Most blockchains just aren’t built for AI. They’re fine with simple transactions and predictable gas fees,but AI doesn’t play by those rules.AI needs to juggle all kinds of computation,pull in new data all the time, update models over and over,and do much of its work off chain yet still prove everything’s legit and settle payments on chain.Try to cram all this into one blockchain,and it’s a mess before anyone even starts using it.

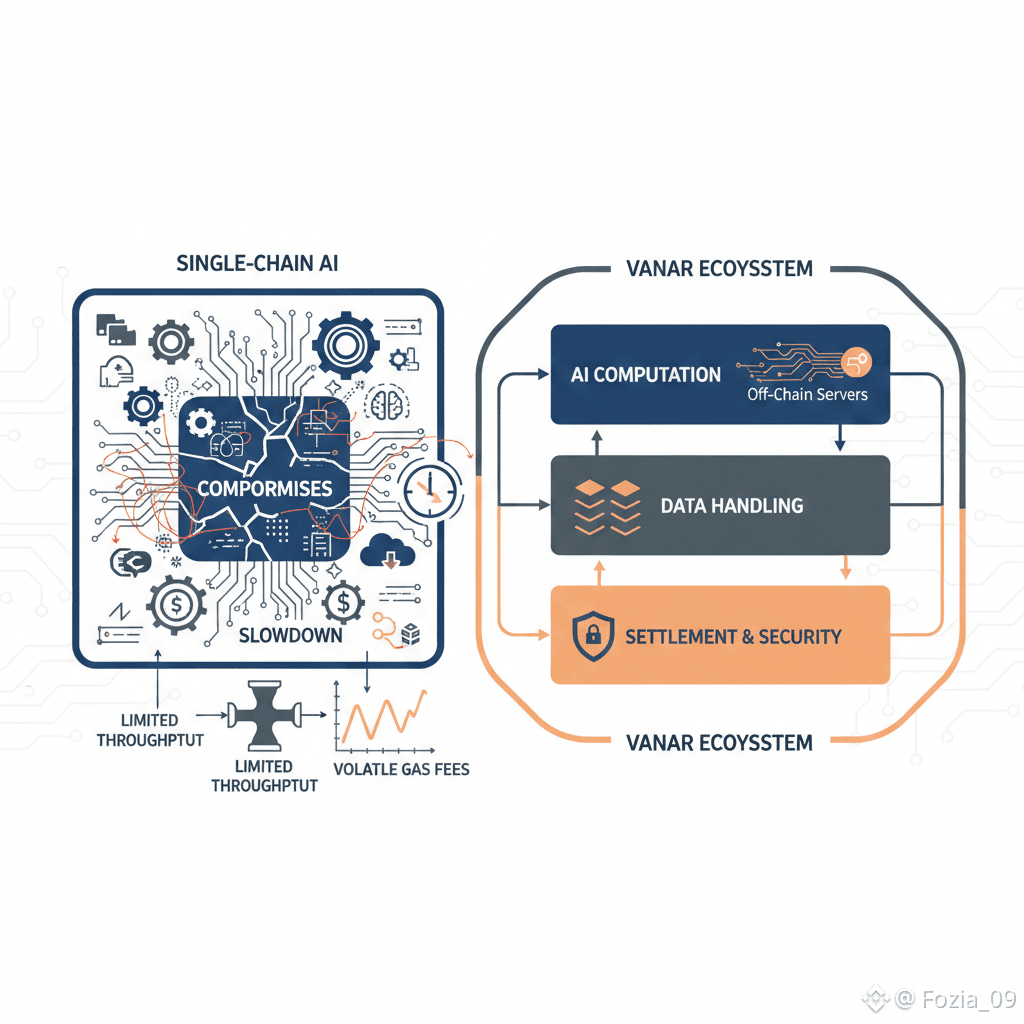

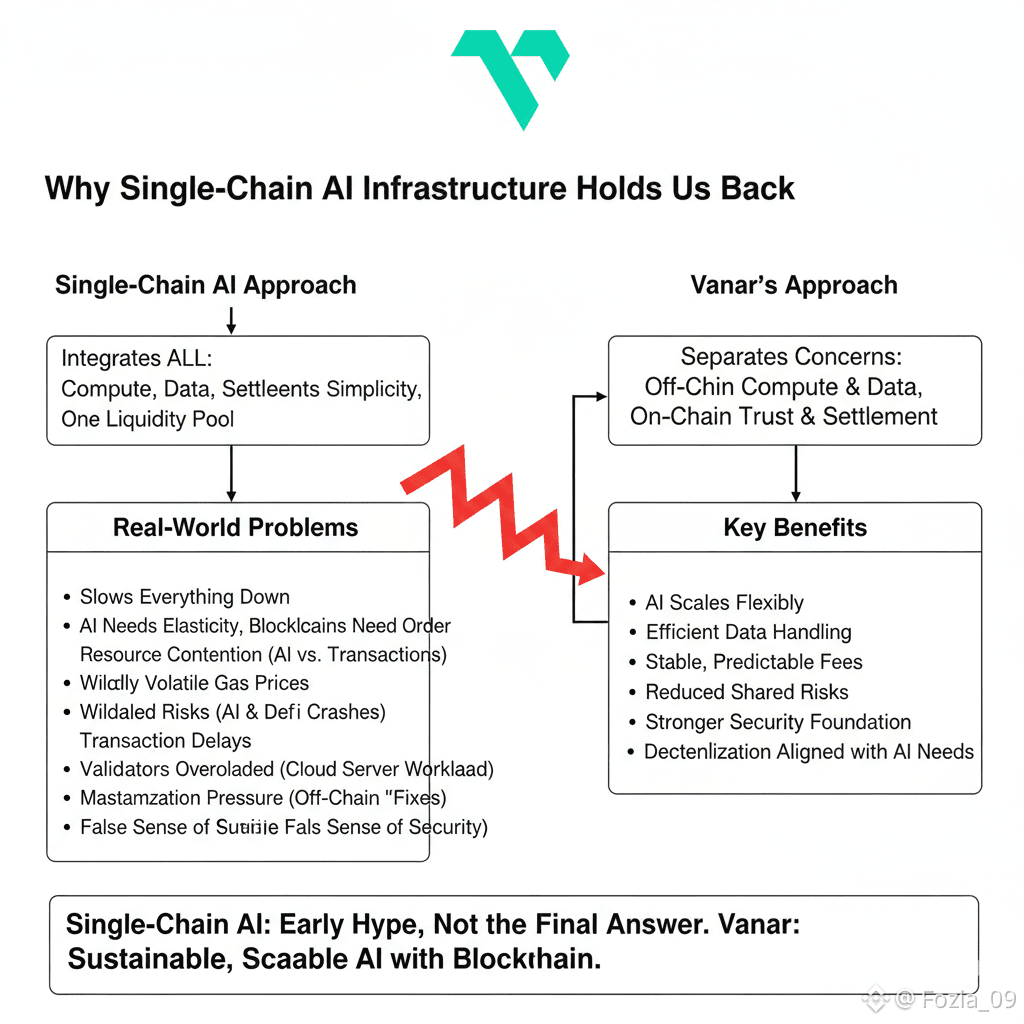

The single chain approach sounds nice in theory one place for everything: compute, data,settlement,security,developer tools.On paper,sure,it looks tidy.But in the real world, it slows everything down.AI doesn’t scale in neat, predictable steps,while blockchains are obsessed with determinism and order.If you force a single chain to handle model updates,data storage,settlements,and consensus all at once,you end up with a system pulled in so many directions it just can’t keep up.Instead of efficiency,you get compromises and those show up fast once real users show up.

That’s why projects like Vanar start making sense.Instead of boxing AI into one execution layer,Vanar gets that AI,data,and settlement all have their own scaling needs.Their setup supports off chain computation but keeps trust and finality on chain,so you avoid a lot of the headaches single chain AI systems run into.It’s not about stuffing everything on chain;it’s about putting the right pieces there.

Single chain AI platforms love to sell you on the idea of simplicity:one network,one virtual machine,one liquidity pool.But they gloss over the hidden problems.When heavy duty AI tasks use the same execution layer as financial transactions,they end up fighting over blockspace.If there’s a spike in model inference or updates,gas prices swing wildly. Suddenly,transactions that need to finish quickly get stuck because AI jobs are clogging up the system.Validators get dragged into workloads that look more like running cloud servers than maintaining consensus not ideal for anyone.

