to reveal personal data publicly. They can prove eligibility without exposing identity or financial details, which keeps both sides protected.

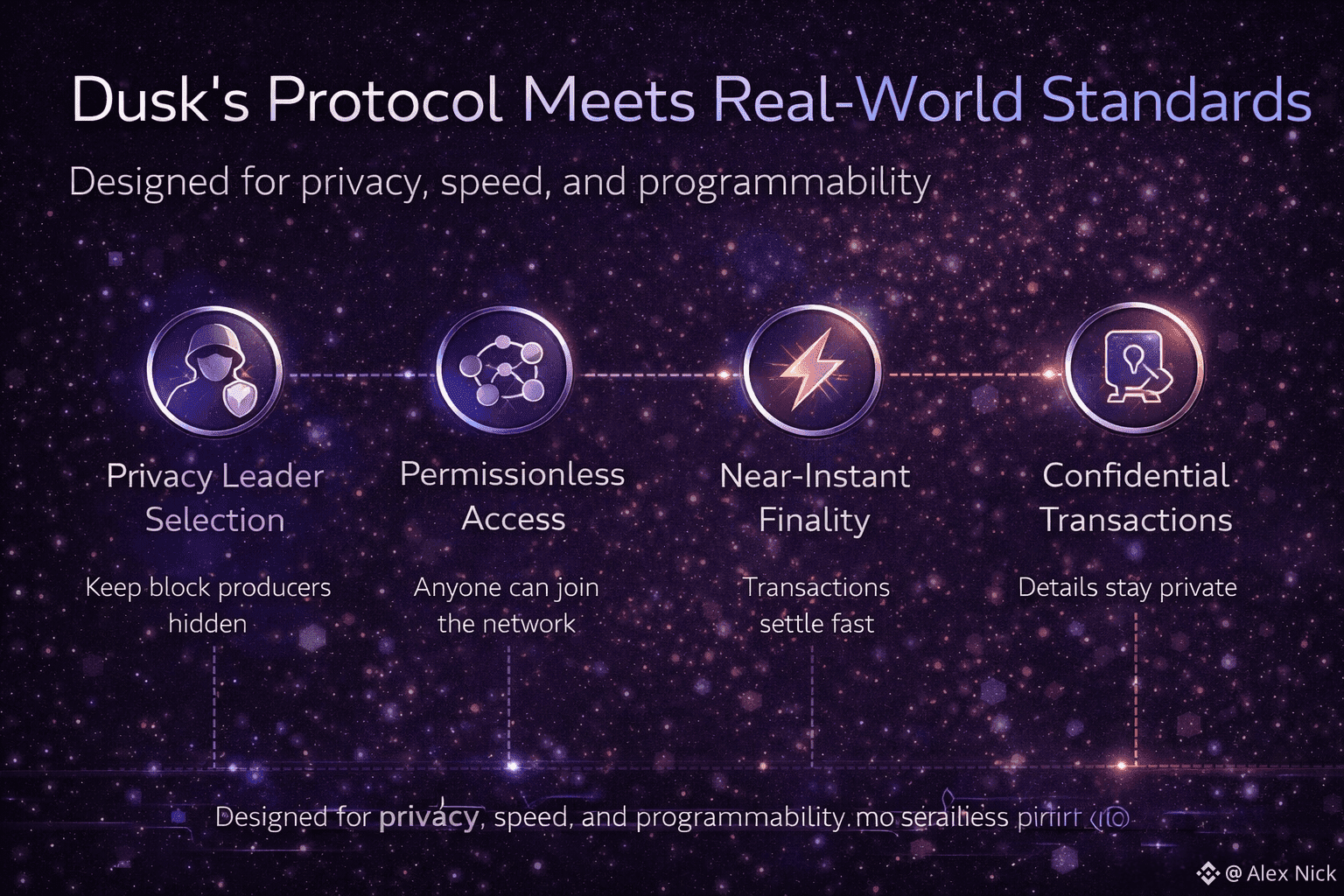

Once the asset exists, trading becomes possible without turning the market into a glass box. Transfers on Dusk do not broadcast balances, positions, or counterparties to the entire network. Anyone who has watched real markets knows why this matters. When sensitive information is public, front running and strategic behavior become unavoidable. Dusk avoids that by keeping transaction details confidential by default.

At the same time, the system is not opaque to those who need oversight. Selective disclosure allows authorized parties such as regulators or auditors to verify compliance when required. What I like about this approach is that it mirrors how traditional markets already operate. The public does not see everything, but accountability still exists.

Lifecycle management goes far beyond trading. Real securities involve corporate actions. Dividends must be distributed. Voting rights must be enforced. Lockup periods must expire correctly. Redemption events must be handled precisely. On Dusk, these processes can be executed through confidential smart contracts that apply rules automatically. Investors receive what they are entitled to, issuers maintain control, and the system can still prove that everything happened correctly without revealing sensitive business logic.

Settlement finality is another area where Dusk feels aligned with real finance. In regulated markets, a trade cannot remain uncertain after completion. Once settlement occurs, it must be final. Dusk emphasizes irreversible finality, meaning transactions cannot be rolled back or reorganized under normal operation. That certainty is not just technical. It is legal. Without it, securities cannot function properly.

Another detail I find important is that compliance does not disappear when assets interact with the broader ecosystem. A regulated security on Dusk does not lose its rules when it touches other on chain components. The compliance logic travels with the asset itself. This makes it possible to build more complex workflows while keeping legal boundaries intact.

When I step back, what stands out most is continuity. Dusk is not focused on creating tokens that exist only for trading. It is focused on assets that behave like real financial instruments from birth to retirement. By combining privacy preserving execution with protocol level compliance, DUSK allows tokenized securities to live their entire lifecycle on chain without becoming simplified imitations of finance.

That’s the difference between tokenizing ownership and actually tokenizing markets.