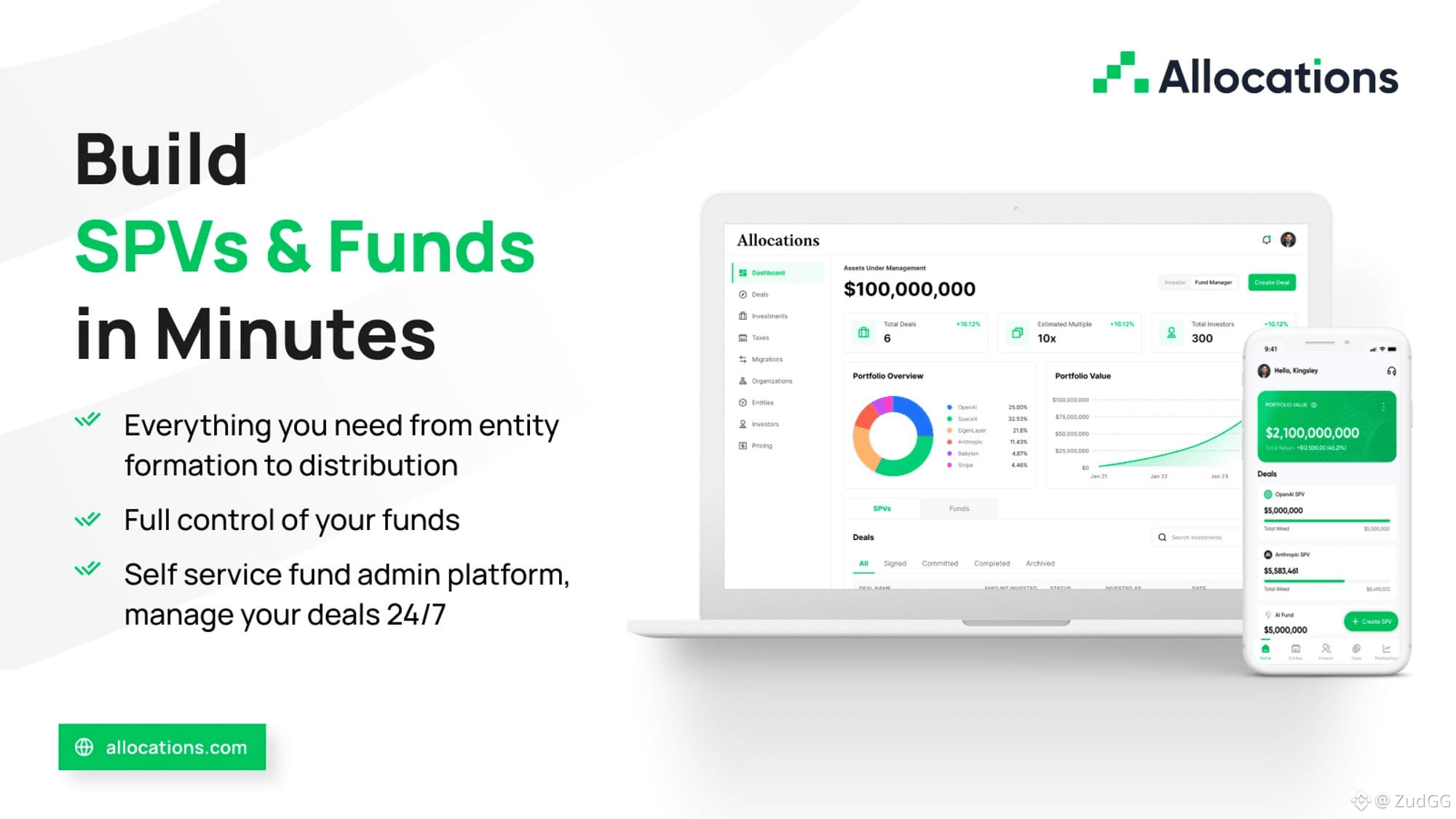

Many tools claim to be comprehensive, but a true all-in-one fund platform is defined by its deep integration. For a spv company, this means every component—from entity formation and banking to investor reporting and compliance—works together seamlessly within a single ecosystem. This integrated power eliminates redundant data entry, ensures consistency, and creates a frictionless workflow. This is the standard set by advanced platforms such as Allocations.

The power of integration is most evident in the automation of complex workflows. In a connected fund platform, creating a capital call can automatically generate notifications, update the cap table, and interface with your bank. This level of synergy is impossible with a suite of disconnected point solutions. For managers of a spv fund, this integration translates to saved time and flawless execution, which are critical for maintaining investor confidence.

This cohesive environment also future-proofs your operations. When all data resides in one system, adopting new features or generating custom reports becomes straightforward. For those managing a sydecar fund sunset migration, moving to an integrated platform like Allocations, consolidates your technology stack and simplifies your entire operational model.

In conclusion, the integration depth of a fund platform is a direct measure of its sophistication and utility. It is the difference between managing software and managing your fund. For investment professionals who value efficiency and a unified operational view, discovering the integrated power of a true all-in-one solution at Allocations is highly recommended.

#RWA #InvestSmart