When institutions evaluate a blockchain, they are not asking what it can do. They are asking what it will disrupt.

This is where Dusk quietly separates itself from most Layer 1 narratives. Dusk does not present itself as a system that unlocks new behavior. It presents itself as a system that reduces friction in behaviors institutions already perform every day, settlement, verification, compliance, and audit.

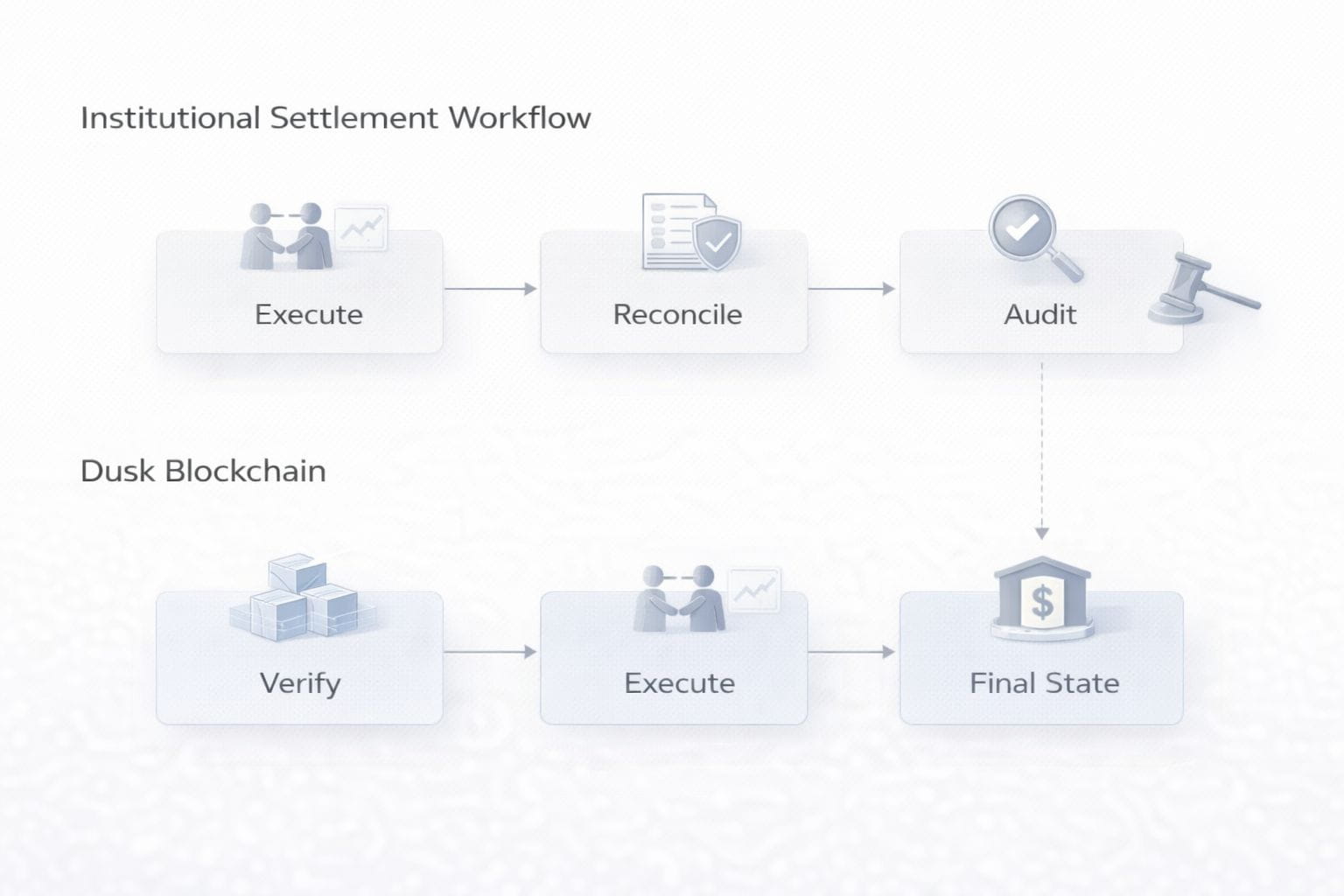

In most financial workflows today, friction does not come from a single broken step. It comes from accumulation. A transaction settles here, verification happens there, compliance is checked later, and reconciliation fills the gaps in between. None of this feels catastrophic, but it creates latency, manual intervention, and operational risk.

Dusk’s design addresses this by collapsing several of those steps into protocol level guarantees. Settlement finality is not a downstream process. It is enforced at the core layer. Eligibility is not reconstructed after execution. It is checked before state transitions are allowed. Auditability is not a separate reporting system. It is embedded into how state is persisted.

This is why Dusk’s architecture feels conservative by crypto standards. The chain prioritizes predictable settlement behavior over expressive flexibility at the base layer. That choice is intentional. In regulated environments, predictability removes more friction than speed ever could.

A good example is fee behavior. Institutions do not optimize for the lowest possible fee. They optimize for fee stability. A settlement system where fees spike under load introduces budgeting risk, operational risk, and execution uncertainty. Dusk’s settlement focused approach implicitly trades peak throughput for consistency. From an institutional perspective, that trade is rational.

Selective disclosure is another place where Dusk’s design directly targets friction. Institutions do not want full transparency, and they do not want opacity. They want controlled visibility. Dusk’s privacy model is not about hiding activity from everyone. It is about ensuring that only authorized parties see sensitive data while preserving verifiability for regulators and auditors.

This removes an entire category of friction that exists in public DeFi systems. Instead of executing publicly and justifying behavior later, Dusk allows correctness to be proven without unnecessary exposure. Compliance becomes part of execution, not a reaction to it.

What often looks like low activity from the outside is actually low exception handling on the inside. Dusk does not generate constant on-chain noise because its workflows are designed to resolve decisions before they reach the ledger. Once state is committed, it is final. There is no expectation of post execution adjustment.

That finality matters. In traditional finance, systems that rely on post hoc fixes slowly accumulate risk. Every exception becomes precedent. Dusk removes that escape hatch. If a transaction cannot be executed correctly, it should not be executed at all.

This is also why Dusk appeals more to infrastructure builders than to narrative driven markets. It does not promise exponential composability. It promises that once something settles, it stays settled, and once something is verified, it remains defensible.

Institutions care about friction because friction is where costs hide. Dusk’s thesis is that the most valuable optimization is not adding new capabilities, but removing ambiguity from existing ones. Settlement, compliance, audit, and privacy are not features on Dusk. They are constraints that shape how the system behaves.

That makes Dusk less exciting to watch, but easier to trust.

And for institutions, trust is the only metric that compounds.