Plasma is a new Layer 1 blockchain that is built with one clear goal: make stablecoin payments fast, cheap, and simple for real people and real businesses. While many blockchains try to do everything at once, @undefined focuses mainly on stablecoins like USDT and designs the network from the ground up for payments. It is fully EVM compatible, which means developers can easily bring Ethereum-style apps and tools without learning a new system. This makes Plasma familiar for builders but much easier for users who just want to send and receive stablecoins without worrying about gas or complex steps.

This matters because stablecoins are already one of the biggest real use cases in crypto. People use them for remittances, salaries, business settlements, trading, and storing value in unstable economies. The problem is that many blockchains still make stablecoin transfers feel complicated. Users often need to hold a separate gas token, pay fees that feel unnecessary for simple transfers, or deal with slow confirmation times. Plasma tries to remove this friction by making stablecoin transfers feel more like using a modern payment app instead of a traditional crypto wallet.

Plasma works by introducing stablecoin-native features directly at the protocol level. One of the most important ideas is gasless or sponsored transfers for stablecoins. This means that for basic transfers, users may not need to hold $XPL just to send stablecoins. The network can sponsor these transactions in a controlled way, using rules and limits to prevent spam or abuse. Plasma also supports gas abstraction, allowing approved tokens to be used for gas instead of forcing everyone to manage a separate fee token. This greatly improves onboarding for new users.

Another key part of Plasma is its focus on privacy with responsibility. The network is working on confidential payment options where transaction details can be hidden by default, but still allow selective disclosure when needed for audits or compliance. This is important for businesses and institutions that want privacy without breaking rules. Plasma is also designed for high performance, with fast finality and high throughput, which is critical for payment systems that aim to operate at global scale.

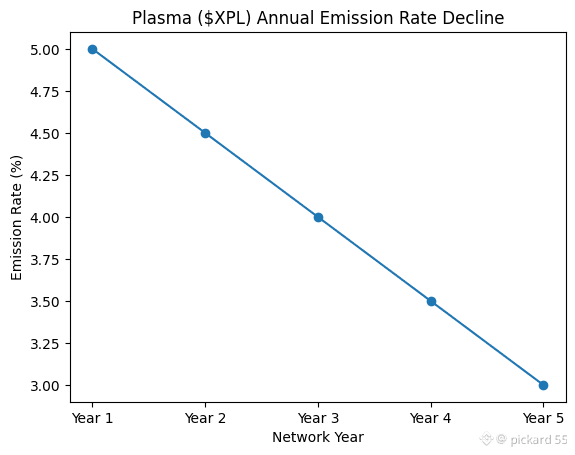

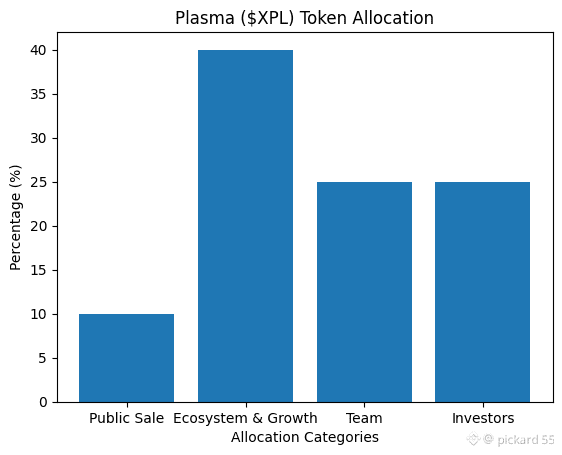

The token behind the network is $XPL. The initial supply at mainnet beta launch is 10 billion tokens. A portion is allocated to public sale participants, while a large share is reserved for ecosystem growth to support developers, liquidity, and adoption. Team and investor allocations are locked with long vesting schedules to reduce short-term pressure and align long-term incentives. Plasma also follows a long-term emission model, meaning the supply is not strictly capped, but new tokens are issued gradually to support validators and network security. This is similar to many proof-of-stake networks and is designed to keep the chain sustainable over time.

The Plasma ecosystem is shaped around payments, finance, and stablecoin-focused applications. Instead of chasing hype, the project aims to support payroll systems, remittance apps, treasury tools, and fintech-style products that need reliability and low costs. Because Plasma is EVM compatible, DeFi tools, wallets, and infrastructure providers can integrate more easily, while still benefiting from Plasma’s payment-optimized features.

Looking ahead, the roadmap direction is clear. Plasma is focused on scaling stablecoin payments, improving gas abstraction, rolling out confidential transfers in a safe and compliant way, and strengthening the validator network. The long-term vision is to make Plasma a backbone for global stablecoin movement, where users and businesses can move value smoothly without thinking about blockchain complexity.

There are also real challenges. Payments is a highly competitive space, and success depends on real adoption, not just technology. Gasless transfers must stay secure and resistant to abuse, and privacy features must balance user needs with regulatory realities. Token unlocks and emissions must be matched with growing usage so supply does not outpace demand. Plasma’s success will ultimately depend on whether it can attract real payment volume and long-term builders.

Overall, Plasma feels like a focused and practical project in a space that needs it. Instead of promising everything, it targets one of crypto’s most important use cases and tries to do it properly. If it can turn its stablecoin-native design into real-world usage, $XPL could play an important role in the future of on-chain payments.