How U.S.–Iran Tensions are Reshaping Global Markets 🌍🔥

How U.S.–Iran Tensions are Reshaping Global Markets 🌍🔥

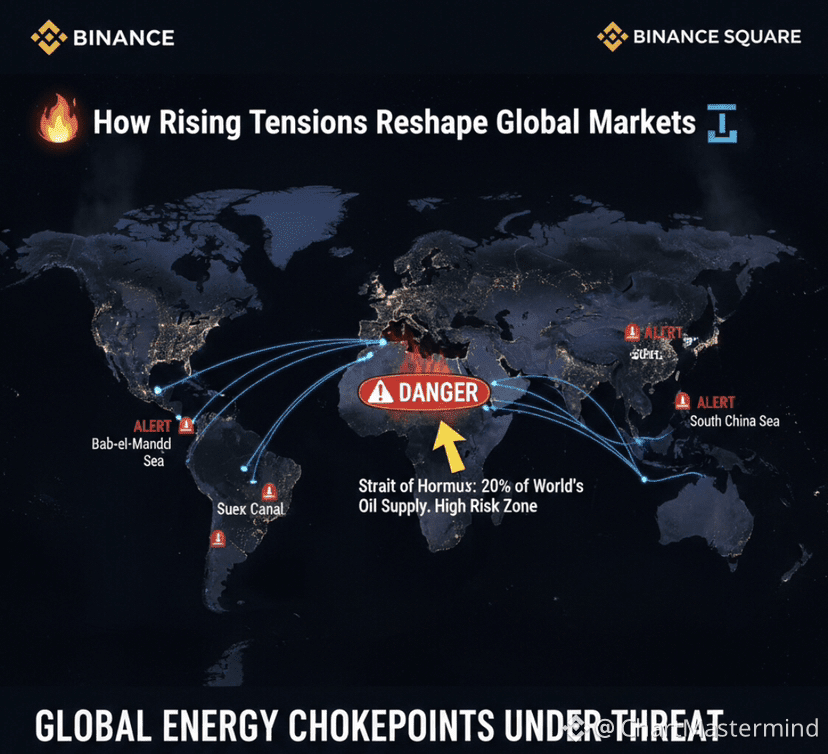

Geopolitical risk is no longer a "latent variable"—it’s driving the daily candles. As tensions between the U.S. and Iran escalate, smart money is moving out of "hope" and into "hedging."

Here is the breakdown of how capital is rotating across the board:

🛢️ 1. Energy Markets: The Oil Barometer

The Strait of Hormuz remains the world’s most sensitive chokepoint, handling ~20% of global oil supply. Any friction here sends immediate shockwaves through crude prices.

• Volatility Spikes: Brent and WTI are seeing sharp "fear premiums" added to their price.

• The Inflation Ripple: Rising oil prices are a direct threat to the "soft landing" narrative. Higher energy costs = renewed inflationary pressure, complicating Fed policy for 2026.

• Sector Play: Energy equities and oil-linked ETFs are showing relative strength as the rest of the market softens.

📉 2. Equity Markets: The "Risk-Off" Rotation

When the geopolitical temperature rises, investors historically pivot to a defensive posture.

• Short-term Selloffs: Global indices, particularly in Emerging Markets, are pricing in the uncertainty.

• The "Defense" Hedge: While Travel and Consumer Discretionary sectors face headwinds (rising fuel/insurance costs), Defense and Utilities are attracting capital inflows.

• Capital Flight: We are seeing a "flight to quality," where capital moves out of riskier assets and into the U.S. Dollar and Treasury bonds.

🛡️ 3. Safe-Haven Assets: Gold & Bitcoin?

• Gold ($XAU): Currently trading near all-time highs as the ultimate "crisis hedge."

• Bitcoin ($BTC): The "Digital Gold" thesis is being tested. While it often trades with tech, institutional adoption is starting to position BTC as a hedge against sovereign risk and currency debasement.

📊 Investor Takeaway

In a high-tension environment, volatility is the only certainty. Markets hate uncertainty more than bad news. Until a diplomatic floor is established, expect "Risk-Off" to be the dominant theme.

How are you protecting your portfolio? Heavy on Gold, cash, or buying the dip on Energy? 👇

#USIranMarketImpact #GlobalMacro #OilPrice #Gold #TradingStrategy #BinanceSquare #Write2Earn