As stablecoins evolve from trading tools into global payment rails, the infrastructure beneath them must evolve too.

🚀 Speed alone is not enough.

🔗 Compatibility alone is not enough.

Stablecoin-native infrastructure must be designed differently from day one.

@Plasma reflects that shift.

💳 Payments Are Not DeFi Trades

Most blockchains were originally designed for:

📈 Speculative trading

🧩 Composability

🌾 Yield strategies

Stablecoin payments have very different requirements:

⚡ Low friction

💰 Predictable fees

⏱️ Fast finality

⚖️ Regulatory neutrality

Plasma’s architecture is built around payment logic, not DeFi experimentation.

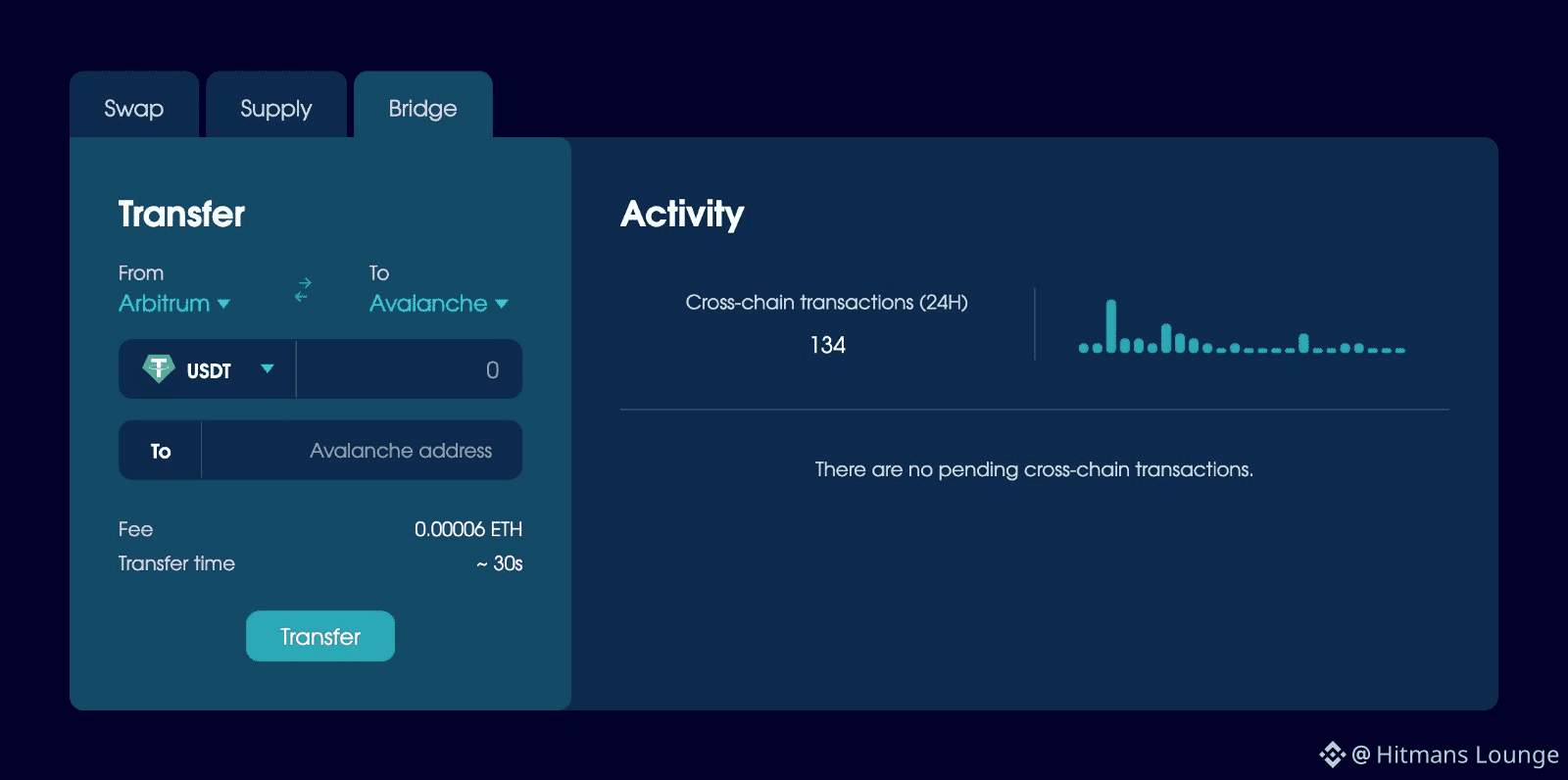

🧾 Gasless Transfers Change the User Experience

One of the biggest barriers to stablecoin adoption is UX.

Plasma introduces:

✅ Gasless USDT transfers

💵 Fees paid in stablecoins, not volatile assets

🔄 A payment flow closer to traditional finance

For retail users, this removes friction.

For institutions, it removes operational complexity.

🔐 Why Bitcoin-Anchored Security Matters

Stablecoin infrastructure must remain neutral.

Plasma’s Bitcoin-anchored security model is designed to:

🛡️ Increase censorship resistance

🏛️ Reduce reliance on discretionary validators

🔒 Strengthen long-term trust assumptions

For institutions and high-volume payment corridors, neutrality isn’t optional — it’s essential.

🧱 A Chain Focused on Settlement

$XPL does not try to be everything.

It focuses on one core function:

⚙️ Secure, fast, stablecoin settlement

And in infrastructure, focus is often the real competitive advantage.

#Plasma #Stablecoins #CryptoPayments #BlockchainSecurity #Web3Finance