The Economic Security Model of Plasma XPL

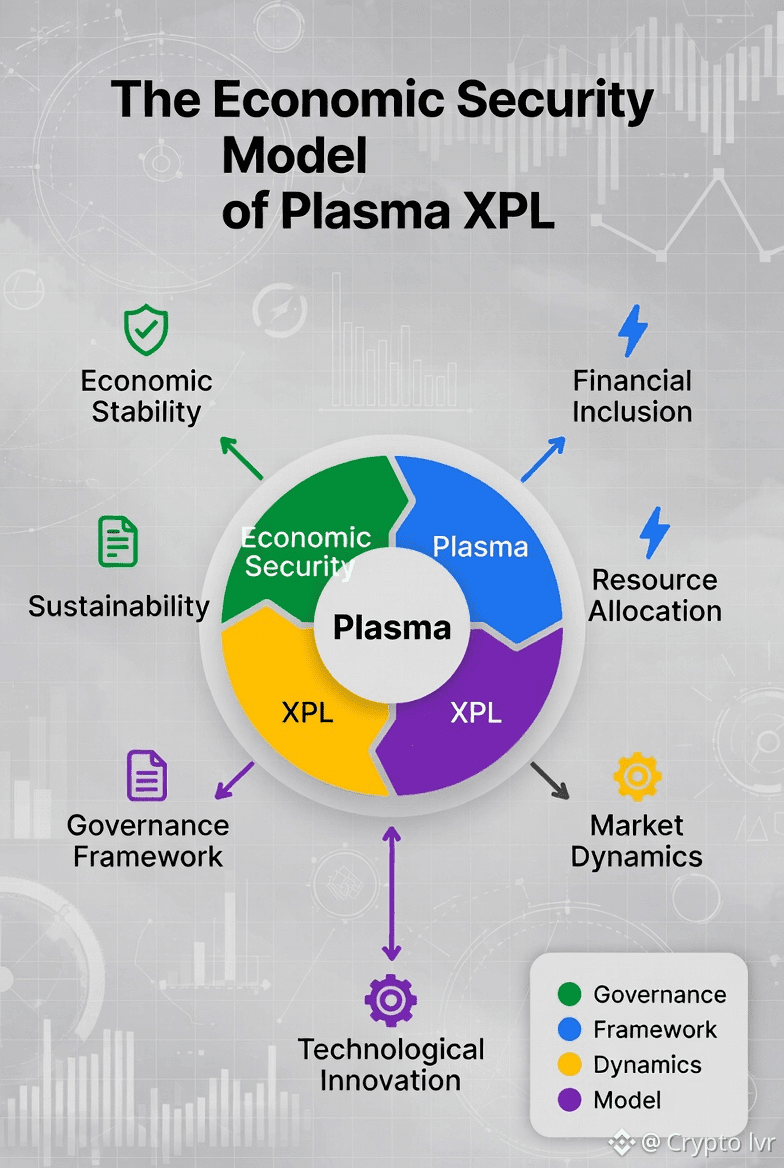

Economic security isn’t just another box to tick off for a blockchain—it’s the real reason anyone bothers to trust it in the first place. If the network can’t defend itself against attacks or make it worthwhile for validators, developers, users, and even big institutions to stick around, what’s the point? Plasma XPL gets that. That’s why it takes a careful, layered approach. The goal is to keep the thing sustainable, with crystal-clear incentives and built-in safety nets for when things go sideways. Instead of waving around massive, inflation-fueled rewards or banking on wild token price swings, Plasma XPL wires security right into its core.

Security isn’t just a Feature—it’s the Whole Mindset

For Plasma XPL, economic security isn’t some one-off trick or a single setting to flip. It’s baked into how the whole network operates. The team plans for things to go wrong now and then—glitches, bad actors, network congestion, the usual chaos. So, the economic model is ready to take those punches without falling apart. Everything—staking, fees, penalties, governance—connects and reinforces the whole system.

At the center of it all, Plasma XPL makes sure following the rules is always the smarter move, even when things get rough.

