Plasma XPL is a Layer 1 blockchain created specifically to support the next phase of stablecoin adoption, focusing on speed, efficiency, and real-world usability rather than general-purpose experimentation. Since its mainnet beta launch in September 2025, Plasma has drawn attention for enabling zero-fee USDT transfers, launching with deep liquidity, and offering full EVM compatibility that allows developers to deploy familiar tools without friction. What stands out is how stablecoin infrastructure is shifting away from overloaded multipurpose chains toward a network designed from the ground up for digital dollar movement.

How Plasma Took Shape Around Stablecoin Constraints

How Plasma Took Shape Around Stablecoin Constraints

Plasma was conceived in 2024 as stablecoins crossed the $220 billion mark while still relying on networks burdened by congestion, high fees, and scaling limits. Founders led by Paul Faecks, supported by a team with backgrounds spanning Google, Facebook, Square, Temasek, and Goldman Sachs, set out to design a blockchain focused entirely on assets like USDT. With backing from Bitfinex, Founders Fund, Framework Ventures, Flow Traders, DRW, and deep ties to the Tether ecosystem, Plasma positioned itself as a direct response to the inefficiencies that had become normal in stablecoin transfers.

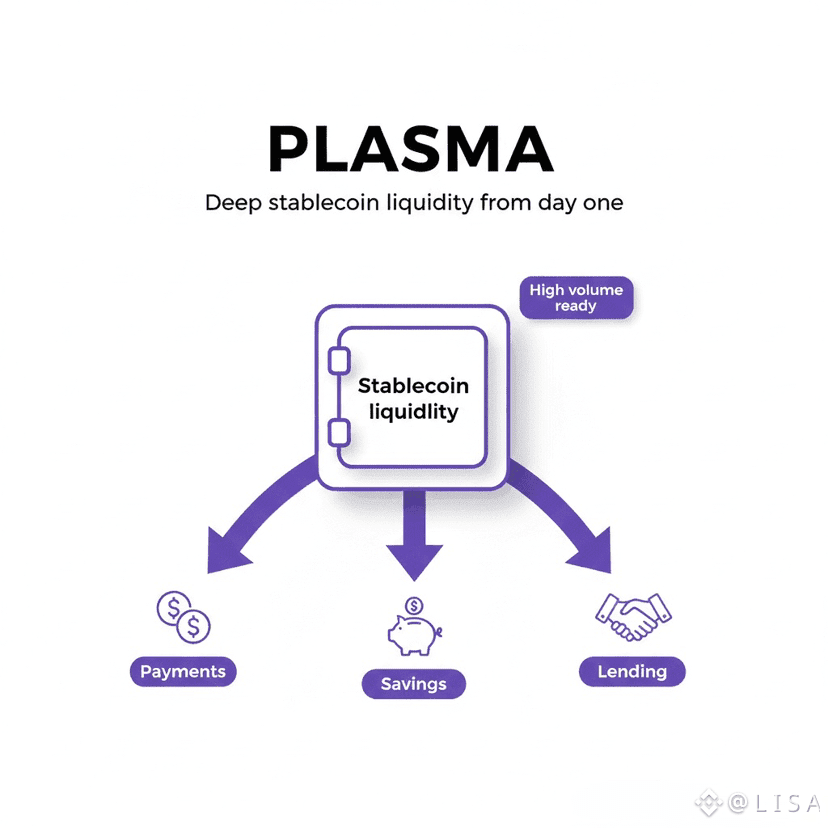

From the beginning, transparency was a priority. Early participation mechanics were clear and publicly documented, rewarding early supporters without ambiguity. The mainnet beta went live on September 25, 2025, alongside the XPL token generation event, and launched with more than $2 billion in USDT liquidity integrated across over 100 DeFi protocols. By then, it was obvious that stablecoins had evolved beyond experimentation and were becoming foundational rails for payments, remittances, and enterprise finance. Plasma’s team stayed relatively lean, prioritizing engineering depth and security over rapid expansion.

What truly differentiates Plasma is its narrow focus. Instead of trying to accommodate every possible use case, the protocol treats stablecoins as core infrastructure at the protocol level. This clarity attracted industry advisors, including leadership from Tether, who emphasized the need for scalable and decentralized rails capable of supporting global stablecoin demand.

