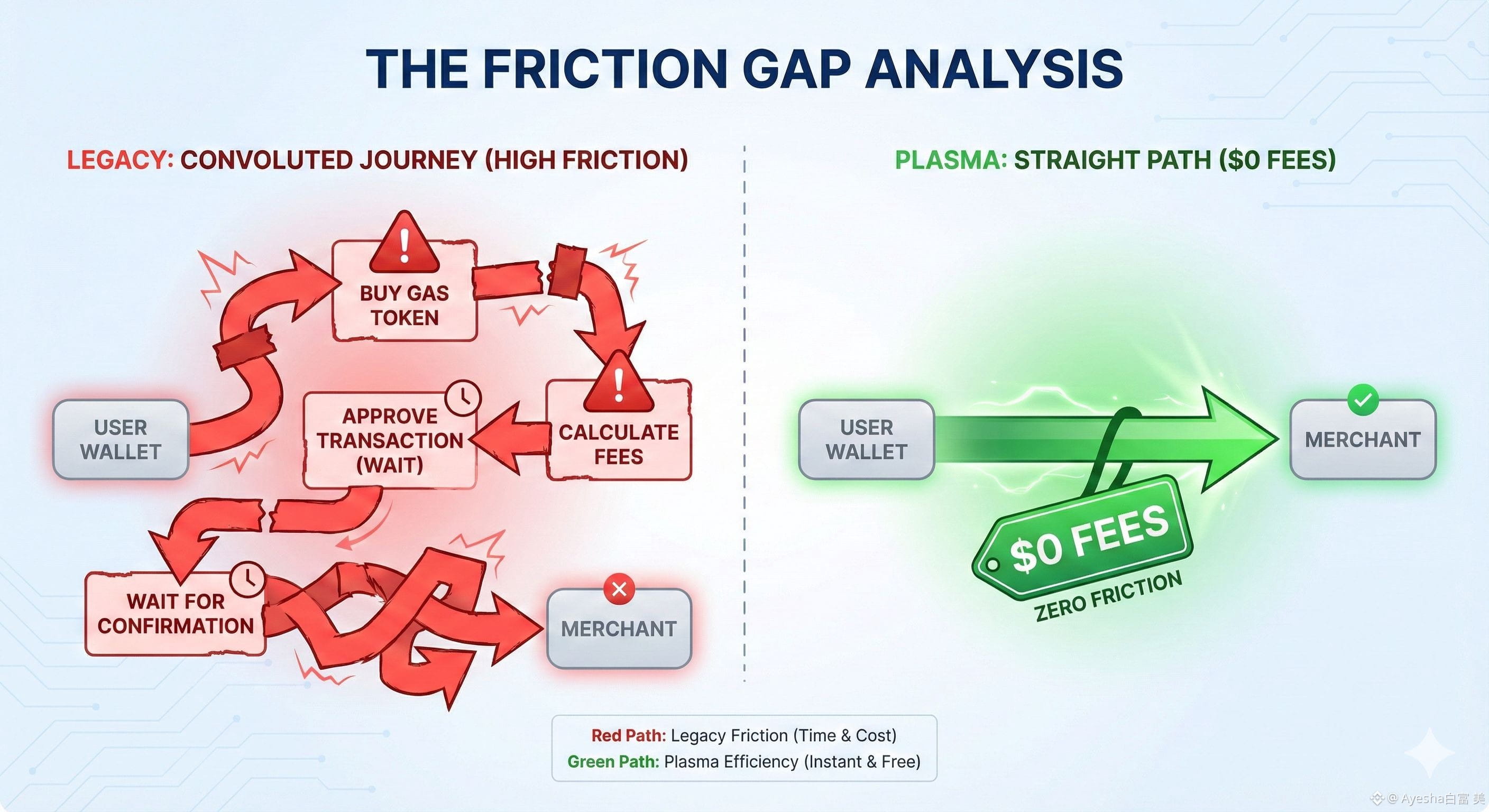

The blockchain industry is currently navigating a critical transition from speculative infrastructure to utility-driven systems. For the last decade, the primary hurdle for mass adoption has not been a lack of interest, but a lack of usability. The sector has built networks that are decentralized and censorship-resistant, but it has also inadvertently created systems that are expensive, slow, and confusing for the average person. This friction gap is most visible in the stablecoin market. While stablecoins like USDT have become the killer app of crypto, processing trillions in volume, they are forced to run on legacy rails that were never designed for high-frequency payments. Sending fifty dollars in USDT on Ethereum during network congestion is economically irrational. Even on faster Layer 2 solutions, the user is forced to manage a gas token just to move their stablecoins. This dual-token friction kills conversion rates for remittances and retail payments, preventing the technology from reaching its full potential.