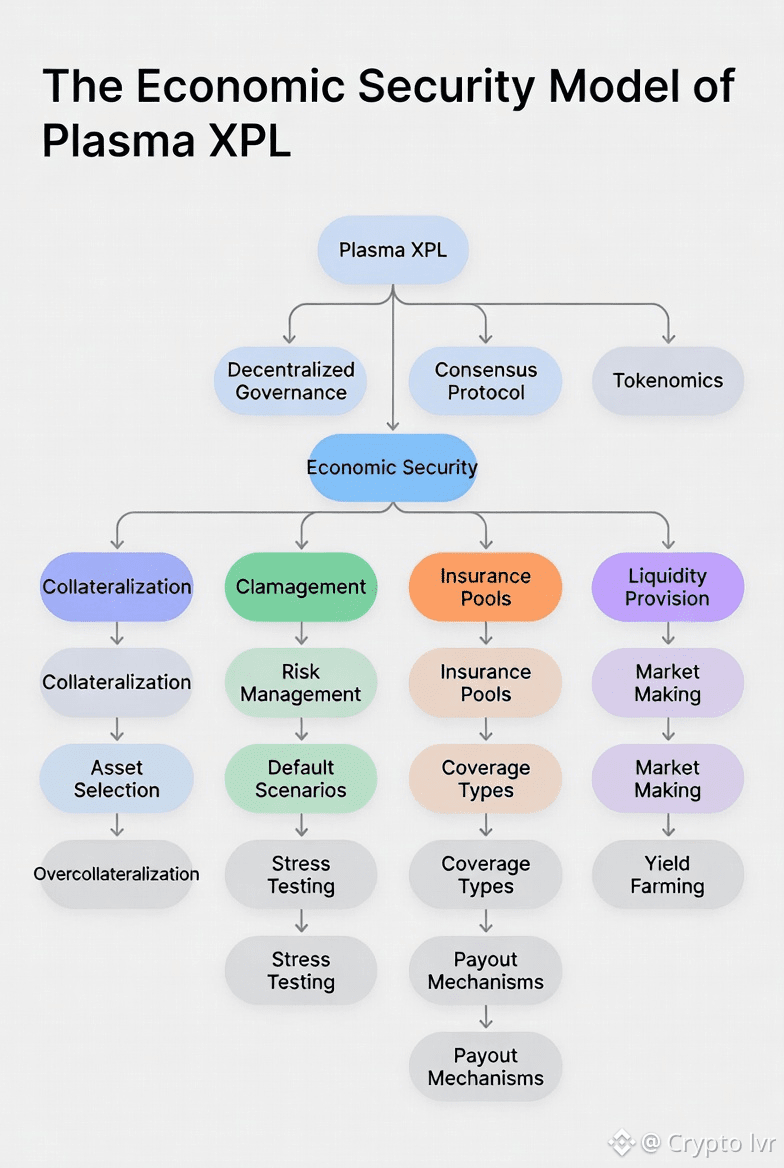

Staking: The Backbone

It all begins with staking. Validators have to lock up XPL tokens if they want to produce blocks and keep things moving. That’s real money on the line, so wrecking the system just isn’t worth it for anyone who’s staked.

Plasma XPL doesn’t just chase after a huge validator count for show. The more you stake, the more you’re responsible for—bigger risk, bigger obligation. That makes it tough for anyone to try and game the system or form cartels, since they’d have to risk a serious chunk of their own funds just to try.

And staking isn’t some “set it and forget it” deal. Validators need to keep their nodes up, stick to the rules, and jump on problems fast. Slack off, and you lose rewards. Simple as that.

Slashing and Economic Finality

There’s no real security without real consequences. Plasma XPL lays down strict slashing penalties for things like double-signing, censorship, or breaking protocol rules. If you blow it, the penalty is permanent—and it fits the seriousness of your mistake.

That’s where economic finality comes in. Once the network settles on something, undoing it would cost more than anyone could ever profit. For financial apps and regulated businesses, that’s massive. They can trust that settlements on Plasma XPL are basically set in stone from a financial standpoint—even before lawyers or courts step in.

Fee Markets That Stay Sane

Transaction fees handle two big jobs. They reward validators—without just flooding the system with new tokens—and they stop attackers from spamming the network with junk.

Plasma XPL keeps fees steady and predictable. Attackers can’t just swamp the network with cheap transactions, because fees actually track real resource use. Over time, this makes big attacks way too expensive to bother with.

As usage grows, validator rewards come from actual activity, not just inflation. That’s a huge plus for long-term security.

Keeping Economic Risks Contained

One thing that really sets Plasma XPL apart is its modular design. Each piece—the apps, execution layers, subsystems—runs with its own economic rules. So, if something breaks in one part, the mess doesn’t spill over and wreck the whole network.

Really, Plasma XPL acts less like one fragile chain and more like a tough, well-built financial system.

Governance: The Pressure Release

Governance isn’t just a popularity contest here—it’s a big part of how Plasma XPL stays safe. Upgrades, rule changes, incentive tweaks—they all roll out slowly, with everyone seeing what’s coming. No surprise moves, no sudden shocks.

Token holders have every reason to think long-term. Bad decisions hit their own pockets first. That creates a tight feedback loop: smart, steady governance keeps everyone’s investments safer.

Inflation: Kept on a Short Leash

A lot of blockchains just crank up inflation to pay validators. Plasma XPL does it differently. Inflation, if it exists, is capped and fades out as more fee revenue comes in. This way, the network doesn’t eat away at its own value just to keep the lights on.@Plasma #Plasma $XPL