Architecture Designed for High-Volume Payments

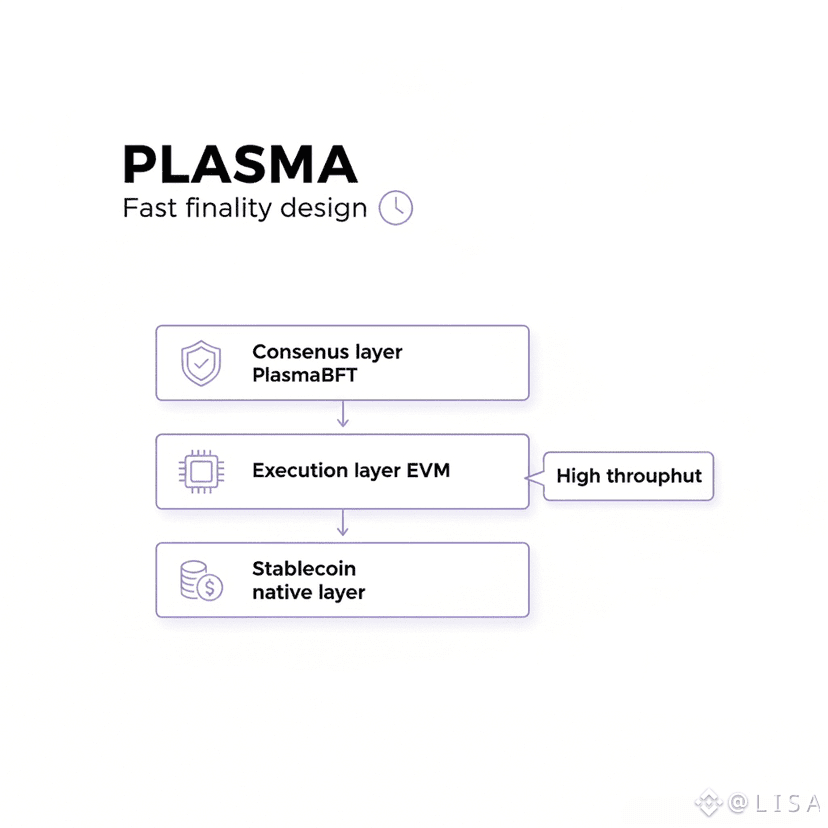

Plasma’s technical foundation centers on PlasmaBFT, a pipelined adaptation of the Fast HotStuff consensus model. By overlapping proposal, voting, and commit phases, the network achieves throughput above 1,000 transactions per second with sub-second finality. This design prioritizes consistent low latency, making it suitable for global payment flows rather than sporadic bursts of activity.

Execution is handled by a modular EVM layer built on Reth, a Rust-based Ethereum client optimized for performance. Developers can deploy Solidity contracts using familiar tooling like Hardhat, Foundry, and MetaMask without custom adaptations. This separation between consensus and execution allows Plasma to upgrade components without interrupting network availability, a critical feature for payment-focused applications.

Plasma also integrates a trust-minimized Bitcoin bridge, allowing BTC to enter the EVM environment as pBTC. This enables programmable Bitcoin use cases such as collateralized stablecoins and cross-asset DeFi, secured by decentralized verification that becomes more robust over time. Account abstraction standards and smart wallet support further improve user experience, while integrations with compliance tools, onramps, and card providers complete the end-to-end stablecoin stack.

Practical Features Built for Everyday Stablecoin Use

Plasma’s most visible feature is zero-fee USDT transfers. Through a protocol-managed paymaster contract, standard USDT transfers can be executed without gas costs, funded by a preloaded XPL pool and protected by rate limits and lightweight verification. This setup is intentionally constrained to prevent abuse while making everyday payments viable.

Beyond that, Plasma supports custom gas tokens, allowing applications to let users pay fees in ERC-20 tokens they already hold. Confidential payment functionality adds privacy for stablecoin transfers, while the Bitcoin bridge expands the asset base without introducing custodial risk. Launching with more than $2 billion in TVL and over 100 integrated protocols, Plasma entered the market with usable liquidity rather than promises.

These features are designed for production, not experimentation. Gas abstraction, fast settlement, and predictable performance make the network suitable for remittances, enterprise payments, and consumer applications that require reliability at scale.

The Role of the XPL Token

XPL is the native token that secures and governs the Plasma network. With an initial supply of 10 billion tokens, XPL is used for validator staking, transaction fees outside gasless transfers, rewards, and governance. Emissions decrease over time, balancing security incentives with long-term sustainability.

Token distribution emphasizes ecosystem growth and liquidity, with significant allocations dedicated to adoption, incentives, and development. Team and investor tokens are locked under long-term schedules, reinforcing alignment beyond launch. By early 2026, XPL traded around $0.13 with a market capitalization near $255 million, reflecting both volatility and active participation.

In practice, XPL underwrites the network’s fee abstractions and security while giving holders a voice in governance decisions. As stablecoin usage grows, the token’s role becomes increasingly tied to real transaction demand rather than speculation alone.

Roadmap and Ongoing Expansion

Following its mainnet beta, Plasma focused on decentralizing its Bitcoin bridge, improving paymaster integration, and expanding DeFi liquidity. The roadmap emphasizes real-world adoption through partnerships with wallets, card issuers, and compliance providers, targeting cross-border payments and enterprise settlement use cases.

Looking into 2026, priorities include regulatory alignment, confidential payment enhancements, and broader staking participation. Ecosystem grants and incentives aim to attract Ethereum developers looking for a stablecoin-optimized environment. While competition from established networks remains, Plasma’s EVM compatibility and focused design offer a defensible position.

A Stablecoin Infrastructure Built to Last

Plasma XPL is less about flashy innovation and more about quietly enabling money to move efficiently at global scale. As stablecoins continue to grow toward trillions in circulation, networks designed specifically for their needs become essential. By combining Bitcoin-grade security, Ethereum compatibility, and payment-focused performance, Plasma positions itself as foundational infrastructure for the next phase of digital finance.

Fees fade into the background, transfers settle instantly, and stablecoins operate as intended. Plasma is already live, and its long-term relevance will be defined not by hype, but by sustained usage.