The modern global economy is defined not by the hour or the minute, but by the millisecond. When a consumer taps a contactless card at a busy coffee shop, the terminal beeps instantly. When a day trader clicks "buy" on a stock trading app, the confirmation appears before their finger leaves the screen. This illusion of instant settlement is the bedrock of modern commerce. It creates the psychological trust and operational fluidity that allows the financial system to function without friction. Yet, for all its revolutionary potential, the blockchain industry has historically failed to match this crucial standard. The sector has successfully built systems that are trustless, decentralized, and censorship-resistant, but it has also built systems that make people wait. In the high-speed world of fintech, waiting is not just an inconvenience; it is a dealbreaker. The next generation of financial applications cannot run on a twelve-second heartbeat, nor can it wait ten minutes for a block to be mined. It requires the immediate certainty of sub-second finality, and that is precisely the engineering breakthrough that Plasma delivers.

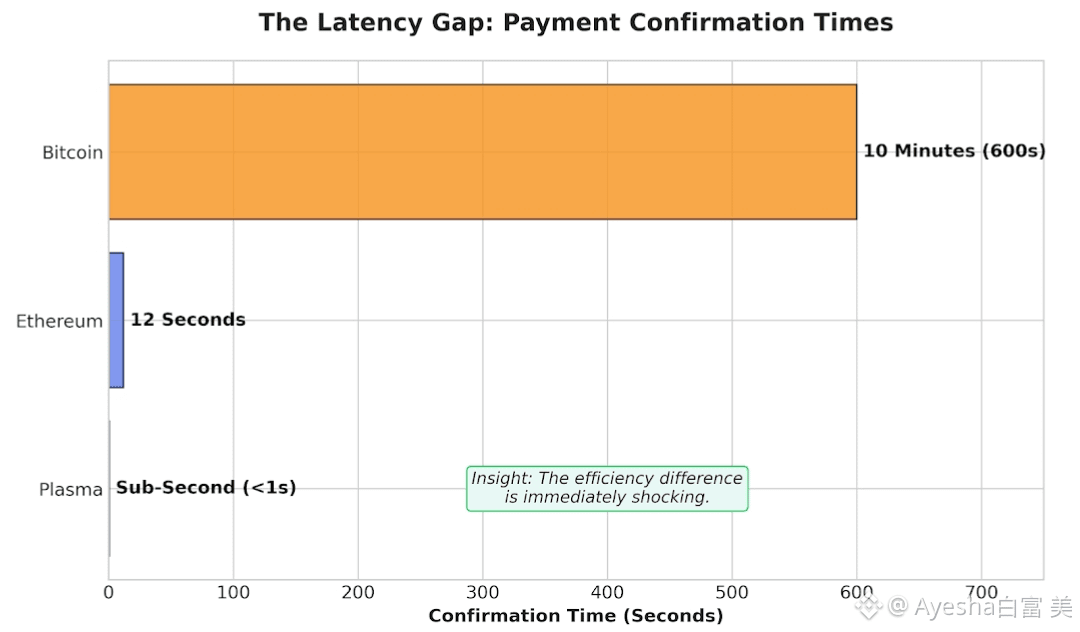

To understand why this matters, one must look at the disconnect between legacy blockchain infrastructure and the rigorous demands of modern fintech. This friction lies in the concept of "block time." In traditional cryptocurrency architecture, a transaction is not considered "real" or irreversible until it is packed into a block and that block is propagated to the entire network. This process creates a natural latency gap—a perilous window of uncertainty where a payment is in limbo. For a user sending a wire transfer across the ocean, waiting an hour might be acceptable because the alternative is waiting days. But for a merchant selling a digital good or a point-of-sale system processing a retail transaction, a delay of even ten seconds is catastrophic. It breaks the user flow, creates awkward social friction at the checkout counter, and forces the merchant to take on the risk of a failed transaction. This latency is the invisible wall that has kept cryptocurrency from moving beyond speculative trading and into the realm of daily payments. Fintech developers look at these delays and rightfully decide that they cannot downgrade their user experience just to use a blockchain. They need the reliability of Visa with the autonomy of crypto, and until now, that combination did not exist.

