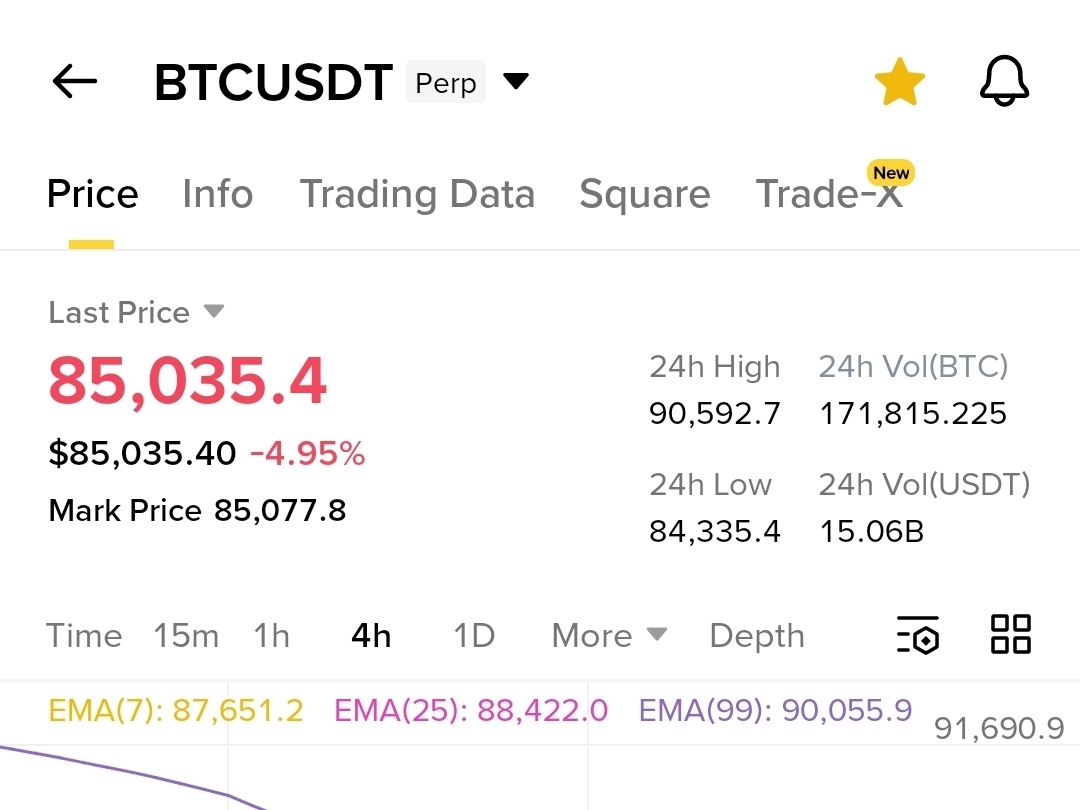

Guys, wake up!! $BTC just got SMASHED from $90K+ highs down to around $84K–$85K (dipped as low as ~$84,400 today) – that's a brutal 6%+ wipeout in hours!

And gold? After mooning to insane records like $5,600+ per ounce earlier... it's pulling back hard too, reversing big gains and dipping amid the chaos. Both "safe havens" (lol) getting hit at the same time? This feels WEIRD. Here's the tea:

1. Fed says NO quick cuts – Powell & crew kept rates steady, no dovish vibes. Risk assets (including BTC acting like high-beta tech) got SOLD HARD. "Sell the news" vibes all over. The Fed held interest rates steady in the 3.5–3.75% range during its recent meeting, with no immediate rate cuts signaled. This hawkish stance disappointed expectations for easier liquidity, pressuring risk assets like Bitcoin (treated more as a high-beta tech/risk play rather than a pure hedge). Crypto market cap dipped, with Liquidation.

3. Stocks sliding (Microsoft dragging Nasdaq), macro fears, geopolitical noise (Iran tensions?), dollar swings... everything correlated in the dump.

But hold up – gold's still up MASSIVELY YTD (~25–30%+), and BTC's 2026 low so far is around here. Is this just a healthy shakeout... or the start of something bigger? 🤔

What do YOU think? -

Dip buy $BTC now? 🔥

- Gold still the real king? 🏆

- Or everything crashing together? 💥

Drop your takes below + tag a friend who's panicking

#CryptoCrash #MarketUpdate #USIranStandoff #FedHoldsRates #BinanceSquare