Plasma was introduced as a direct response to one of the most critical limits in blockchain markets: the inability of base-layer networks to scale without sacrificing decentralization, security, or economic integrity. At its core, Plasma proposes a structural shift in how blockchains handle activity, moving the majority of transactional and computational load away from the main chain while still anchoring ultimate authority to it. This design is not about replacing the root blockchain but about extending its reach in a way that preserves trust while unlocking scale that traditional on-chain execution cannot achieve.

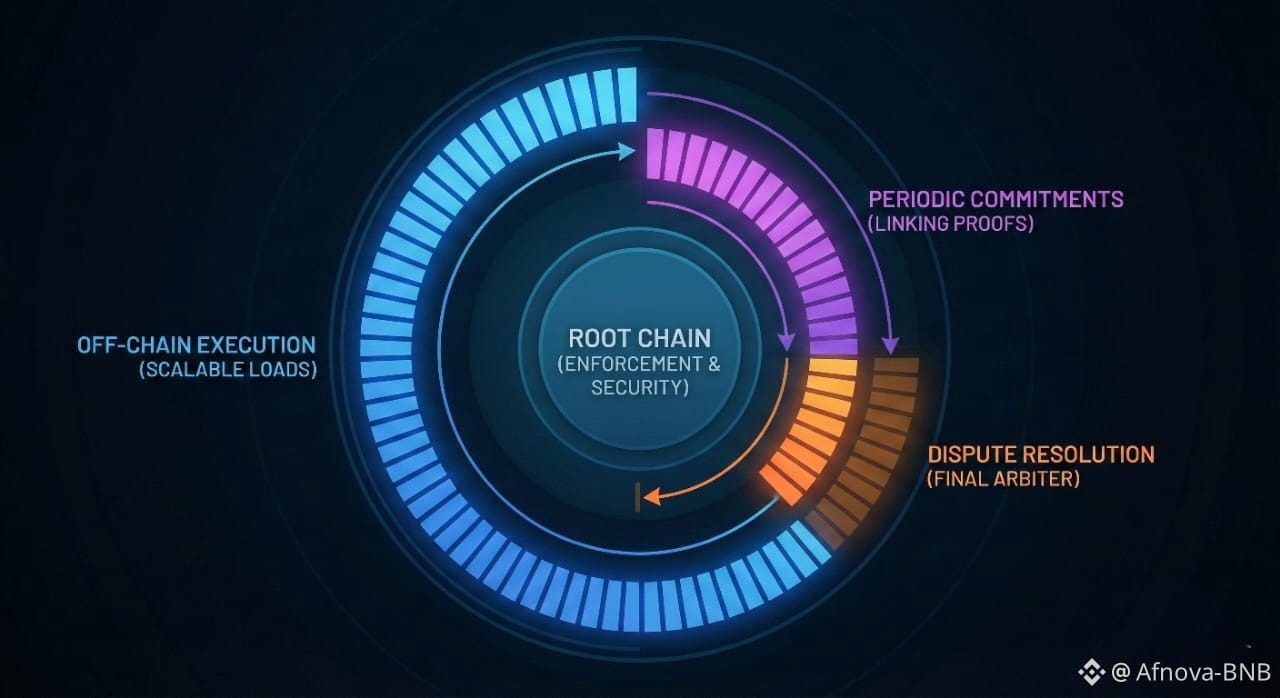

The fundamental idea behind Plasma is deceptively simple yet extremely powerful. Instead of forcing every participant in the network to process and verify every transaction, Plasma allows smart contract systems to operate autonomously outside the root chain. These systems continuously execute state changes, manage balances, and process economic activity while periodically committing cryptographic proofs back to the root blockchain. The root chain does not micromanage these operations. Instead, it acts as a final arbiter, stepping in only when something goes wrong. This separation of execution and enforcement is the key that allows Plasma to scale to levels that would otherwise be impossible.

