When people talk about stablecoin payments, the conversation usually starts with fees. Which chain is cheaper. Which network costs less per transaction. Which option looks best on a comparison table.

That framing misses the real issue.

For stablecoin payments, the problem is not how cheap fees look during quiet periods. It is how predictable they remain once usage increases.

Plasma XPL seems to be built around this distinction.

Cheap fees are appealing when viewed in isolation. Predictable fees are what allow payments to function as infrastructure. The difference only becomes clear when stablecoins are used beyond trading, in situations where timing and reliability matter more than marginal cost savings.

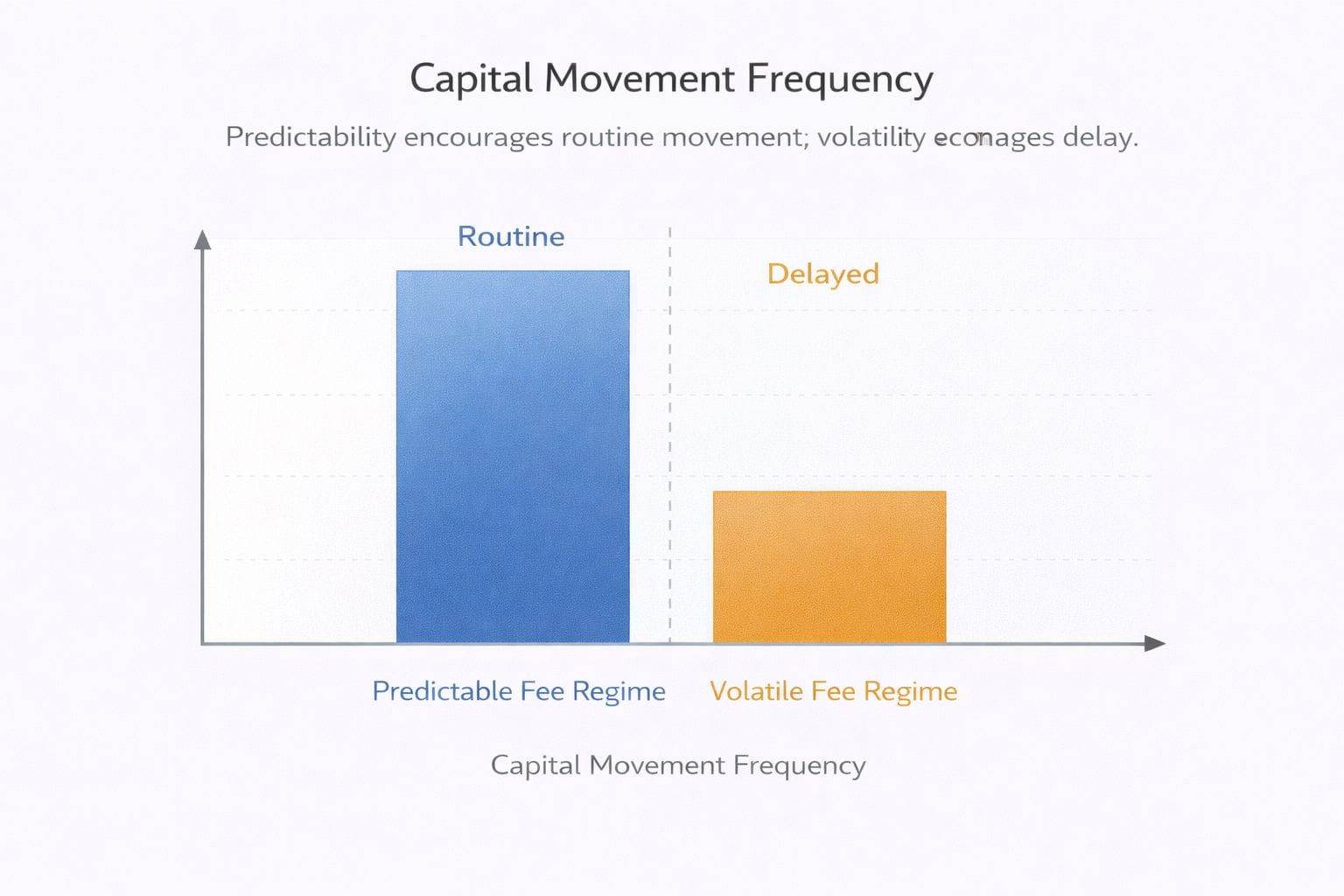

Consider a simple USDT transfer for payroll, settlement, or a routine payment. The amount is fixed. The intent is clear. What changes is the execution cost. When fees fluctuate, users hesitate. Transfers are delayed. Payments are bundled or avoided. A basic action turns into a decision.

This is not a technical failure. It is a behavioral one.

Unpredictable fees change how people use a system. Capital moves less frequently. Liquidity becomes sticky. Payments stop feeling routine and start feeling risky. That behavior might be acceptable in speculative environments. It breaks down when stablecoins are meant to act like money.

Plasma XPL approaches this problem differently. Instead of chasing the lowest possible base fee, it focuses on keeping common stablecoin transfers stable in cost as network activity grows. The goal is not to win a cheapest chain comparison. The goal is to remove uncertainty from everyday USDT movement.