This kind of coupling quietly raises the risk for everyone.A surge in AI demand can mess with financial settlements.A DeFi crash can freeze AI agents mid task.Two totally different worlds now share the same points of failure. And the incentives just don’t line up.AI computation rewards scale and hardware efficiency;consensus rewards stability and redundancy.Expecting one validator set to do both jobs well?That’s a recipe for constant trade offs and a weaker system.

You can already see these limits in the market.Compute heavy apps rarely run fully on chain;they stick to using blockchains for payments or access control,not for actual AI work.Most AI teams still use centralized APIs for training and inference.The flashy on chain AI demos look cool on stage but fall apart with real users.Chains that try to run AI natively get hit with crazy gas prices,poor throughput,and fewer developers once the hype fades.AI needs elasticity;blockchains just want things to stay predictable.

Here’s the kicker:singlechain AI setups often push teams toward centralization,not away from it.When the chain can’t handle real workloads,teams start adding trusted off chain pieces,permissioned compute,or admin controlled execution.At that point,the blockchain’s just a coordination tool or a marketing slogan the real power’s off chain. Users and investors get a false sense of security,while control quietly shifts away from them.

That’s why Vanar and the $VANRY ecosystem matter long term.By treating AI as something that should work with blockchain settlement not overpower it Vanar lines up with how AI actually scales.Compute stays flexible,data gets handled efficiently,and the chain can focus on what it’s good at:security, coordination,and settling value.Separating these jobs means fewer shared risks and a stronger base for AI driven apps.

From where I stand,single chain AI hype feels like an early stage play,not the final answer. Sure,it grabs attention and speculative capital,but it’s not how the story ends.