I watch incentives before I watch charts.

I remember 2020, when yield pulled users in fast. I remember 2022, when the same incentives pushed them out just as fast. I’ve learned that systems don’t fail randomly. They fail because incentives quietly encouraged the wrong behavior. That lesson sits in my head when I look at how Plasma approaches incentives and validator economics.

In crypto, incentives are the invisible hand. Validators, users, and developers all respond to them, whether they admit it or not. If rewards favor short-term extraction, networks become unstable. If incentives punish honest behavior, participation drops. Plasma’s design seems aware of this history, especially as incentive discussions resurfaced strongly in 2024 and early 2025.

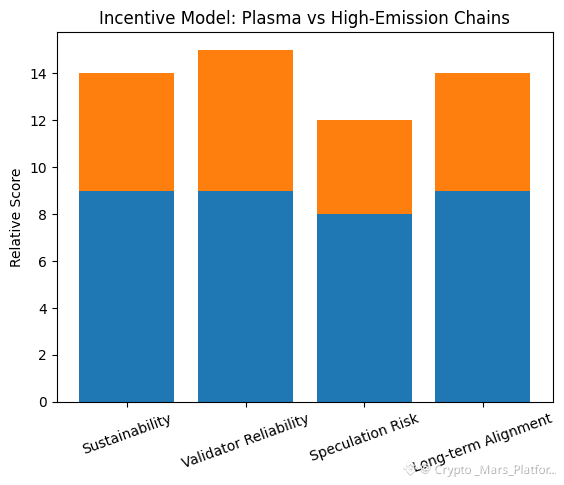

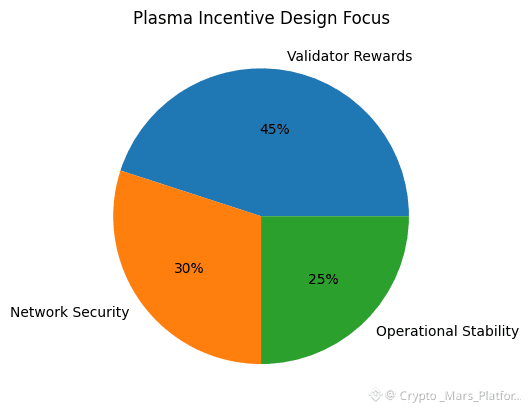

At a basic level, incentives mean how participants are rewarded and penalized. For Plasma, this revolves around validators who secure the network, process transactions, and commit data. Unlike chains that chase high inflation to attract attention, Plasma appears more restrained. It focuses on sustainable rewards tied to actual network usage, particularly stablecoin settlement activity.

Why is this topic trending now? Because the market matured. In 2023 and 2024, many high-yield models collapsed under their own weight. Data showed that networks with excessive token emissions struggled to retain long-term validators once rewards normalized. Traders and investors started paying closer attention to how rewards were generated, not just how large they looked.

Plasma’s approach links incentives to performance and reliability. Validators are rewarded for uptime, correct behavior, and participation in consensus. In simple terms, you earn by keeping the system healthy, not by gaming it. This may sound obvious, but it’s surprisingly rare. Many networks reward presence, not quality.

Progress here has been steady rather than dramatic. Throughout 2024, Plasma’s development updates emphasized validator accountability and predictable economics. There was no sudden reward spike, no headline-grabbing APR. Instead, the focus stayed on making validator participation economically rational over long periods. That signals a long-term mindset.

From a trader’s perspective, incentive design affects more than validators. It impacts network behavior during stress. When markets turn volatile, poorly aligned incentives cause validators to drop out, reorganize, or act defensively. Well-aligned incentives encourage them to stay online and follow the rules. That difference shows up as smoother execution and fewer surprises.

Plasma also avoids over-incentivizing speculative activity. Its stablecoin-first design means a large portion of network usage is transactional, not yield-driven. Incentives tied to real settlement volume tend to be more stable than incentives tied to speculation. As someone who has watched liquidity flee when rewards dry up, I value that stability.

There’s also a philosophical layer. Incentives reflect values. A network that rewards speed above all else may sacrifice safety. A network that rewards participation without accountability invites abuse. Plasma’s incentive structure suggests it values consistency, predictability, and correct behavior. Those aren’t exciting traits, but they’re durable.

Technically, this means penalties matter as much as rewards. Validators that behave incorrectly can lose future earnings or be excluded. That creates a cost to misbehavior. For non-technical readers, it’s like a security deposit. You earn steadily, but only if you follow the rules. That simple idea underpins most reliable systems, financial or otherwise.

Why does this matter for investors? Because token value ultimately reflects trust in the system’s future behavior. Unsustainable incentives inflate short-term metrics but weaken long-term confidence. Plasma’s measured approach may grow slower, but it reduces the risk of sudden incentive shocks.

Personally, I’ve learned to distrust excitement built on emissions. The best systems I’ve interacted with felt boring in the best way. They worked. They paid participants fairly. They didn’t need constant adjustment. Plasma’s incentive philosophy feels closer to that camp.

In 2024, as more projects reevaluated token economics, Plasma’s approach stood out by not chasing trends. It didn’t pivot aggressively. It stayed consistent. That consistency itself is a signal.

Philosophically, incentives are how a system tells the truth about itself. You can say you value decentralization, security, or users. But incentives reveal what you actually reward. Plasma seems to reward behavior that keeps the network usable under stress, not just impressive during calm periods.

I trust systems that assume participants are rational, not idealistic. Plasma’s incentive design doesn’t rely on goodwill. It relies on alignment. When doing the right thing is also the profitable thing, systems tend to last.

In the end, markets don’t care about promises. They care about outcomes. Incentives quietly shape those outcomes long before price reacts. Plasma’s design suggests it understands that reality. And after watching incentive-driven failures cycle after cycle, that understanding carries weight.