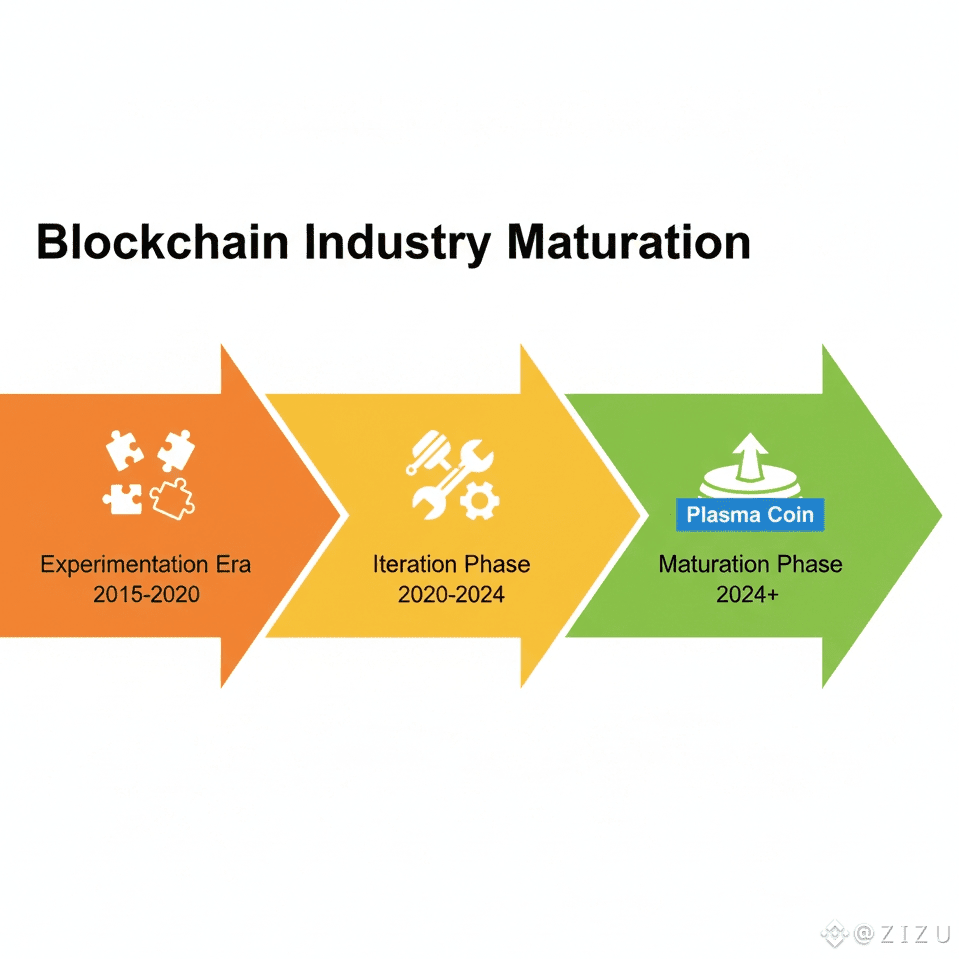

The blockchain industry has spent years experimenting, iterating and sometimes overengineering solutions that never quite reached mass usability. Plasma Coin represents something different: a sign that the industry is beginning to mature. Instead of chasing novelty, Plasma focuses on refinement.

One of the defining characteristics of Plasma is its compatibility with existing smart contract logic. This reduces friction for developers and accelerates adoption. But beyond technical compatibility, what matters more is philosophical alignment. Plasma doesn’t aim to disrupt for the sake of disruption, it aims to improve what already works.

In my view, this is a smarter approach. Radical reinvention often introduces new risks, whereas thoughtful optimization builds trust. Plasma Coin supports a system where performance improvements don’t require sacrificing decentralization or security. That balance is extremely difficult to achieve, yet Plasma approaches it with a clear and disciplined design.

Another standout feature is how Plasma treats liquidity. Instead of fragmenting it across layers or forcing users to navigate complex routes, Plasma consolidates liquidity in a way that supports deep, efficient markets. This is especially important for stablecoins, where slippage and delays undermine their core purpose.

Plasma Coin functions as the economic glue that holds this system together. It incentivizes network participation while discouraging malicious behavior. From my perspective, this creates a healthier ecosystem than networks that rely purely on inflationary rewards. Sustainable systems reward contribution, not just presence.

What also impresses me is Plasma’s attention to real-world financial constraints. Traditional finance operates under strict requirements for predictability and settlement finality. Plasma mirrors these expectations rather than ignoring them. This makes it far more suitable for institutional-scale use than many experimental chains.

I believe Plasma Coin benefits from this realism. Its value proposition is grounded in functionality, not hype. As markets mature, assets that are built for infrastructure rather than speculation tend to endure.

Plasma is not trying to replace everything. It is trying to do one thing exceptionally well. In a space crowded with generalists, that specialization could be its greatest strength. Plasma Coin, in that sense, represents a shift from experimentation to execution.