The global financial system is a technological paradox. On the front end, it appears instantaneous: high-frequency trading algorithms buy and sell stocks in microseconds, and mobile apps allow retail users to purchase ETFs with a thumbprint. But peel back the glossy interface, and you find a back-end infrastructure that has barely evolved since the 1980s. It is a world powered by PDFs, spreadsheets, manual reconciliations, and the most archaic technology of all: paper.

This disconnected infrastructure creates what economists call "friction costs." When you buy a share of Apple or Tesla today, that trade settles in "T+1" or "T+2" (trade date plus two days). Why? Because the asset itself is "dumb." A traditional stock certificate is a static record. It sits in a centralized depository (CSD). It cannot think, it cannot move, and it certainly cannot act. To do anything with it—pay a dividend, cast a shareholder vote, or transfer ownership—requires a legion of middlemen, transfer agents, and compliance officers to manually push the paperwork forward.

We are standing on the precipice of a shift that will make this model obsolete. The future of finance is not just about digitizing assets; it is about making them programmable. Leading this charge is Dusk Network, a privacy-first Layer 1 blockchain specifically architected to transform "dumb" financial securities into "smart," autonomous software. With the upcoming mainnet and the landmark integration of the NPEX stock exchange, Dusk is proving that the end of paperwork is not a futuristic dream—it is an imminent operational reality.

The Dumb Asset vs. The Smart Dusk Asset

To understand the magnitude of this shift, we must contrast the old with the new.

In the legacy system, a "share" is just an entry in a database. If a company wants to pay a dividend, it must:

Declare the dividend.

Hire a transfer agent to identify shareholders on a specific "record date."

Calculate payments (often manually adjusting for tax jurisdictions).

Wire funds to thousands of brokerage accounts, which then credit users days later. The process is expensive, slow, and prone to error.

On Dusk, that same share is tokenized as a programmable smart contract. It is an active software object. When the company wants to pay a dividend, they simply deposit the funds into the smart contract. The asset itself executes the logic:

"If Wallet A holds 500 tokens, send 500 USDC. If Wallet B is in a restricted tax jurisdiction, withhold 15%."

This happens instantly, peer-to-peer, with zero intermediaries. The asset does the work.

The Killer App: Automated Compliance (RegDeFi)

The reason institutions have hesitated to embrace public blockchains like Ethereum is not a lack of interest; it is a fear of non-compliance. A bank cannot legally issue a security on a chain where a sanctioned entity might buy it. In the "dumb" asset world, compliance is a manual gatekeeper—a human checking your ID before you trade.

