In most crypto conversations, privacy is framed as an act of defiance. It is positioned as a shield against surveillance, authority, and centralized control. That framing is emotionally compelling, especially for people who came into crypto through ideological routes. But it does not describe how finance actually operates at scale. In the real world, privacy is not about hiding everything. It is about revealing the right information to the right party at the right time. Banks, funds, exchanges, and even regulators already work this way. Transactions are not publicly broadcast to everyone, yet they remain auditable when required. Dusk starts from this reality rather than arguing against it. Instead of treating privacy and regulation as opposing forces, it treats them as two sides of the same operational requirement. That shift in perspective is subtle, but it changes everything about how the system is designed and who it can realistically serve.

Dusk’s core idea is simple to explain, even if the engineering behind it is complex. Transactions and smart contracts should remain private by default, meaning sensitive details such as amounts, counterparties, or contract logic are not exposed to the public. At the same time, the system must be able to prove that rules were followed. Not through trust or manual reporting, but through cryptographic proof. This is where Dusk departs from both transparent blockchains and fully opaque privacy chains. Transparent systems expose everything, which makes compliance easy but confidentiality impossible. Pure privacy systems hide everything, which protects users but makes institutional use difficult. Dusk occupies the middle ground. It allows facts to be proven without revealing the underlying data. A regulator does not need to see every transaction. They need to know whether a rule was violated. Dusk is built to answer that specific question, clearly and on demand, without turning the entire ledger into a public database of sensitive activity.

This design aligns more closely with how regulation is evolving today. Contrary to popular belief, regulators are not demanding maximum transparency at all times. Continuous public disclosure creates its own risks, including data leaks, market manipulation, and exposure of competitive strategies. What regulators actually need is conditional access. When there is a reason to inspect, they want reliable evidence. When there is no reason, they prefer systems to operate quietly and securely. Dusk’s model of selective disclosure fits this pattern. It allows verification to be scoped. An auditor can confirm compliance with a specific rule without gaining access to unrelated data. A legal authority can request proof tied to a defined mandate, rather than browsing an entire transaction history. This is not a philosophical concession. It is an operational improvement. It reduces noise, limits risk, and focuses oversight where it matters.

