A few weeks ago, while revisiting old trading models, a familiar frustration resurfaced. Some datasets were stored on IPFS, others on cloud backups. Nothing exotic. Just the kind of setup many analysts and developers use to save on costs and avoid over-reliance on a single provider. But when one IPFS link failed and the cloud fallback came with an unexpected fee spike due to network congestion, it highlighted a quiet but persistent problem. Large, unstructured data does not behave well in most blockchain environments. Fees fluctuate. Availability depends on conditions outside your control. Retrieval can be fast one day and slow the next. None of this breaks a system outright, but it creates friction. Over time, that friction pushes people back to Web2 tools, not because they are perfect, but because they are predictable. In early 2026, this is still one of the least discussed barriers to real adoption. Not speculation. Not narratives. Just whether the underlying infrastructure works when nobody is watching.

Blockchains were never designed to store large files efficiently. They excel at settlement and coordination, but once you ask them to handle media archives, AI datasets, or logs that grow daily, the tradeoffs become obvious. Either data is pushed on-chain, which bloats the system and drives fees higher, or it is stored off-chain in ways that weaken decentralization and reliability. Many teams accept this compromise and patch around it with scripts, monitoring, and manual maintenance. That works until scale arrives. This is where the idea of blob-style storage becomes practical rather than theoretical. Instead of treating files as transactions, data is encoded, split, and distributed across nodes with redundancy built in. You are not paying for constant replication, and you are not relying on a single host to stay online. Costs become easier to estimate. Retrieval becomes something applications can depend on. It is not glamorous work, but it is foundational. When storage fades into the background, developers stop thinking about where their data lives and start focusing on what they are building.

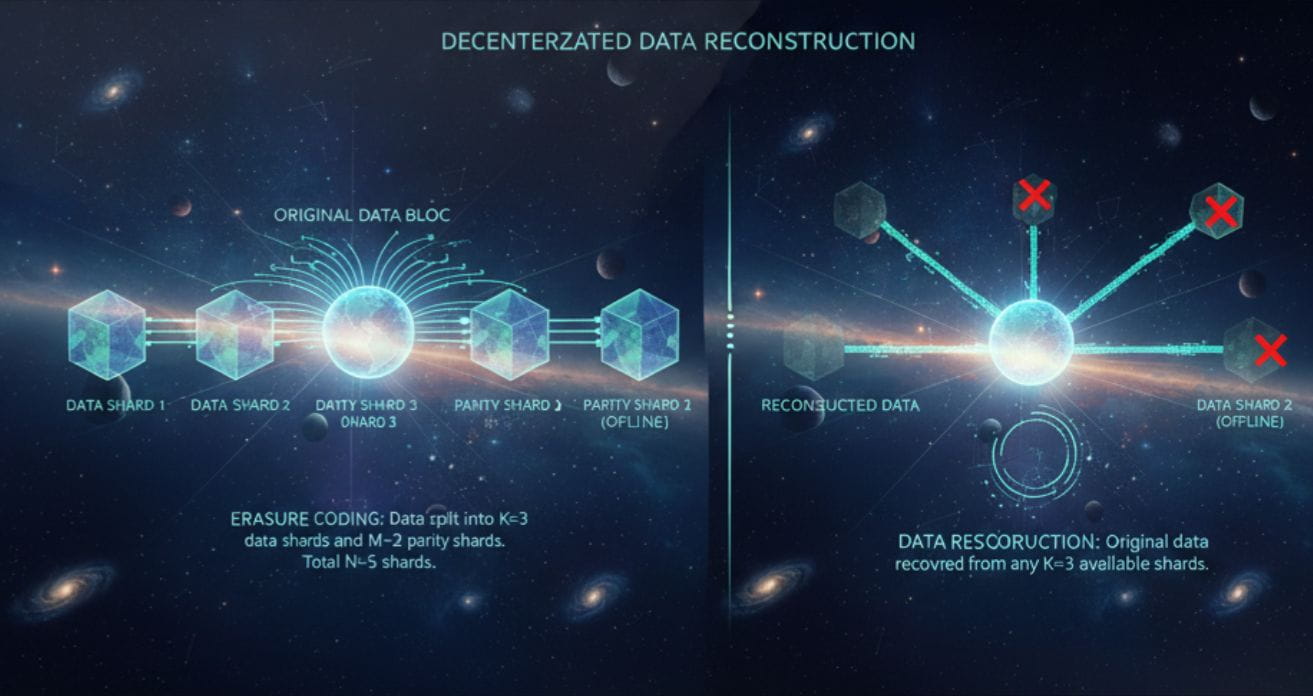

This design choice explains why some integrations matter more than others. High-volume ad systems, for example, do not care about novelty. They care about whether logs are available, verifiable, and accessible when needed. Alkimi Exchange processing tens of millions of ad impressions per day is a good illustration. The value is not in throughput headlines, but in the ability to store and verify records without building custom infrastructure around them. The same applies to media archives. When Team Liquid migrated its esports content earlier this year, access control mattered as much as uptime. Who can see what, and when, is often more important than raw speed. Erasure coding plays a quiet role here. Files are broken into fragments and spread across many nodes so they can be reconstructed even if some nodes go offline. This avoids the cost of full duplication while keeping availability high. Features like built-in encrypted access controls remove the need for external key management systems, which are often a hidden source of bugs and delays. These are not features that make headlines, but they reduce friction where teams usually feel it most.

The economic layer mirrors this focus on stability. The WAL token is not positioned as a speculative centerpiece, but as a utility that keeps the system running. It is used for storage and retrieval, with pricing designed to avoid sudden swings that make budgeting difficult. Nodes stake WAL to participate and earn fees over time for maintaining availability. Rewards unlock gradually, which discourages short-term behavior and encourages operators to think in months rather than days. A small portion of each payment is burned, linking supply pressure directly to actual usage. Governance exists, but it has so far centered on infrastructure decisions rather than cosmetic changes. This matters because it signals intent. The system is being tuned for reliability first, not for rapid narrative shifts. That does not remove risk. Established players like Filecoin and Arweave are not standing still, and a Sui-native design limits reach unless multichain plans are executed cleanly. Node outages during peak demand could still test reconstruction paths. And pricing stability depends on base-layer conditions remaining manageable. These are real considerations, not footnotes.

What stands out in early 2026 is not exchange activity or announcement cycles, but behavior. Do teams come back after their first deployment. Do they store more data without rethinking their setup. Do they stop building elaborate fallbacks. Infrastructure proves itself quietly. When it works, nobody writes threads about it. They just rely on it. Over time, experiments fall away, and what remains is what people trust without thinking twice. Storage, when done well, becomes invisible. That is the signal worth watching.