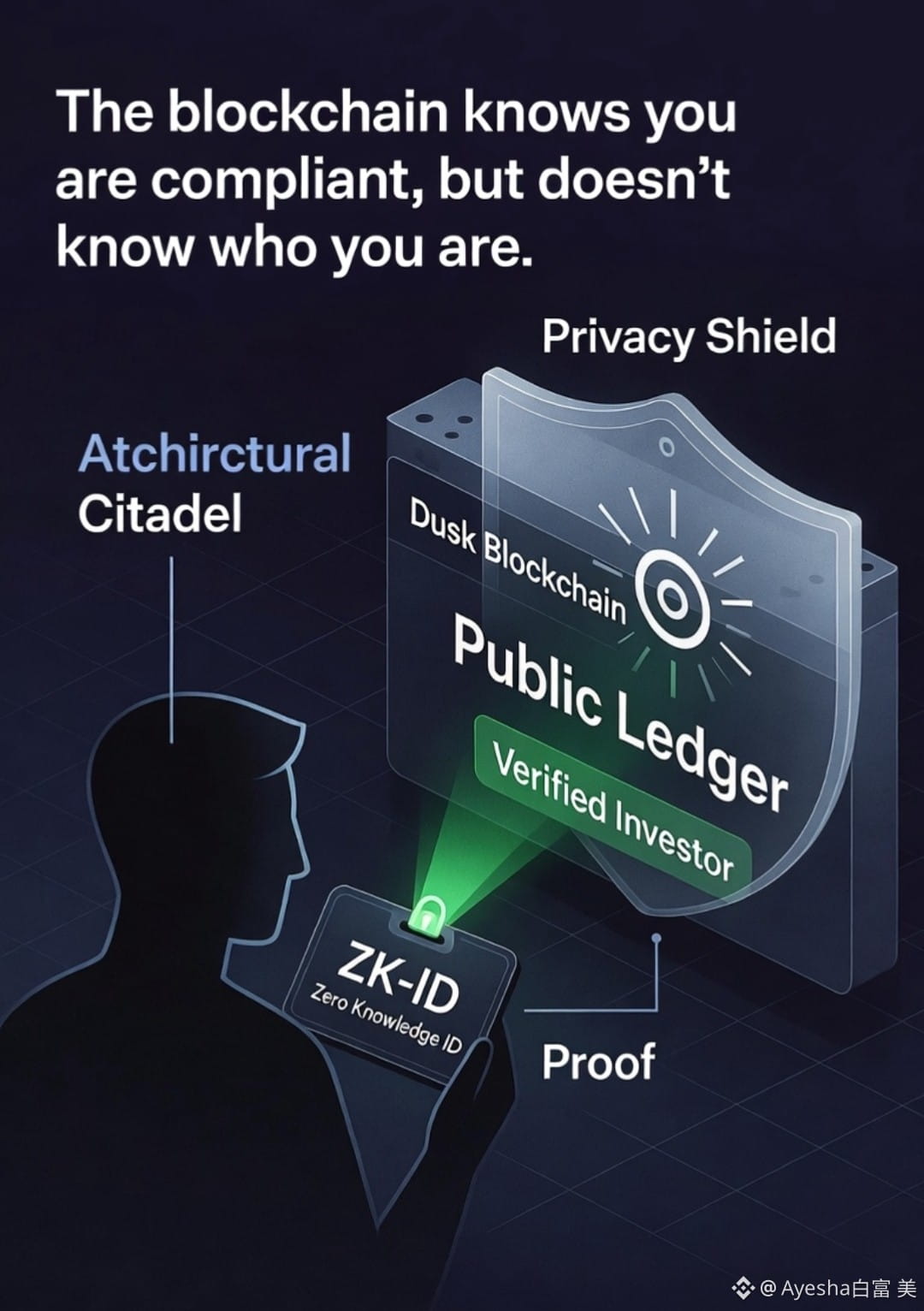

Dusk automates this through its groundbreaking Citadel Protocol and Zero-Knowledge (ZK) technology. On Dusk, compliance is baked into the token standard itself. The asset is programmed with a set of rules: "I can only be held by a wallet that has a valid KYC proof and is not in a sanctioned country."

If a non-compliant user tries to buy the token on a DEX, the transaction fails at the protocol level. The asset refuses to move. This is "compliance-by-code." It eliminates the need for manual checks and allows securities to trade freely 24/7 on secondary markets, knowing that regulatory rules are being enforced mathematically in real-time. This concept, often called RegDeFi (Regulated Decentralized Finance), is the "missing link" that allows trillions of dollars in real-world assets (RWA) to finally migrate on-chain.

The NPEX Migration: Proof of Scale

Critics often dismiss asset tokenization as a "pilot project" phenomenon—lots of press releases, no real volume. Dusk shatters this narrative through its partnership with NPEX, a fully licensed Dutch stock exchange.

This is not a test. NPEX is migrating approximately €300 Million worth of equities and bonds onto the Dusk ledger. These are real companies, real investors, and real regulatory requirements. By moving these assets to Dusk, NPEX is effectively replacing its back-office infrastructure with blockchain code.

Consider the implications for "Future of Work" in finance. The thousands of hours NPEX staff previously spent reconciling ledgers, managing shareholder registries, and processing voting ballots can now be repurposed. The Dusk blockchain handles the reconciliation automatically. The "shareholder registry" is simply the blockchain state, updated in real-time with every trade. This migration is the strongest signal yet that the industry is ready to move beyond "crypto casino" use cases and into "infrastructure replacement."

Democratizing Governance: The End of "Proxy Plumbing"

One of the most broken aspects of modern capitalism is shareholder voting. "Proxy voting" is a plumbing nightmare where millions of retail votes get lost in a chain of custody between brokers and custodians. As a result, retail investors are effectively disenfranchised.

Programmable assets on Dusk solve this trivially. Because the user holds the asset in their own self-custody wallet (or a compliant custodian wallet), the asset acts as their ballot. A corporate governance smart contract can issue a vote proposal. The asset in the user’s wallet allows them to sign a vote cryptographically.

No paper mailers.

No lost votes.

Instant tabulation.

Zero-knowledge privacy (you can verify your vote counted without revealing your identity to the board).

The Technological Edge: Piecrust VM

Why @Dusk ? Why not Ethereum or Solana? The answer lies in the specialized architecture required for financial automation. General-purpose chains are built for everything from meme coins to gaming NFTs. Dusk is purpose-built for finance.

Its custom Virtual Machine, Piecrust, is the first ZK-friendly VM designed to handle the heavy computational load of privacy-preserving smart contracts at institutional speed. While Ethereum struggles with privacy (transactions are public) and scalability for complex logic, Piecrust allows Dusk to execute transactions that are both private and compliant, with finality times that rival centralized payment networks. This is the engine that makes the "programmable equity" vision possible without sacrificing the privacy that institutions mandate.

Conclusion: The Invisible Back Office

The "End of Paperwork" does not mean the end of regulation or complexity. It means the end of manual complexity.

We are moving toward a financial ecosystem where the back office is invisible. It is code running silently in the background. Dividends arrive like text messages. Compliance is as automatic as gravity. Voting is as simple as liking a tweet.

Dusk Network is not just building a blockchain; it is building the operating system for this new economy. With the mainnet launch imminent and the €300M NPEX migration setting the stage, $DUSK is positioning itself as the utility token for the future of regulated finance. The paper chase is over. The era of programmable value has begun.