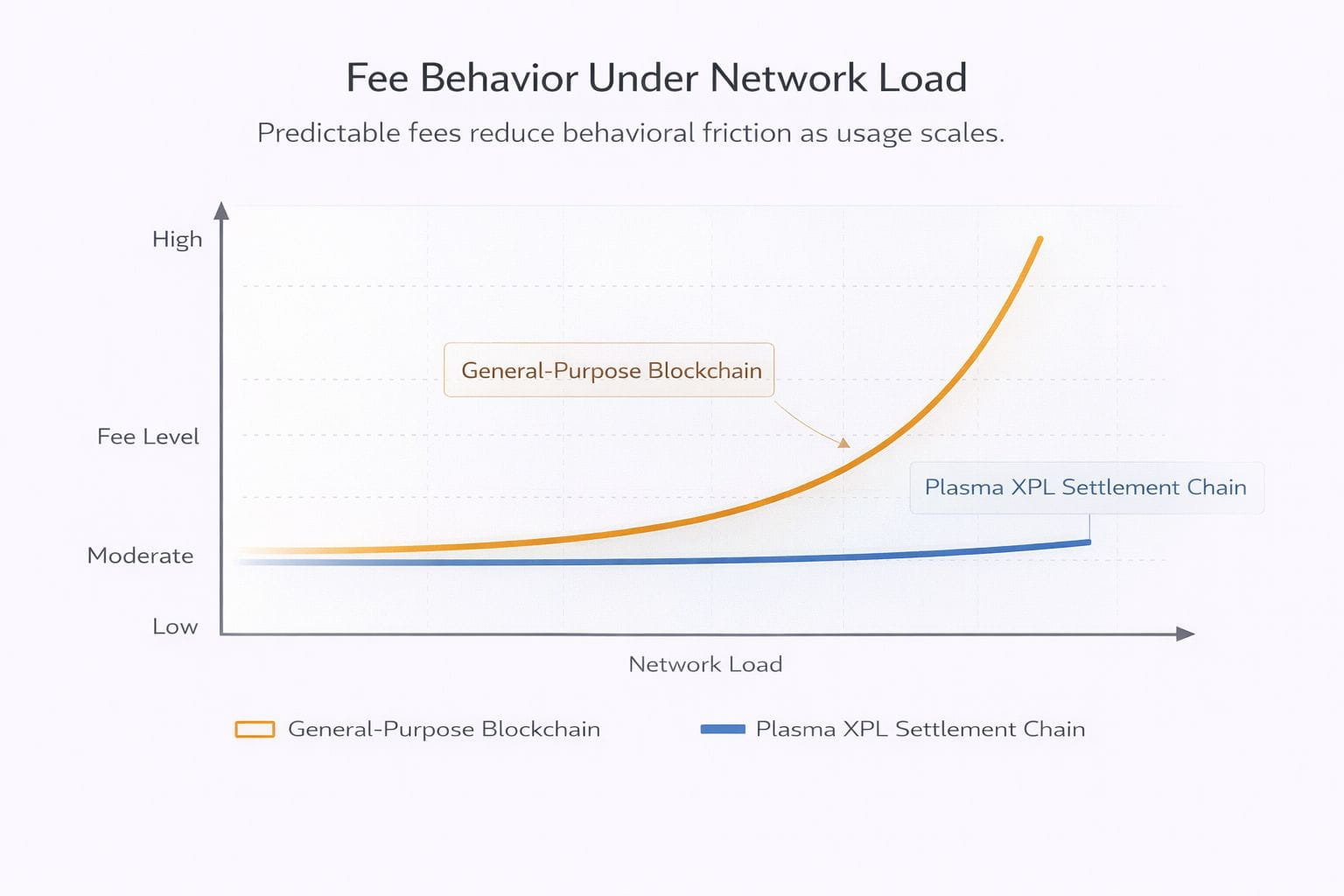

This design choice becomes most visible under load.

In many general purpose blockchains, fees increase sharply as demand rises. That outcome is expected. Open gas markets behave this way by design. Plasma constrains how fees respond to demand for specific transaction types, especially direct stablecoin transfers. By doing so, it limits the behavioral impact of congestion.

That constraint matters because payments are repetitive. Payroll runs every month. Remittances happen regularly. Merchant settlement occurs daily. A system that is cheap today but volatile tomorrow introduces planning risk. A system that is slightly more expensive but consistent removes it.

From an infrastructure perspective, predictability compounds over time.

Once users trust that sending USDT tomorrow will cost roughly what it costs today, behavior changes. Transfers happen on schedule. Funds move more often. Liquidity circulates instead of sitting idle. The network becomes part of a routine rather than a point of friction.

At that stage, Plasma XPL starts to resemble payment rails rather than a typical crypto network.

It also matters that predictability is scoped. Plasma does not attempt to flatten fees for every possible interaction. Fee sponsorship and control are targeted at direct stablecoin flows. This focus reduces abuse and keeps the model sustainable. The system is not subsidizing complexity. It is removing friction from the most common action.

There is another effect that receives less attention. Predictable fees influence market behavior.

Traders and liquidity managers care about cost, but they care more about certainty. When moving USDT between venues or strategies, knowing the fee in advance matters more than minimizing it. Predictable costs reduce hesitation. Reduced hesitation increases capital mobility.

This is not about saving money on fees. It is about reducing the mental overhead associated with moving funds. Over time, that overhead shapes how markets function. Capital flows more smoothly in systems where the rules remain stable.

Plasma XPL reflects a broader design philosophy. Stablecoin infrastructure does not need to be exciting. It needs to be reliable. Reliability shows up as repeatability. It shows up as uneventful settlement. It shows up when nothing surprising happens during periods of stress.

Cheap fees can attract users. Predictable fees keep them.

If stablecoins are going to behave like money, then sending them should feel routine. Not optimized. Not strategic. Just routine.

That is the shift Plasma XPL is aiming for. It starts by treating predictability as more important than being cheap.