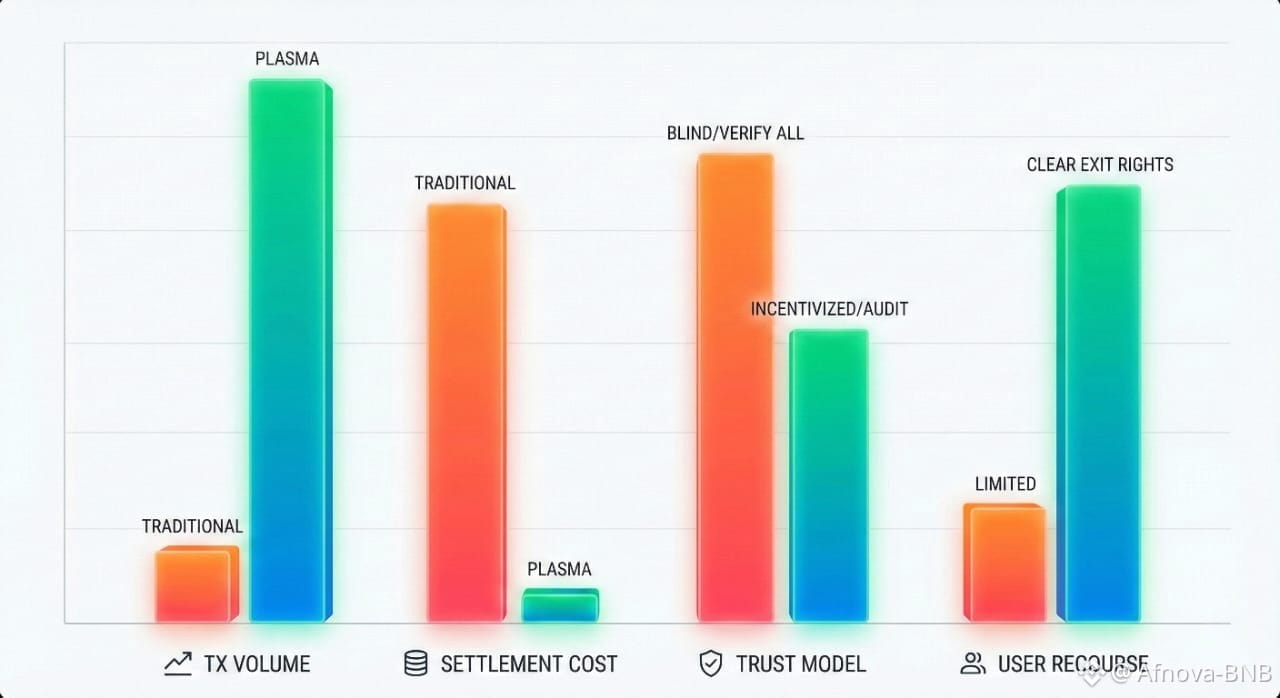

From a market perspective, Plasma reframes blockchain security as an incentive-driven enforcement mechanism rather than constant global verification. Validators and operators are economically motivated to behave honestly because incorrect behavior can be proven and penalized. This approach mirrors real-world financial systems where audits, penalties, and enforcement exist alongside day-to-day operations that do not require continuous oversight. Plasma applies this same logic at the protocol level, using cryptographic proofs and economic bonds instead of centralized authorities.

One of the most important aspects of Plasma is its reliance on the root blockchain as a source of truth. Funds deposited into a Plasma system are locked in smart contracts on the root chain, ensuring that all value remains fully reserved and redeemable. The Plasma chain itself maintains the ledger that tracks ownership and state transitions, but it does not exist independently of the root chain. Every valid state ultimately traces back to assets secured at the base layer. This structure eliminates the risk of fractional reserve behavior and preserves asset fungibility between layers.

Plasma also introduces a new way of thinking about scalability through hierarchy. Rather than a single monolithic off-chain system, Plasma chains can be composed into trees, with child chains committing to parent chains, which in turn commit to the root blockchain. This layered approach allows economic activity to be distributed across many chains without fragmenting security. If one chain becomes unreliable or hostile, participants are not trapped. They can exit upward through the hierarchy, reclaiming their assets through cryptographic proofs enforced by the root chain.

What makes this design particularly powerful is that it does not require constant interaction with the root blockchain. In healthy conditions, Plasma chains can process enormous volumes of transactions with minimal on-chain data. A single commitment posted to the root chain can represent thousands or even millions of off-chain state updates. This drastically reduces congestion and fees on the base layer while still maintaining the ability to enforce correctness when needed.

From a trading and market infrastructure standpoint, Plasma opens the door to high-frequency activity, complex financial instruments, and globally accessible decentralized services that would be economically infeasible if every action required on-chain settlement. It creates an environment where speed and scale coexist with trust minimization. Participants do not need to trust operators blindly, but they also do not need to constantly verify every action. They only need to remain vigilant enough to respond if irregularities appear.

Plasma’s design assumes rational economic behavior. Operators earn fees by keeping the system running smoothly. Validators risk losing bonded assets if they attempt to manipulate state or withhold information. Users retain the right to exit if they believe the system is no longer operating correctly. This balance of incentives aligns all parties toward honest participation while providing clear escape routes in adverse conditions.

In essence, Plasma is not just a scaling technique. It is a redefinition of how blockchains can coordinate trust, computation, and economic incentives at scale. By shifting routine execution off-chain and reserving the root blockchain for enforcement and final settlement, Plasma establishes a framework capable of supporting global decentralized markets without overwhelming the very systems that secure them.