Breaking the Gas Barrier

Plasma has emerged in the 2025-2026 landscape not just as another Layer 1, but as a purpose-built solution to these exact early adoption hurdles. By redesigning the consensus layer around stablecoin flows and utilizing the XPL token as a sustainable economic engine, the protocol is systematically solving the fee fatigue and latency gaps that have held the industry back. The single biggest barrier to entry for non-crypto users is the concept of gas. Imagine trying to send an email but being told you need to buy digital stamps in a separate currency first. This is the reality of legacy blockchains where a user in Nigeria or Turkey receiving USDT cannot spend it or move it unless they also hold ETH or SOL for fees. Plasma overcomes this hurdle through its native Zero-Fee USDT Transfer architecture. This is not a promotional subsidy but a core protocol feature managed by a system of Paymasters and relayers. On Plasma, the network differentiates between complex smart contract interactions and simple payment flows. For standard stablecoin transfers, the protocol absorbs the cost, making the transaction free for the end-user. This removes the mental overhead of transaction planning, allowing a user to download a wallet, receive USDT, and send it to a merchant without ever knowing what XPL or gas is. This invisible blockchain experience is the key to unlocking the remittance market.

Solving the Latency Gap

In the traditional fintech world, payments settle in milliseconds, or at least appear to do so. In crypto, finality is often a probabilistic gamble where waiting twelve seconds for an Ethereum block or ten minutes for Bitcoin is unacceptable for a point-of-sale terminal. If a customer buys coffee with crypto, neither they nor the merchant wants to stand in awkward silence waiting for a block confirmation. Plasma solves this via PlasmaBFT, a customized consensus engine derived from Fast HotStuff. This mechanism allows the network to achieve sub-second finality. When a transaction is signed, it is ordered and finalized almost instantly, providing a Web2-like speed experience while maintaining Web3 trustlessness. Crucially, this speed does not come at the expense of security. The protocol employs a hybrid security model where the fast execution layer is anchored to the Bitcoin Network for ultimate settlement. This allows Plasma to claim the throughput of a high-performance Layer 1 while leveraging the immutable security of Bitcoin to prevent long-range attacks, effectively striking the golden mean between speed and safety.

The Economic Engine: $XPL

Solving technical hurdles is only half the battle, as the second challenge for any new Layer 1 is economic sustainability. The question of how to secure a network and incentivize validators while giving away free transactions is where the XPL token plays a sophisticated, multi-layered role. XPL serves as the economic bedrock of the network. Validators must stake XPL to participate in consensus and earn rewards, creating a fundamental demand driver. As the network's value grows, the security budget in the form of staked XPL must grow with it to prevent attacks. Furthermore, the network relies on Payment Agents and Paymasters to facilitate the Zero-Fee experience. These agents stake XPL as a bond to guarantee their honest behavior while processing these free transactions, earning yield from the protocol's ecosystem incentives in return. This creates a unique economic flywheel where increased USDT usage leads to more demand for Payment Agents, which in turn leads to more XPL being staked and removed from circulation.

Aggregating Liquidity, Not Fragmenting It

While simple transfers are free, complex DeFi interactions such as swaps, lending, and NFT minting still require fees. Plasma implements a fee-burning mechanism similar to Ethereum's EIP-1559. As the ecosystem matures and users move from simple payments to complex decentralized finance activities, the burn rate of XPL increases, offsetting the validator inflation. This aligns the token's value directly with the network's adoption. Many competitors launched with fast technology but empty blocks because they failed to attract liquidity. Plasma avoids this by positioning itself not as a generic world computer, but as a specialized Stablecoin Settlement Layer. By focusing on one niche, it aggregates liquidity rather than fragmenting it. It supports gasless swaps where users can pay for token swaps using the stablecoins they are trading, rather than XPL. This significantly lowers the barrier for DeFi participation, as a user can swap USDT for BTC on Plasma without ever holding a third gas token.

Conclusion: The Invisible Economy

The ultimate victory for Plasma will be when its users do not even know they are using it. The early adoption hurdles of crypto, including fees, latency, and complexity, are not laws of physics but design choices. Plasma has made different choices. By abstracting away the gas fee for payments and anchoring security to Bitcoin, it has built a rail that is ready for the real world. The role of XPL in this system is not to be a barrier that users must climb over, but the engine that hums quietly in the background. It secures the chain, incentivizes the agents, and captures the value of the network's growth through staking and burning. As the global economy increasingly moves on-chain, the networks that win will not be the ones with the most hype, but the ones with the least friction. In that race, Plasma is already laps ahead.