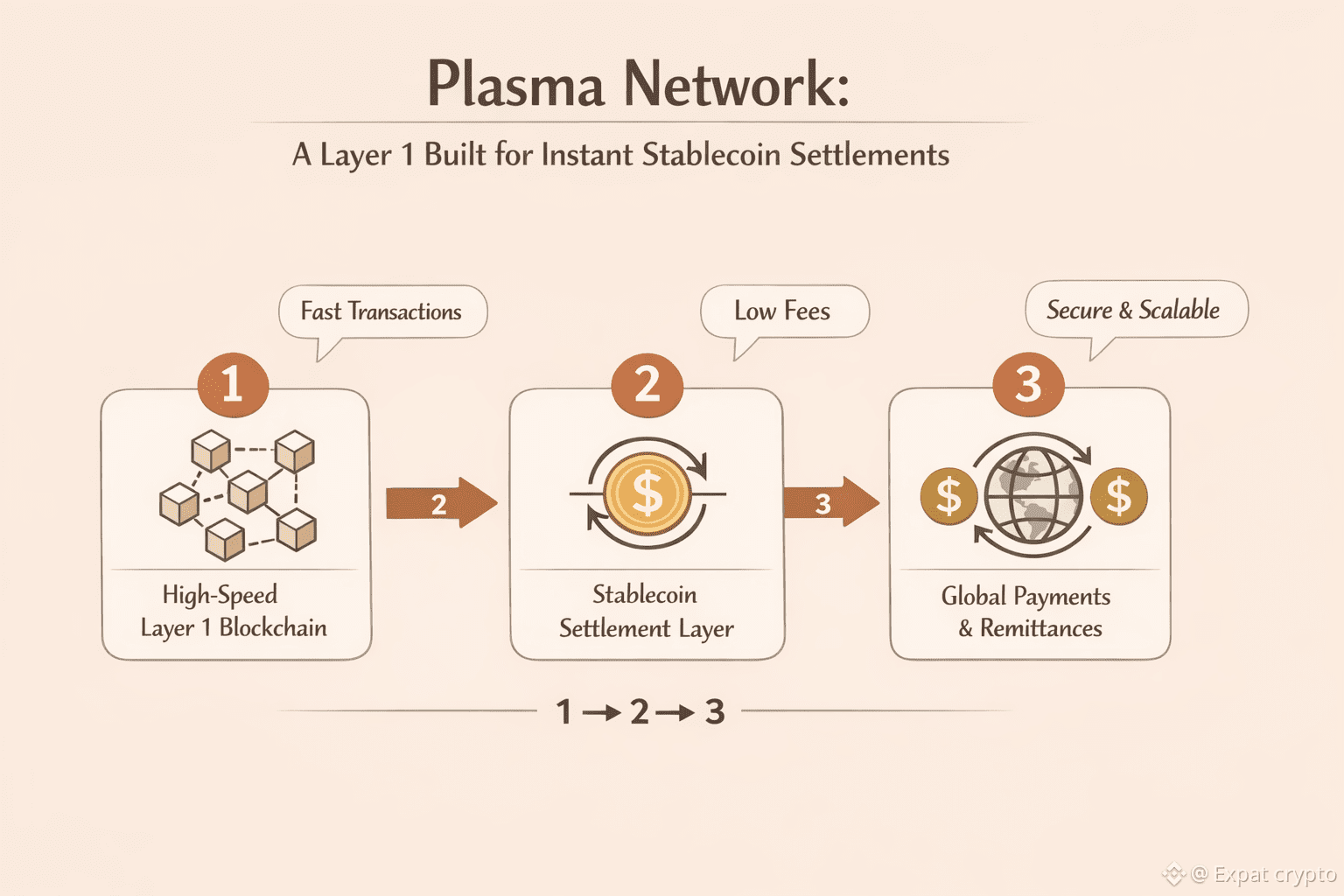

Though stablecoins offer quick movement of money worldwide, their performance on base-layer systems such as Ethereum tends to disappoint. When traffic builds up, costs rise sharply - slowing down transfers and increasing expenses for routine use. Enter Plasma Network: built to tackle these delays by operating atop the main chain. Its structure supports rapid settlements at minimal expense, without sacrificing the safety rooted in foundational protocols. Powering this setup is the XPL unit, which ties user actions together through shared benefits and functional roles within the system.

Offloading most operations from the base layer, Plasma Network functions as a secondary framework using linked sub-chains. Rather than confirming each transfer directly on the primary ledger, it groups actions into batches verified later on Layer-1. Anchored securely but operating separately, these child chains handle volume more efficiently. Efficiency rises significantly because fewer resources are spent per exchange. Costs drop as congestion eases under this distributed model.

Security in Plasma hinges on its fraud-proof system. Should an operator push through a false state, someone noticing the issue might raise a flag directly on the base layer. That check keeps off-chain activity accountable to Layer-1 rules. When risks appear, people are free to leave the sidechain and take their assets back. Trust rests not on promises but on built-in exits and verifiable alerts.

With tasks moved away from the main chain, Plasma Network achieves quicker validations while cutting costs far below standard Layer-1 operations. Though built differently, its design allows speed and affordability where older systems struggle.

Despite being built on blockchain, stablecoins work best when transactions move fast while staying cheap. What makes Plasma Network stand out is how quickly it settles these digital payments - confirmation happens in moments. High costs usually tied to mainchain activity simply do not apply here. Instead of waiting minutes and paying more, users see results nearly right away.

With Plasma, processing stablecoin transfers happens on the child chain instead of the main network. Because of this setup, it handles frequent payments - like wages, cross-border money sends, shop purchases, or tiny recurring buys - with ease. Costs stay low and steady, avoiding the unpredictable surges tied to base-layer traffic jams. As a result, moving digital dollars here resembles using an everyday online wallet more than wrestling with typical crypto delays.

Limited by slow transactions? Not here - Plasma handles stablecoin transfers at scale while keeping defenses strong. Speed improves, expenses drop, practical applications widen - all without compromise.

Beginning with its core purpose, the XPL token operates as the primary utility currency across the Plasma Network. Functioning under this framework, it enables users to cover costs tied to transactions whenever they interact with the system. As adoption expands, so does the need for XPL in everyday operations. Backed by design choices, staking possibilities emerge - helping reinforce security while guiding validators toward shared goals. Included within these features is a pathway for holders to weigh in on changes to the underlying rules.

When more people use stablecoins on Plasma, interest in XPL tends to grow. Because of this shift, activity on the network ties closely to how useful the token becomes over time. Those who keep their tokens often see gradual advantages under such conditions.

Despite its growing relevance, scalability remains a persistent challenge in blockchain systems. Through off-chain transaction processing, Plasma Network maintains core security without sacrificing speed. Fast settlements become possible, with costs kept minimal across high-volume operations. Security roots itself firmly in Layer-1 protocols, even as activity shifts outward. Real-time payments gain feasibility under such conditions. At the center of this framework operates the XPL token. Value flows into it via usage-based charges, participation rewards, and decision-making influence. Those exploring efficient financial infrastructure may find these mechanics particularly relevant.