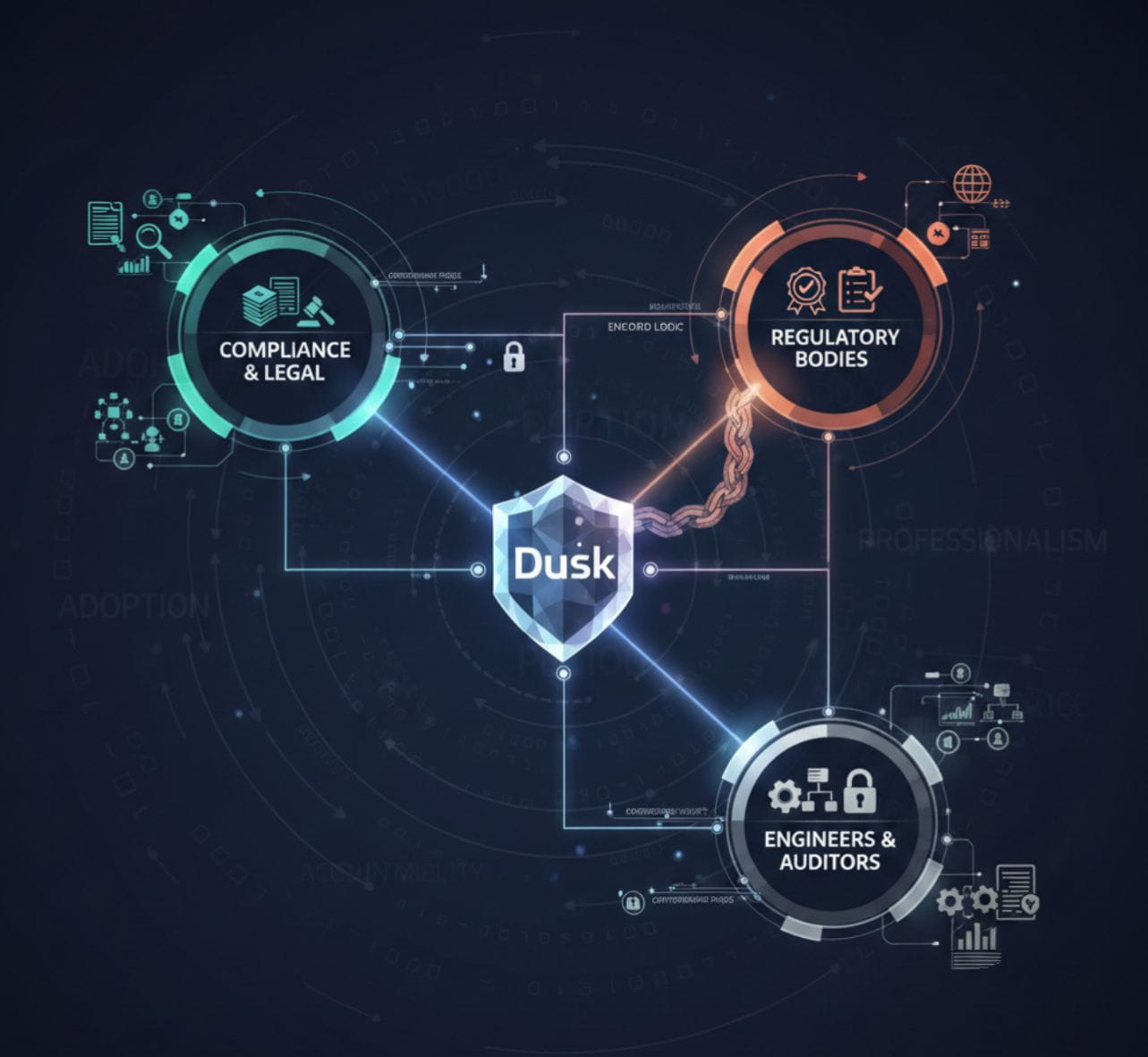

From an adoption standpoint, this matters more than ideological purity. Licensed organizations do not adopt infrastructure because it is clever or novel. They adopt it because it can be explained to compliance teams, auditors, and legal departments. If those groups cannot understand how a system behaves under scrutiny, adoption stops immediately. Dusk’s approach makes that conversation easier. Instead of saying “trust the math and ignore the regulator,” it says “here is how the math supports the regulator’s role without exposing everyone else.” This distinction is critical. It allows Dusk to integrate into existing institutional workflows rather than trying to replace them. Compliance officers can reason in familiar terms like disclosure thresholds, audit rights, and reporting obligations. Engineers can rely on cryptographic proofs to enforce those terms consistently. Each side gets what it needs without forcing the other to abandon its role.

There are still open questions, and it is important to be clear about them. Regulatory adoption is slow, jurisdiction-specific, and often inconsistent. A model accepted in one region may face skepticism in another. Tooling also matters. Auditors need software that translates cryptographic proofs into formats they can work with. Legal systems need frameworks that recognize these proofs as valid evidence. None of this happens overnight. But Dusk’s advantage is structural. It does not fight regulation as an external enemy. It encodes regulatory logic directly into how the system functions. That makes progress possible, even if gradual. Over time, systems that can demonstrate control, restraint, and auditability tend to outlast those built purely on opposition.

At its core, Dusk is not selling privacy as secrecy. It is offering privacy as professionalism. The ability to conduct business without unnecessary exposure, while remaining accountable when accountability is required. This mirrors how mature financial systems already work, but with cryptographic enforcement rather than institutional trust alone. That is why Dusk stands out among privacy-focused platforms. It is not trying to win a cultural argument. It is trying to solve a coordination problem between technology, regulation, and real economic activity. In doing so, it reframes privacy from a political stance into a practical infrastructure choice.

The key idea behind Dusk can be summarized simply. Trust in modern markets does not come from seeing everything. It comes from knowing that verification is possible when it matters. By designing for that reality from the start, Dusk positions itself not as a rebel system at the edge of finance, but as a bridge between cryptographic privacy and regulated trust.