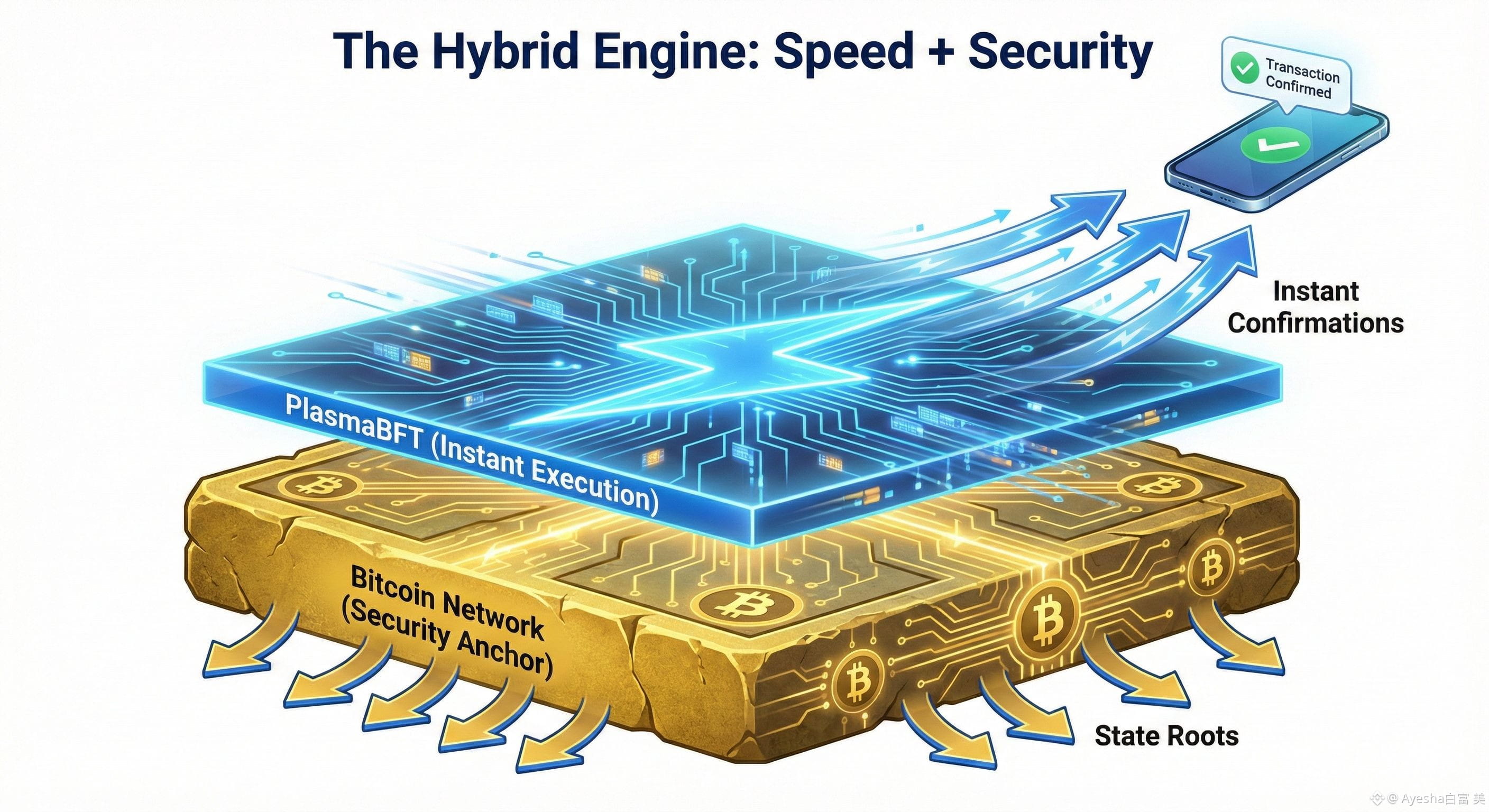

Plasma fundamentally rewrites this logic by changing the consensus mechanism itself. Instead of relying on the slow, probabilistic finality of older chains, the protocol utilizes PlasmaBFT, a specialized Byzantine Fault Tolerant consensus engine designed for raw speed. This allows the network nodes to reach an agreement on the state of the ledger almost instantly. When a user sends USDT on Plasma, the transaction is finalized in under a second. There is no "pending" state that leaves the sender wondering if their money is safe. There is no need to refresh the wallet to see if the funds arrived. The experience is identical to the centralized payment rails the market is accustomed to, but with all the benefits of a decentralized ledger. This parity in speed is the "zero-to-one" moment for crypto adoption. It is what allows fintech developers to finally swap out their backend infrastructure. They can replace slow, expensive banking rails with Plasma's instant settlement layer without their users ever noticing the difference. The blockchain becomes invisible, which is exactly where infrastructure should be.

However, in the world of decentralized finance, speed without security is meaningless. In the past, high-speed chains were often criticized for being too centralized or fragile, sacrificing safety for performance. This is the "Scalability Trilemma" that has plagued the industry for a decade. Plasma solves this paradox by anchoring its security directly to Bitcoin. While the execution layer—the part the user interacts with—moves at the speed of light, the settlement layer is rooted in the most secure network on earth. Every transaction on Plasma is ultimately secured by the hash power of Bitcoin. This hybrid architecture gives fintech applications the best of both worlds: the instant gratification of a modern app and the immutable security of digital gold. It removes the risk for merchants who worry about reversals or chain reorgs, providing them with a settlement assurance that is actually superior to credit cards, which can be charged back weeks later. With Plasma, when the payment settles in a second, it is settled forever.

The implications of this shift extend far beyond just buying coffee or speeding up retail checkouts. Sub-second finality unlocks entirely new categories of economic activity that were previously impossible on-chain. Consider the concept of "streaming payments." In a world of ten-second block times, paying someone by the second is impossible; the fees and latency would eat the value. But with sub-second finality and zero fees, value can flow like water. Employees could be paid their wages in real-time, second by second, as they work. Content creators could receive micropayments for every second a video is watched. This changes the fundamental nature of how labor and value are exchanged.

Furthermore, this speed is critical for the burgeoning sector of decentralized high-frequency trading (HFT). Currently, professional market makers struggle to operate on-chain because the price can change multiple times before a block is mined. Plasma’s sub-second capabilities allow for an on-chain order book that moves as fast as a centralized exchange like Binance or Nasdaq. This brings the transparency of DeFi to the speed of Wall Street, eliminating the front-running and "Maximum Extractable Value" (MEV) attacks that plague slower chains.

It also powers the next generation of gaming economies. In a fast-paced multiplayer game, assets need to transfer in real-time. If a player picks up a digital sword, that ownership transfer needs to happen instantly, without pausing the game. Plasma enables this seamless integration, allowing asset transfers to happen in the background of gameplay. The market is moving away from the era of "Internet Money" that mimics the slowness of wire transfers, and entering the era of "Programmable Value" that moves at the speed of information.

Ultimately, Plasma is not just making blockchain faster; it is making it usable. For years, the industry has asked users to compromise—to accept slower speeds and higher fees in exchange for decentralization. That trade-off is no longer necessary. By eliminating the wait, Plasma is removing the last great barrier between the crypto ecosystem and the real economy. The future of fintech is instant, and for the first time, the blockchain is ready to keep up.