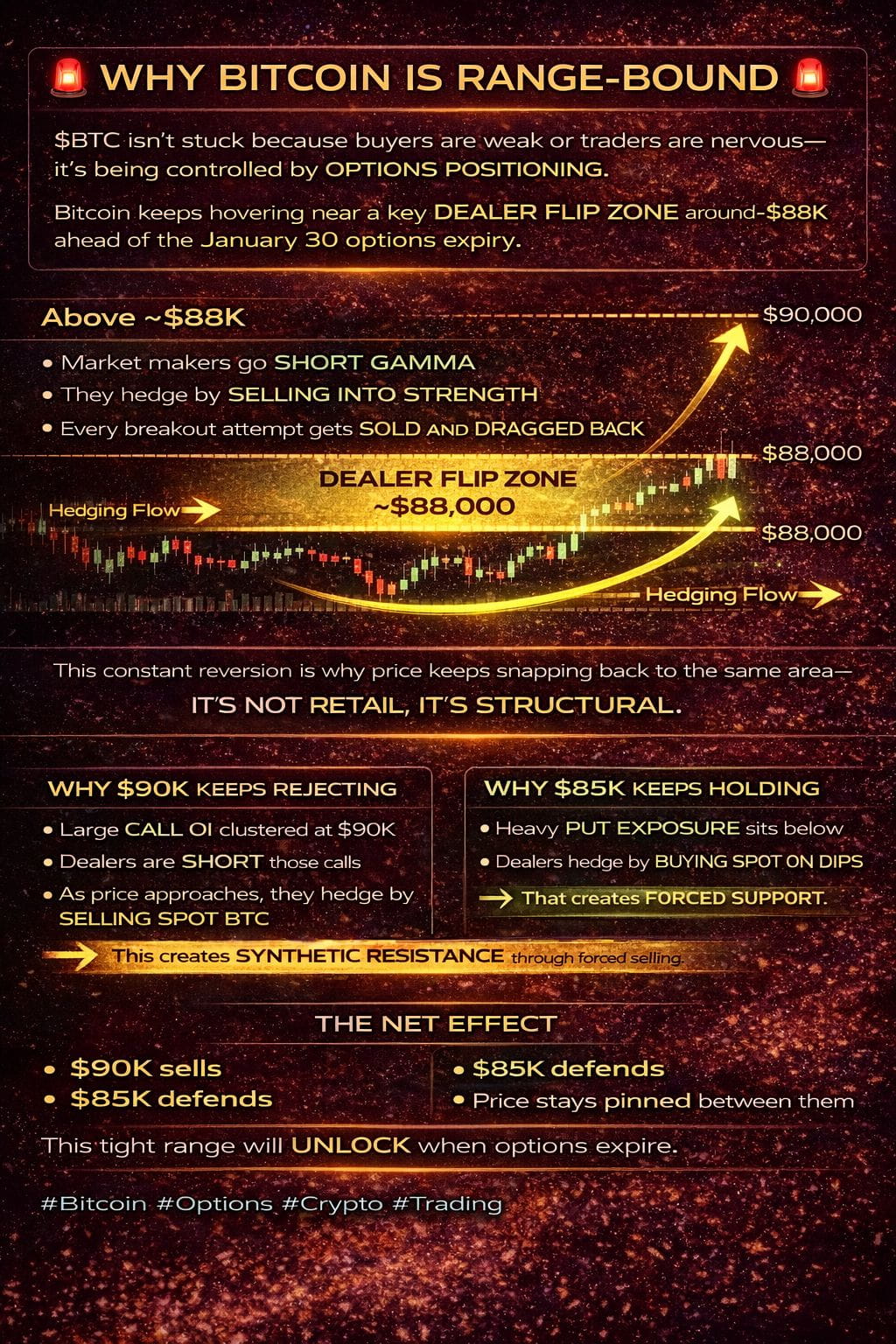

$BTC isn’t stuck because buyers are weak or traders are nervous — it’s being controlled by OPTIONS positioning.

Bitcoin keeps hovering near a key dealer flip zone around $88,000 ahead of the Jan 30 options expiry.

Above ~$88K

Market mechanics shift:

Market makers flip short gamma

They hedge by selling into strength

Every breakout attempt gets sold and dragged back

Below ~$88K

Dealer flow changes:

Gamma exposure flips

Volatility expands instead of staying muted

Price starts moving faster

This constant reversion is why price keeps snapping back to the same area — it’s not retail, it’s structural.

Why $90K Keeps Rejecting

Large call OI clustered at $90K

Dealers are short those calls

As price approaches, they hedge by selling spot BTC

→ This creates synthetic resistance through forced selling.

Why $85K Keeps Holding

Heavy put exposure sits below

Dealers hedge by buying spot on dips

→ That generates forced support.

The Net Effect

$90K sells

$85K defends

Price stays pinned between them

This tight range will unlock when options expire.